Accounting Interview Questions and Answers

(33 Samples)

(33 Samples)

33 common accounting interview questions. Examples include technical, transactional, behavioral, and logical tests with sample answers

Accounting has been considered the benchmark for a stable and growing career path in the vast world of finance for over decades now.

Therefore, it establishes itself as a compelling career prospect for various professionals, from individuals looking for long-term job security to professionals beginning their career at a big four accounting firm before lateraling to other financial fields, such as investment banking or private equity.

The competitive interview process seeks to identify and reward applicants who are well-equipped with strong technical and financial skills and good attention to detail.

Consequently, answering the technical, behavioral, and logical questions with confidence and consistency is key to converting an interview into an offer.

The following free WSO Accounting Interview Guide is a comprehensive tool designed to cover every aspect of the interview process, guiding you from the beginning to the end, therefore drastically improving your odds of landing the job at your desired accounting firm.

Our guide features a total of 33 of the most common technical, behavioral, and logical questions, along with proven sample answers, that accounting professionals ask to candidates during the hiring process.

This resource includes 12 firm-specific questions from the big four accounting firms (Deloitte, KPMG, etc.) and proven sample answers to them.

The First Accounting Interview Question

First impressions are key in interviews, and accounting is no different. Irrespective of which accounting firm you're applying to, you can be sure that your interviewer will ask this question, as it's a notable standard in the industry.

Anticipating this question beforehand, crafting a compelling narrative around it, and selling yourself on it will make you stand out from the pool of potential candidates.

Walk me through your background/resume

There are two ways to answering this question flawlessly. First, know your story and tell it like a master bard. When they ask you about yourself, they're judging whether they would want to work with you. These questions hold serious weight; use them to make yourself a desirable coworker.

af09.jpg)

First, dial-in a cohesive 90-second resume walkthrough that focuses on the positive and motivating factors behind every transition (school to job, job to better job, most recent job to grad school).

Be deliberate. Every move you made should have a reason (preferably that you initiated). Don't be negative. Never say you left because you were bored or "wanted to try something new."

Second, have a few backup stories in mind. Stories that effectively portray you as a good teammate, a problem-solver, a go-getter. Have these stories ready and use them to answer whatever the interviewer is asking you. Make sure your resume lines up with these. Tell them with confidence, clarity, and relevance, and you'll be putting yourself in good territory.

Sample Answer:

I went to school to learn how to design cars, but after my first internship, I realized that I like interacting with clients directly and pursued full-time roles in B2B sales. In these sales roles, I developed solid selling skills and gained exposure to a, b, and c. Since I wanted to continue honing those skills and focus on x, y, and z, I am seeking a new role/promotion that provides that opportunity.

15 Common Accounting Technical Questions

Technical questions are undoubtedly a critical component of the accounting recruiting process. Therefore, your interviewers will expect detailed and accurate responses to commonly asked technical questions, and your answers must demonstrate in-depth knowledge and expertise of the topic at hand.

dfb3.jpg)

The following section features 15 common accounting interview questions and sample answers for them.

At the end of these 15 questions, we have provided you with eight exclusive firm-specific technical questions to kickstart your mock interview training.

1. What are the three main financial statements?

Sample Answer:

The three main financial statements are

The Income Statement discloses a company's revenues and expenses, which together yield net income over a period of time. The Balance Sheet discloses a company's assets, liabilities, and equity on a specific date. The Cash Flow Statement starts with net income from the Income Statement; then adjusts for non-cash expenses, non-operating expenses like capital expenditures, changes in working capital, or debt repayment and issuance to arrive at the company's closing cash balance.

