DCF MODELING COURSE

Introducing...

75+ Lessons, 5 hours of video lessons

To Help You Thrive in the Most Prestigious Jobs on Wall Street....

HERE’S JUST SOME OF WHAT YOU’LL GET IN THIS COURSE

DCF - The Big Picture (15 video lessons)

In this module, we use 15 video lessons to explain the theory and logic behind valuation before we put this knowledge into practice with a Nike case. Learn the difference between intrinsic and relative valuation, enterprise vs equity value, and more.

Enterprise & Equity Value Practice (10 video lessons)

In this module, we use 10 video lessons to explore enterprise value and equity value, a bit more in-depth by applying the knowledge we gained so far across a number of practice exercises.

DCF Introduction (9 video lessons)

In this module, we use 9 video lessons to fully break down a DCF analysis. This module will also go into key terminology, how to locate information and drivers of Free Cash Flow Projections.

DCF Fundamentals (13 video lessons)

In this module, we use 8 video lessons to explain Unlevered vs. Levered Free Cash Flow and how to calculate and project Net Working Capital. We also learn sample ratios used by professionals to project UFCF.

WACC Overview (8 video lessons)

This module uses 8 video lessons to cover how to calculate the Weighted Average Cost of Capital and its implications on valuations.

Deriving Share Price from the NPV (13 video lessons)

In this module, we use 13 video lessons to go over how to derive a company's share price from the Net Present Value of Future Cash Flows. Here is where you get the final output of a DCF.

Nike DCF Modeling (7 video lessons)

During the course, we will be using Nike, Inc. as our primary case to construct a DCF and demonstrating the calculations used throughout the model to make sure the examples and illustrations are realistic.

WSO DCF Modeling Course - Video Preview

Course Summary - Table of Contents

Below you will find a list of the modules and lessons included in this course.

- About Your Instructors (2Min)

- DCF Valuation Modeling Course Objectives (3Min)

- What You Will Learn From the Course (4Min)

- Additional Resources (2Min)

- Valuation Roadmap (4Min)

- Conceptual Framework for Company Value (4Min)

- Intrinsic vs. Relative Valuation (7Min)

- Simple Example of Valuation Thought Process (4Min)

- Introduction to Discounted Cash Flows (4Min)

- Example - Simple DCF Valuation Calculation (3Min)

- Example - Simple DCF Valuation in Perpetuity (3Min)

- Use of DCF in Practice (4Min)

- Introduction to Equity Value (3Min)

- Example - Simple Equity Value Calculation (2Min)

- Introduction to Enterprise Value (2Min)

- Example - Moving from Equity Value to Enterprise Value (2Min)

- Example - Nike's Market-Implied Enterprise Value (3Min)

- Nike's Balance Sheet Implications on Enterprise Value (2Min)

- Module Summary, Reflections, and Calculations (3Min)

- Module Overview (2Min)

- Example 1 - What Affects Enterprise Value (3Min)

- Example 2 - What Affects Enterprise Value (2Min)

- Enterprise Value's Relationship with Capital Structure (2Min)

- Enterprise Value and Equity Value Practice Examples (I-II) (3Min)

- Enterprise Value and Equity Value Practice Examples (II-II) (3Min)

- Other Activities Impacting Enterprise Value (3Min)

- Intro to Enterprise and Equity Value Multiples (5Min)

- Common Metrics that Pair with Enterprise and Equity Value (4Min)

- Module Summary, Reflections, and Calculations (3Min)

- 4.1 Conceptual DCF Process Overview (2Min)

- Core Competencies for Building a DCF Valuation Model (1Min)

- P&L Terminology Used in DCF Valuation (5Min)

- How They are Applied in DCF Valuation (6Min)

- Other Financial Statement Terminology for DCF Valuation (4Min)

- Introduction to Preparing LTM Financial Metrics (6Min)

- Locating Relevant Information to Project Free Cash Flow (2Min)

