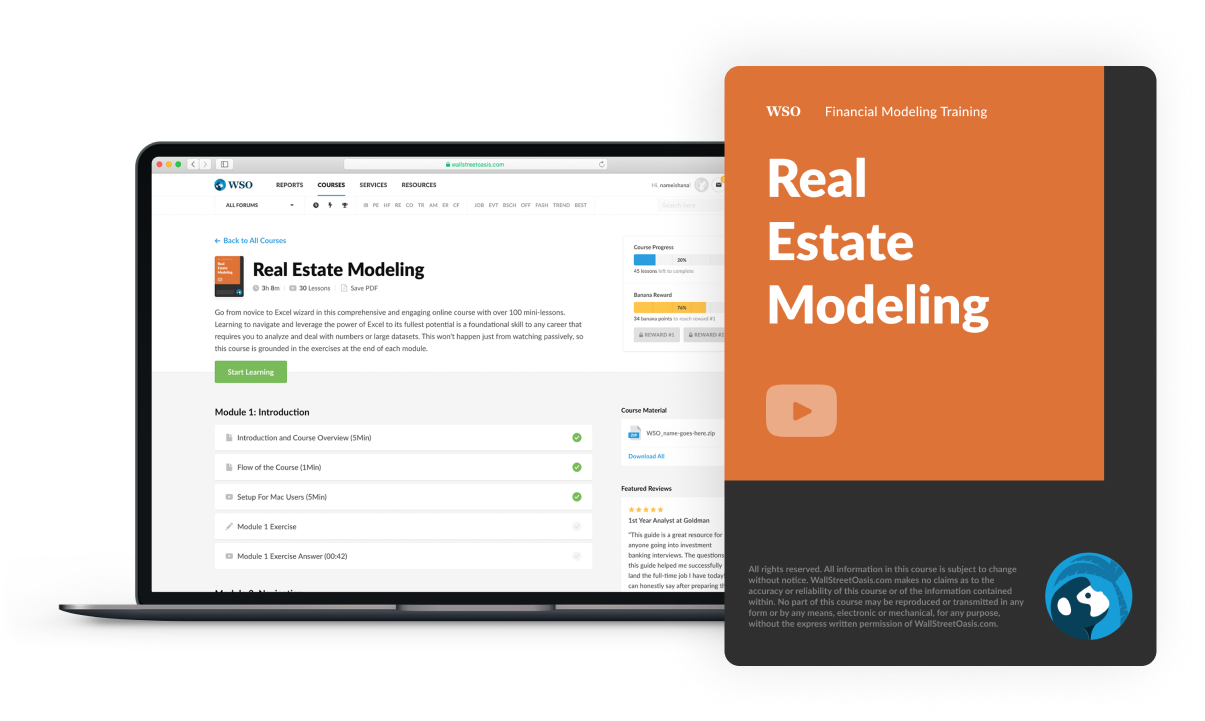

Real Estate Modeling Course

Introducing...

A Course with 60+ Lessons, 6 Cases or Modeling Tests + More on the Way

To Help You Thrive in the Most Rigorous RE Interviews and Jobs...

HERE’S JUST SOME OF WHAT YOU’LL GET IN THIS COURSE

Multifamily Modeling Basics (12 video lessons)

This module uses 12 video lessons to explain the basics of real estate modeling. We will go over how to read a multifamily operating statement, forecast that into cash flows, calculate the Cap Rate and IRR, and how to modeling financing.

Commercial Modeling Basics (9 video lessons)

This module uses 9 video lessons to go over the nuances of commercial real estate modeling and touch on the basics again. We will explore software, lease structures, tenant improvements, leasing commission, and how to read a commercial operating statement.

Advanced Concepts (7 video lessons)

This module will use 7 video lessons to introduce advanced concepts and get into the nitty-gritty of real estate modeling. We will identify the differences between GP and LP equity and how to add value and develop multifamily and commercial properties. We will also introduce hospitality property such as hotels

Simple Multifamily Underwriting Test (11 video lessons)

In this module, we use 11 video lessons to demonstrate how to solve a modeling test and underwrite a potential acquisition of a multifamily property using a real-life OM, a pro forma model, and historical financials. Learning how to extract data points and input them into a model to forecast cash flows. We will also simulate a situation where incomplete data was provided, and how to fill those gaps.