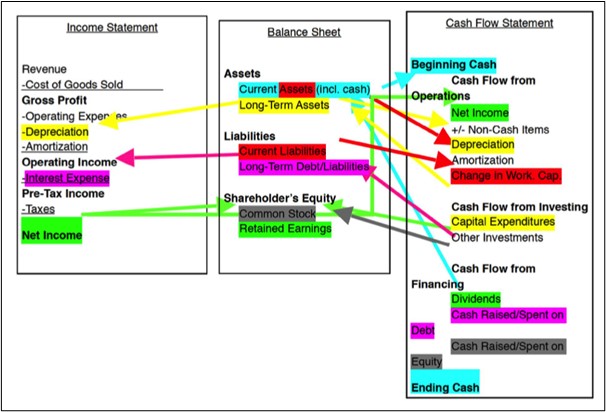

2. How are the three main financial statements connected?

Sample Answer:

Net income flows from Income Statement into the Cash Flow Statement (CFS) as Cash Flow from Operations. Dividends subtracted from net income are added to retained earnings from the prior period's Balance Sheet (BS) to come up with retained earnings as on the date of the current period's BS. The opening cash balance on the CFS is from the prior period's Balance Sheet, while the closing cash balance on the CFS is the balance on the current period's Balance Sheet.

The following chart gives you a more comprehensive overview of how the three financial statements are connected to help visualize and present better for your interview:

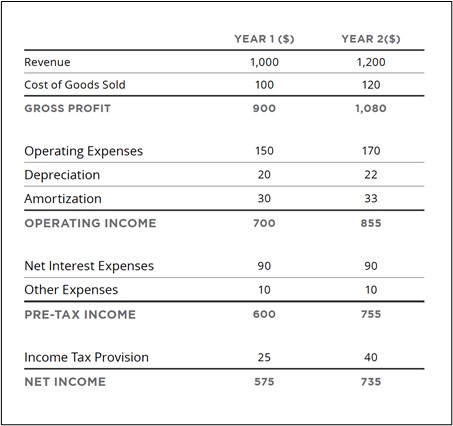

3. Walk me through the major line items of an income statement (negative numbers are shown in parentheses)?

Sample Answer:

The first line of the Income Statement represents revenues or sales. Next, you subtract the cost of goods sold, which leaves gross profit. Subtracting operating expenses, depreciation, and amortization from gross profit gives you operating income. Next, you subtract interest and any other expenses (or add other income) from operating income to get pre-tax income. Then subtract tax payments and what's left is net income.

4. If you could only use one financial statement to evaluate the financial state of a company, which would you choose?

Sample Answer:

I would want to see the Cash Flow Statement to see the actual liquidity position of the business and how much cash it is using and generating.

The Income Statement can be misleading due to any number of non-cash expenses that may not truly be affecting the overall business. And the Balance Sheet alone just shows a snapshot of the company at one point in time, without showing how operations are performing.

Whether a company has a healthy cash balance and generates significant cash flow indicates whether it is probably financially stable, and this is what the CF Statement would show.

Sample Follow-up Question: Now, assume you can choose to see two of a company's three financial statements. Which would you choose?

Sample Follow-up Answer:

I want to see the Income Statement and the Balance Sheet because one can produce an accurate expected or illustrative Cash Flow Statement with the information presented in the Income Statement and Balance Sheet.

The Cash Flow Statement begins with Net Income and then adjusts for non-cash and non-operating expenses, both of which are available in the Income Statement. We can calculate the changes in net working capital from information on the Balance Sheet to arrive at the Cash Flow from Operations.

Capital Cash Expenditures in the investing section of the Cash Flow Statement could be inferred by taking the year-over-year change in PP&E from the Balance Sheet, plus depreciation expense, less any cash inflows from the sale of capital assets.

Repayments of Debt in the financing section of the Cash Flow Statement can be inferred using the year-over-year changes in short-term and long-term debt balances while also adjusting for any debt capital raised. Similarly, repurchases of equity, dividends paid to equity investors, and equity capital raised would also be reflected on the Balance Sheet.

5. What is the purpose of the changes in the working capital section of the cash flow statement?

Sample Answer:

Due to accrual accounting, certain non-cash items affect the income statement and the balance sheet, like accounts payable and accounts receivable. Therefore, to reverse the effects of the non-cash items, we adjust for them in the "Changes in working capital" section.