- Sample FCF Projection Drivers for a DCF Analysis (3Min)

- DCF Valuation Benefits and Considerations (5Min)

- Unlevered vs. Levered Free Cash Flow (4Min)

- Calculating Net Working Capital (7Min)

- Example - Calculating Annual Changes in NWC (4Min)

- Techniques for Projecting Net Working Capital (4Min)

- Sample Working Capital Ratios for UFCF Projections (5Min)

- Introduction to Weighted Average Cost of Capital (WACC)

- How the WACC Fits Into Valuation

- WACC Overview

- Introduction to the Capital Asset Pricing Model (CAPM)

- Introduction to the Unlevered Beta Calculation

- Example - Simple Beta Comparison

- Example - Calculating Cost of Equity

- Example - Calculating WACC

- Remember - Conceptual DCF Process Overview (2Min)

- Bridging from EV to Equity Value in a DCF (1Min)

- Additional Trading Comps Considerations - Fully Diluted Shares (2Min)

- Additional Detail - Fully Diluted Shares Outstanding (4Min)

- Basic FDSO Exercise (4Min)

- Calculating the Dilutive Impact from Options and Warrants (4Min)

- Example 1 - Dilutive Impact from Options and Warrants (3Min)

- Dilutive Impact from Converts and Other Securities (3Min)

- Examples - Dilutive Impact from Converts and Other Securities (3Min)

- Dilutive Impact form Converts and Other Securities (4Min)

- Example 4 - Dilutive Impact - Convertible preferred Stock (6Min)

- Impacts from Restricted Stock and Other Dilutive Securities (4Min)

- Conducting a Sensitivity Analysis (3Min)

- Projecting Nike's Unlevered Free Cash Flow

- Nike WACC Calculations

- Nike WACC via Beta Comparables

- Calculating NPV of Unlevered Free Cash Flows

- Nike Terminal Value Considerations

- Calculation of Nike Implied Price per Share

- DCF Sensitivity Analysis

Our students have landed and thrived at positions across all top Wall Street firms, including:

Don’t Take Our Word For It

Hear from a few of our 57,000+ students...

Hear from a few of our 57,000+ students...

"I find it very useful in that instead of going into the DCF immediately the instructors talk through EV and give you an extensive background on it. I've done other financial modeling courses and they do not go in-depth as much as this course has. [The] EV practice modules are great. The topics covered helped me grasp the EV concepts much better than I had previously."

"I must say the course is pretty exhaustive and is nicely put together. Kudos to the WSO team and special thanks to Tim, Josh and Levi for putting this together."

"Overall, I was very impressed with the DCF course! The slides were well-designed, the difficulty level was appropriate, and the speakers included many examples of how these concepts can be applied in the industry. I enjoyed the course very much. I look forward to any future projects the WSO team has to offer!"

"Overall, fairly detailed and well structured and was a good review for me. Covered some nuances of each of the step involved. Didn't handhold much and the examples were topical."

"I feel the course helped with understanding the DCF from a conceptual level to the individual steps needed, and the reasoning behind each step. Overall I would highly recommend this course to someone who needs help understanding the DCF step by step."

"I think that the course was very helpful in terms of being a refresher. For some context, I am a rising junior in college, who finished up the recruiting cycle around 5 months ago. Since then, I haven't really looked at any finance content at all, and after taking this course, it made my conceptual understanding of the material stronger as it was now reinforced. I can more confidently remember some of the material and that has been a huge help...For people who have corporate finance backgrounds and are interested in learning about the DCF model, the course probably will serve its purpose."

Before completing Wall Street Oasis' DCF course, I had little experience in DCF modeling. This course was very well taught, clear, and easy to follow. It breaks down key concepts and guides you through introductory exercises followed by a step-by-step DCF-based valuation in a case study format. Applying the information that you learn throughout the course makes it very comprehensive and ensures your understanding! Learning from this course will be very beneficial in the future because it sharpens your Excel skills, and it prepares you for calculating DCF-based valuations. Again, another great course by WSO, and I certainly recommend this course!