Sample Follow-up Question: What does it mean if your change in net working capital is negative on the cash flow statement? Is negative working capital a bad thing for a company?

Sample Follow-up Answer:

While negative working capital by pure definition (i.e., current liabilities > current assets) may indicate a solvency issue for a company, or an inability to satisfy its obligations, negative working capital is not necessarily a bad thing.

Suppose a company is making a concerted effort to stretch out its payment terms with its vendors as much as possible to preserve its cash position (which is not included in the calculation of working capital). In that case, this will result in negative working capital (since Accounts Payable would likely cause an excess of current liabilities over current assets).

The company still has the liquidity to satisfy its obligations, but stretching out the vendor payment provides the company with the most flexibility.

6. What is the difference between accounts payable and accrued expenses?

Sample Answer:

They are the same thing. The main difference is that accounts payable is typically a one-time expense with an invoice (such as the purchase of inventory) while accrued expenses are recurring (like employee expenses). As a result, both accounts are reflected in working capital calculations.

7. Give some examples of accounting events that are typically involved in compound entries.

Sample Answer:

Examples of such accounting events would be:

- Bank deductions which are associated with a bank reconciliation

- Deduction of expenses related to payroll payments

- Sales transaction subject to sales tax

8. Can a company have a negative book value?

Sample Answer:

Yes, a company could have a negative book Equity Value if the owners are taking out large cash dividends or if the company has been operating for a long time at a net loss, both of which reduce shareholders' equity. Negative equity means that the company's current assets are fully funded by debt.

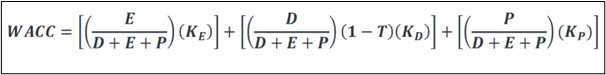

9. What is WACC, and how do you calculate it?

Sample Answer:

WACC is the acronym for Weighted Average Cost of Capital. It is used as the discount rate in a discounted cash flow analysis to calculate the present value of a company's cash flows and terminal value. It reflects the overall cost of a company raising new capital, which represents the riskiness of investment in the company.

WACC represents the blended cost (or return on the invested capital) to both debt holders and equity holders, based on the cost of debt and equity for that specific firm.

The formula below helps you calculate the WACC of a company if you are put on the spot and asked to calculate it as part of your technical interview:

where,

E = Market value of equity

D = Book value of debt

P = Value of preferred stock

KE= cost of equity (Calculate using CAPM)

KD = cost of debt (Current yield of debt)

KP = cost of preferred stock (Interested rate on preferred stock)

T = Corporate tax rate

10. What is goodwill?

Sample Answer:

Goodwill is an asset that captures the amount paid for acquiring a company over its fair market value.

Here is an example: Company A buys Company B for $100 million in cash. Company B has one asset: a factory with a book value of $75 million, debt of $25 million, and equity of $50 million, which equals the book value (assets minus liabilities).

- Company A's cash balance declines by $100 million to finance the acquisition (cost of the acquisition)

- Company A's PP&E increases by $75 million (book value of Company B's factory)

- Company A's debt increases by $25 million (Company B's acquired debt)

- Company A's goodwill increases $50 million (purchase price of Company B minus book value of equity in Company B)

- In short, Goodwill = Consideration paid - Net fair value of assets acquired

- In this case, it is equal to $50 million ($100 million - $50 million)

11. What is a deferred tax liability, and why might one be created?

Sample Answer:

Deferred tax liability is a tax expense amount reported on a company's income statement not paid in cash during that accounting period but expected to be paid in the future. This occurs when a company pays less taxes to the government than they show as an expense on their income statement.

This can be caused due to differences in depreciation expense between book reporting (GAAP) and tax reporting. This will lead to differences in tax expenses reported in the financial statements and taxes payable to the government.

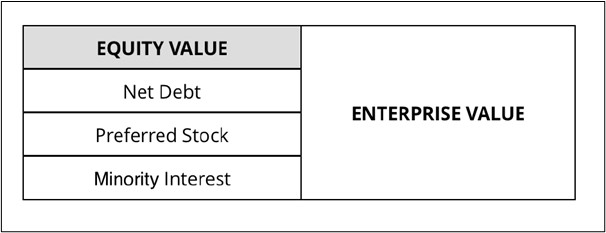

12. What's the difference between enterprise value and equity value?

Sample Answer:

Equity Value represents residual value for common shareholders after the company satisfies its outstanding obligations (net debt, preferred stock, which is senior to common equity).

13. Describe the liabilities items on a balance sheet.

Sample Answer:

- Revolver: This is a line of credit, which is not fixed in size, but rather has a maximum limit. A company can borrow and then pay off the debt at any time. Think of it as a credit card for companies. A Revolver is typically secured by a company's working capital assets, such as Accounts Receivable, Inventory, and Prepaid Assets.

- Accounts Payable: This is almost the opposite of Accounts Receivable. The company has received items but hasn't yet paid for them. It's an IOU to their supplier.

- Deferred Revenue: The company has collected cash from customers for services that will be delivered over time (think a subscription you pay upfront for an entire year).

- Accrued Expenses: These expenses are recorded on the income statement but haven't yet been paid in cash. These are typically recurring expenses like rent, salaries, etc.

- Deferred Tax Liability: The company has paid fewer cash taxes than it owes and will have to make it up by paying additional taxes to the government in the future.

- Long-Term Debt: Just like a car loan or a mortgage on your house, this is an amount of debt that matures in more than a year.

14. Describe the equity items on a balance sheet.

Sample Answer:

- Common Stock and Additional Paid-in Capital: This refers to the market value of the shares of stock when they were issued by the company, not the market value at the current time.

- Treasury Stock: This is the total value of shares that the company has repurchased from investors, at the value they were repurchased, not their current value.

- Retained Earnings: This is the company's cumulative net income minus any dividends that have been paid to equity investors.

15. What is net working capital?

Net Working Capital = Current Assets – Current Liabilities

- Current assets include items on the Balance Sheet like inventory, accounts receivable, prepaid expenses, and other short-term assets. Current liabilities include accounts payable, accrued expenses, deferred revenue, and other short-term liabilities.

- An increase in net working capital is a use of cash. This could be from increasing current assets like inventory or accounts receivable. For example, if you increase inventory, it is not (yet) a cost on the Income Statement but is still a use of cash due, which needs to be accounted for on the CF statement.

- A decrease in net working capital is a source of cash. This could include changes such as increasing accounts payable or reducing inventory. If you reduce inventory, you are selling more goods than you are producing, which means you realize a cost on your Income Statement. This is why in calculating free cash flow, you subtract an increase in net working capital.

- On the other hand, if you are increasing accounts payable, you preserve your liquidity by taking a little longer to pay your vendors for your raw materials/inputs.

- If net working capital went up, a company must have "used" cash to increase (for example, by purchasing more inventory than they sold).

Sample Answer:

Net Working Capital is current assets minus current liabilities. It measures a company's ability to pay off its short-term liabilities with its short-term assets. A positive number means they can cover their short-term liabilities with their short-term assets. A negative number indicates that the company may have trouble paying off its creditors, resulting in bankruptcy if cash reserves are insufficient.

Big 4 Accounting Technical Questions (Deloitte, E&Y, PwC, KPMG)

A detailed understanding of the answers to the 15 technical questions above indicates you have a strong technical foundation to gain a competitive edge over the applicant pool. This section aims to further strengthen your technical skills by helping you tailor your interview preparation specific to the accounting firm you are applying for.

The following section features eight exclusive questions that actual interviewers asked candidates at the Big 4 Accounting Firms.

The following questions have been taken from WSO's company database, which is sourced from the detailed experiences of more than 30,000 people with accounting interviews.