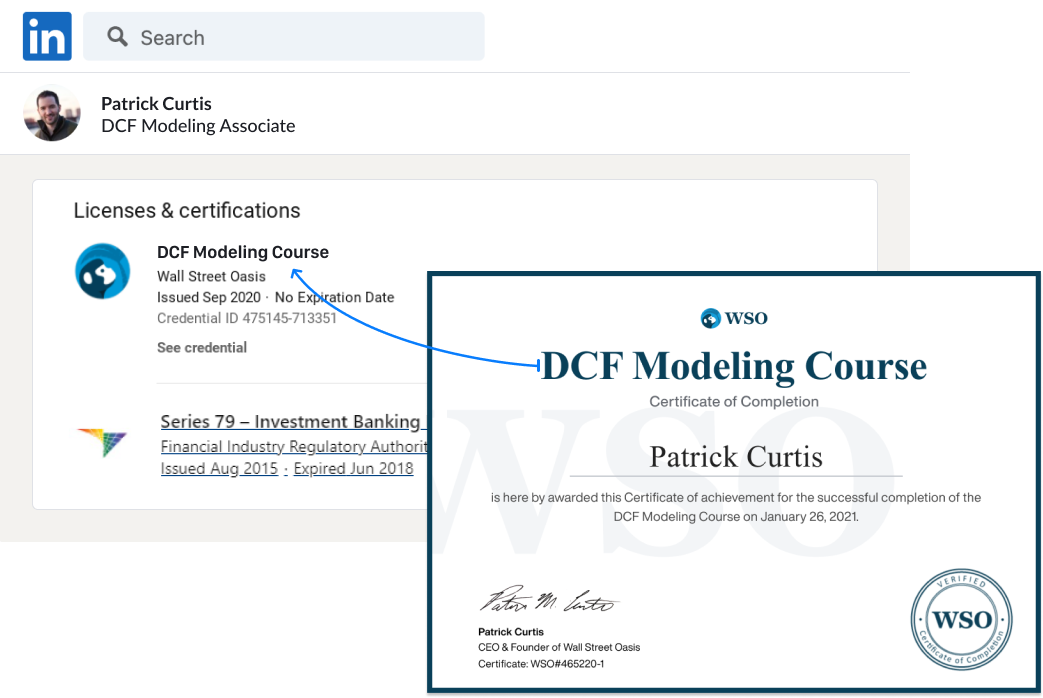

Get the DCF Modeling Course Certification

After completing the course, all students will be granted the WSO DCF Modeling Course Certification. Use this certificate as a signal to employers that you have the technical DCF modeling skills to immediately add value to your team.

Demonstrate that you have put in the work outside of university courses to become a master in discounted cash flow modeling. Easily share to LinkedIn and other social media sites to highlight your skills and strengthen your profile as a candidate.

How Much is Your

Finance Career Worth?

What You Get | Value |

|---|---|

WSO DCF Modeling Course 75+ video lessons across 8 Modules taught by a top-bucket bulge bracket investment banker... | $500 |

Build a Realistic DCF Model of Nike Step by Step Gain realistic practice of DCF modeling with the help of an elite investment banker and megafund PE instructor | $450 |

24 Months of Unlimited Elite Support from Actual Finance Pros Have a technical question? Easily drop a comment into any lesson and get a response from a pro within 48hrs. | $300 |

TOTAL VALUE | $1,250 |

Get Unlimited Lifetime Access To The WSO DCF Modeling Course For 92% Off

$1,250

$97

...or get access today for only $37

Secure checkout

100% Unconditional Money-Back Guarantee

12 Month Risk-Free Guarantee

Your investment is protected by our 12-Month Risk-Free Guarantee. If, for any reason, you don't think the WSO DCF Modeling Course is right for you, just send us an email, and we'll refund every penny. No questions asked. In short, you get a great return on your investment, or you get your money back. It's that simple.