Deloitte Technical Questions

Sample Answer:

Beta is a measure of the volatility of an investment compared with the market as a whole. The market has a beta of one, and hence, investments that are more volatile than the market have a beta greater than one, while those that are less volatile have a beta less than one.

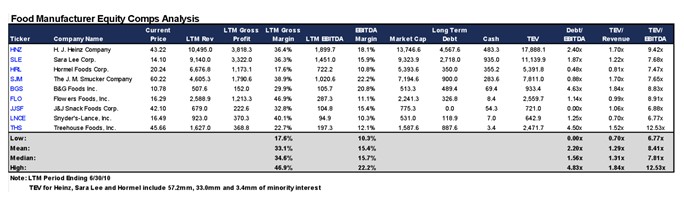

"Spreading comps" is the task of collecting and calculating relevant multiples for comparable companies.

Sometimes an analyst can pull the relevant multiples from a resource like CapitalIQ.

However, sometimes you have to research a company's data and financial information in their 10-K/10-Q to make sure they have adjusted for non-recurring charges or irregular accounting across an industry that can skew multiples across comparable companies. These charges can include one-time legal expenses, restructuring fees, asset write-downs, etc.

These adjustments will be detailed in the footnotes section of the financial statements.

A simple comps table is shown below.

Sample Answer:

Spreading comps means calculating relevant multiples from comparable companies and summarizing them for easy analysis and comparison. It can be challenging when a company's data and financial information must be scoured to conduct the necessary research.

PricewaterhouseCoopers (PwC) Technical Interview Questions

CAPM is used to calculate the required/expected return on equity (ROE) or the cost of equity of a company. The formula for CAPM is as follows:

Re = Rf + ß (Rm – Rf)

Sample Answer:

The Capital Assets Pricing Model (referred to as CAPM) calculates the required return on equity or the cost of equity. The return on equity is equal to the risk-free rate (usually the yield on a 10-year US government bond) plus the company's beta (a measure that compares the stock's volatility to the stock market) times the market risk premium.

Sample Answer:

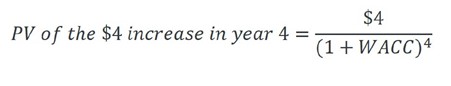

A $10 increase in depreciation decreases EBIT by $10, therefore reducing EBIT (1-t) by$10 * (1-t), where t is the tax rate. Assuming a 40% tax rate, it drops EBIT (1-t) by $6, but you must add back the $10 depreciation in the calculation of Free Cash Flow. Therefore your FCF increases by $4, and your valuation will increase by the present value of that $4 (the equation for PV is below).

This increase of $4 corresponds to the savings in tax due to depreciation.

Ernst & Young (E&Y) Questions with Sample Answers

Sample Answer:

Investing in stocks would be inherently less risky since the investment would still be worth a positive value if the stock price went down to $50, while the option would be worth $0 in the worst-case scenario. Another thing to keep in mind is that while stocks can be held forever, options have a date of expiry, after which it will be useless (especially relevant if the prediction doesn't materialize within the stipulated expiry).

Factors affecting option prices include,

- Current stock price

- Exercise price

- The volatility of the stock

- Time to expiration

- Interest rate

- The dividend rate of the stock.

Below is a chart of how these factors influence the price of an option.

KPMG Sample Technical Questions with Answers

It is important to keep your technical overview at a high level in an interview. Therefore, start with a high-level overview and be ready to provide more detail upon request.

Sample Answer:

- Project out cash flows for 5 - 10 years depending on the stability of the company

- Discount these cash flows to account for the time value of money

- Determine the terminal value of the company - assuming that the company does not stop operating after the projection window

- Discount the terminal value to account for the time value of money

- Sum the discounted values to find an enterprise value

- Subtract Net Debt and divide by diluted shares outstanding to find an intrinsic share price

This answer was edited and taken from the "Investment Banking Interview: Walk Me Through A DCF" post by WSO user @blmon00.

5 Common Accounting Behavioral/Fit Questions

Fit or "behavioral" questions are used to assess whether you have the right attitude, work ethic, personality, and values to fit in with an accounting firm's culture. Most accounting firms look for an alignment between the candidate's values with their firm's culture and do so through asking situational and ethical questions.

This section walks you through 5 of the most common types of fit questions and suggests approaches for answering them. The suggested approaches and sample answers are meant to be illustrative. Always remember, as an accountant, you need to adapt your answers to be true to yourself and your own words.

Common Accounting Behavioural Questions

You will need to be comfortable with numbers and generate formulas and perform calculations using Excel.

It is beneficial to talk about how you have managed your portfolio, completed a self-study modeling course, took the accounting or finance courses offered at your school, etc.

Sample Answer:

Although I majored in English, I have had an independent interest in accounting since I interned at a big four accounting firm in my first year of university. Ever since I completed that project, I have managed my portfolio of limited savings, investing in companies that I view as safe, long-term growth plays through simple fundamental analysis.

As a result, I have achieved an average annual return of 15% on my portfolio over four years.

As an accountant, you will likely be utilizing a lot of Excel. Therefore, having a strong background in Excel will give you a big leg up on the competition.

If your school has any classes focused on Excel, enrolling in those classes would be a good idea. However, if you feel motivated, check out some online courses, such as our Excel Modeling Course, which should give you a leg up while applying.

Have a concise 30-second pitch prepared. Concentrate on the three main bullets highlighted in the introduction, and identify three of your traits that manifest those qualities. Examples include being extremely driven, never giving up, wanting to learn, looking for challenges, etc.

Make sure you take only 20-30 seconds and speak with confidence, but avoid arrogance.

Sample Answer:

My dedication differentiates me from other candidates you may be interviewing. The process of getting an interview here at a Big 4 was exceptionally challenging, as many accounting firms don't recruit directly from my university.

So I cold-called and wrote letters to all the alumni I could find to get here, looking for someone to speak with me.

Finally, I got in touch with Jim Stevens, had an informal lunch to talk about the industry, and he offered to help get me an interview. So I didn't just drop my resume; I had to work to get here - an accomplishment I am proud of. You can be sure that if I am hired, I will show the same dedication to this job.

Motivated, smart, driven, humble, efficient. All good options along those lines. Accounting firms also tend to view applicants as compelling if they have demonstrated integrity in the past and have strong values and ethics. Just have an example to back up whatever word you chose.

Talk about your time management practices. Your task management strategies (how you stay organized, your self-management methods, and how you avoid procrastinating while things pile up) are critical to a career in accounting.

Sample Answer:

Between taking five classes a semester and participating in a few extracurricular activities, I have had a lot of tasks and assignments to keep track of.

However, I managed stress by staying organized, using the planner on my phone to track what was due when, and maintaining a folder or binder for each task.

This firm allows me to make sure I space out my work on projects that are due around the same time, make sure nothing gets lost or neglected, and avoid surprises.

In addition, I try to follow a regular schedule throughout the week that assures I won't let things go; I have found that if I don't allow tasks to pile up, I create less stress for myself to manage.

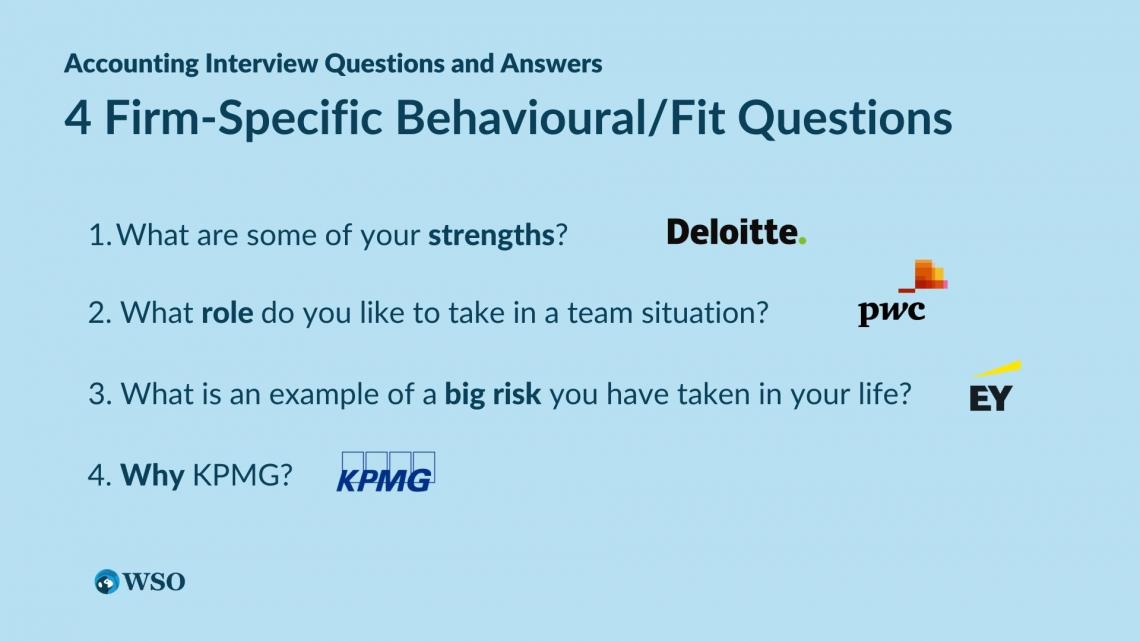

4 Firm-Specific Behavioural/Fit Questions

Knowing the culture of each accounting firm before walking into an interview is key to displaying an alignment between your personal beliefs with the firm's culture and walking out with an offer.

The following section features four exclusive questions asked by interviewers in the big four accounting firms in interviews. This aims to help you jumpstart your training for the respective accounting firms you are interviewing for.

The following questions have been taken from WSO's company database, which is sourced from detailed accounting interviews experiences of more than 30,000 people.

WSO Company Database

Gain Access to Exclusive Data on Compensation, Interviews, and Employee Reviews.

Deloitte Fit Questions

1. What are some of your strengths?

- Going into the interview, you should have your three top strengths in mind and a story ready to go for each of them.

- When you answer this question, make sure you identify your greatest strength and make it very clear. Don't dance around the answer. The strength you describe must be a quality that will help you become a great junior employee.

- You can list anything here; just make sure the strength you discuss backs up those characteristics for success that are listed in the introduction and provide vivid examples in support.

- Reiterate that you are a highly motivated, detail-oriented, great multi-tasker, team player, and fluent communicator with a high level of endurance, etc.

Sample Answer:

From my resume, I have strong quantitative skills and performed well in school as you can probably tell. However, I think one of my greatest strengths vital for accounting is not something that can be documented. And that is my ability to learn quickly.

At my internship last summer, I was brought into the office by my boss, given an old version of an Excel model and a list of variables he wanted to tweak, and told to rebuild the model from scratch. At the time, I had no previous modeling experience, no training, and no idea of what I was doing. I knew my boss didn't have time to hold my hand through the process, so I had to teach myself. I bought a book and used Internet resources to learn how to rebuild the model to my boss's specifications in a very short amount of time.

My boss was amazed at the quality of the model, and it is now being used for his analysis and in presentations to clients.

PricewaterhouseCoopers (PwC) Behavioral Questions

2. What role do you like to take in a team situation?

It is important to show that you are comfortable with both a leadership role and working under someone else's leadership.

Try to talk about your teamwork skills (communication, collaboration, etc.) and how those skills are effective when you are the leader and when you support someone else's leadership.

Sample Answer:

I'm comfortable leading a team or taking instructions from another leader. However, when the leadership isn't appointed, I think it's useful to consider my teammates' concerns and preferences.

For example, in one of my classes last year, I was placed in a group where nobody was confident about the subject matter, so they all shied away from taking responsibility.

I thought I could help in that particular group by taking the initiative, so I stepped up to coordinate the group's assignments. In another group situation, where one student insisted on taking charge, I was happy to support him. He communicated his ideas and organized a plan, which allowed the rest of us to deliver our tasks on time with high quality.

Overall, I think the quality of leadership is more important than who provides it, and most important of all is the quality of the team's work. Since every situation presents a unique set of personalities, it's important to read those personalities and identify how you best fit into the group dynamic.

Ernst & Young (E&Y) Fit Questions with Sample Answers

3. What is an example of a big risk you have taken in your life?

This question asks whether you follow a sound thought process in making important decisions.

Think of the biggest risk you ever took in your life and describe the thought process you went through when deciding to take the risk. Tell how you weighed the positives and negatives of all the alternative scenarios. Then discuss and evaluate the outcome of that risk and what you learned from the experience.

Here are some questions to help generate other ideas. Did you ever travel abroad or afar alone at a young age? Have you ever started a small business? Have you ever made a risky financial investment?

Sample Answer:

One of the biggest risks I have taken was during the final match of my conference golf tournament last spring. We were on the 18th hole, and I was 1-up playing match play. I drove the ball a little offline and ended up partially blocked by a tree. My opponent was in great shape, and I knew he would make par at worst. So I had to decide whether to try to hit a riskier shot that could result in a big number, or play it safe, try to make par, and hope my opponent didn't make birdie.

I weighed my options. It was a shot I had hit before, and I knew that if I executed, chances were good that I would win or halve the hole and win the match. Even on the downside, if I didn't hit the shot, I could still make par and halve, and if I lost the hole, we would go into a playoff. I decided to take the risk, trust my game, and go for the win. I pulled it off beautifully, made my par, halved the hole, and won the match and the championship for my team.

KPMG Behavioral Questions with Sample Answers

4. Why KPMG?

Sample Answer:

Any accounting firm can generally ask this question, and the preparation routine is consistent across all such firms. Ideally, you want to tie in and present an alignment between your interests and values with the firm's culture and support this with examples.

An exceptionally strong way of demonstrating this would be networking with current accountants at the firm, talking about the appreciation you felt towards the characteristics of those you networked with (refer to specific people wherever possible), and concluding with how that makes you feel the firm would be a great place to work.

WSO Elite Modeling Package & Additional Resources

Succeeding as an accountant requires technical expertise in finance. Interviewers can ask over thousands of questions in various ways, and therefore candidates who have memorized answers are eliminated in early interview rounds.

However, the minority of candidates who have taken the effort to master the underlying accounting concepts can answer unexpected questions on the spot and consequently receive offers from accounting firms. If you're an aspiring accountant, WSO has got you covered with its official Accounting Foundations Guide, featuring:

- 45+ lessons

- 15 exercises

- All accounting concepts for someone looking to be proficient at accounting

Think about it - if this page can set you miles ahead of the competition, imagine what our complete package can do for you.

The Accounting Foundations Guide will help you achieve technical mastery and place you in the strongest position to land the job.

Everything You Need To Build Your Accounting Skills

To Help you Thrive in the Most Flexible Job in the World.

Big 4 Accounting Firms

The following are the Big 4 Accounting Firms referenced in this guide, and part of the 185+ accounting firms WSO has data on in its company database:

- Deloitte| Deloitte Overview | Deloitte Site

- PricewaterhouseCoopers (PwC)| PwC Overview | PwC Site

- Ernst & Young (E&Y)| E&Y Overview | E&Y Site

- KPMG| KPMG Overview | KPMG Site

WSO Company Database

Gain Access to Exclusive Data on Compensation, Interviews, and Employee Reviews.

Additional interview resources

To learn more about interviews and the questions asked, please check out the additional interview resources below:

or Want to Sign up with your social account?