Modeling Office Cash Flows Test (13 video lessons)

In this module, we use 13 video lessons to model the 10-year cash flow of a large LA office building. You will use an acquisition overview and a partially built excel model. This module also includes calculating the IRR, calculating the equity multiple, and calculating the 3, 5, and 10-year cash on cash.

Multifamily Acquisition Modeling Case (10 video lessons)

In this module, we use 10 video lessons to analyze a potential multifamily investment called Banana Springs. You will build out cash flows, calculate the returns + other metrics. This module will also help you refine your skills in forecasting the income statement, building an amort schedule, sensitivity tables, and formatting.

Development Modeling Case (10 video lessons)

In this module, we use 10 video lessons to analyze a potential office development. You will be building a model that potential investors will use to decide whether to commit to the project. The models will be done from scratch, to make sure you can do the same on your own in the interview and on the job.

NY Office Metrics Case (6 video lessons)

In this module, we use 6 video lessons to go through a case study of a commercial NYC office. We will calculate Weighted Average Lease Expiry (WALE), Passing Cap Rate at entry and exit, IRR, and build a sensitivity table.

Office Lease-Up Case (6 video lessons)

In this module, we use 6 video lessons to walk through a case study of a 115,000 square foot office campus. We will build a monthly cash flow model, Sources and Use Summary, and incorporate key assumptions such as multiples, profit, and annual cash flows.

WSO Real Estate Modeling Course - Video Preview

Course Summary - Table of Contents

Below you will find a list of the modules and lessons included in this course.

- Property Details, Acquisition, Rent Roll Summary (5Min)

- Market Assumptions (4Min)

- Market Assumptions Forecasting (4Min)

- Income Statement (Income) (4Min)

- Income Statement (Expenses) (6min)

- Income Forecasting (3Min)

- Expense Forecasting (3Min)

- Finance Sizing (5Min)

- Amortization Table (2Min)

- Disposition Analysis (4Min)

- Unlevered Cash Flows (2Min)

- Levered Cash Flows (3Min)

- The Value-Add Play (1min)

- Renovation Costs (3min)

- Renovation Premiums and Timing (3min)

- Renovation Forecasting (5min)

- Renovation Cash Flow (3min)

- Capitalization and Financing (3min)

- Development Intro (2min)

- Timing - Part 1 (2min)

- Timing - Part 2 (5min)

- Lease-Up Income (4min)

- Lease-Up Expenses (3min)

- Development Budget (2min)

- Forecasting Development Costs (4min)

- Constructing Financing - Part 1 (4min)

- Constructing Financing - Part 2 (5min)

- Trended Operating Statement (1min)

- Permanent Financing (2min)

- Disposition Analysis (2min)

- Unlevered Cash Flow (2min)

- Levered Cash Flow (5min)

- WTF is ARGUS (1min)

- Common Lease Types (2min)

- Commercial Operating Statements (4min)

- What is Roll? (4min)

- Getting to NOI (4min)

- Leasing and Capital Costs (2min)

- Circuit Breakers (3min)

- Error Checks (2min)

- Waterfalls Explained Simply (2min)

- Waterfall Build: Deal Structure and Hurdle 1 (3min)

- Waterfall Build: Hurdle 2 and After (4min)

- Intro (1Min)

- The Basic Inputs (1Min)

- Backing into Market Rent (3Min)

- Other Income and RUBS (1Min)

- Vacancy and Deductions (3Min)

- Operating Expenses (6Min)

- Operating Expenses Round Two! (4Min)

- Growth Assumptions and Scenarios (7Min)

- The "Value Add" Play (4Min)

- Acquisition and Disposition (4Min)

- Is this a "Good" Investment? (1Min)

- Module 8 Intro (1Min)

- Modeling Market Assumptions (4Min)

- Max Consulting Base Rent (8Min)

- Max Consulting Operating Expense Recoveries (2Min)

- Max Consulting TIs and LCs (3Min)

- Banana Farm Financial (3Min)

- Prestige Worldwide Base Rent (1Min)

- Prestige Worldwide Operating Expense Recoveries (1Min)

- Prestige Worldwide TIs and LCs (1Min)

- Property Level Cash Flow (2Min)

- Unlevered Cash Flows (5Min)

- IRR, Cash on Cash, and Equity Multiple (3Min)

- Investment Recommendation (4Min)

- Module 9 Intro (1min)

- Forecasting the Income Statement (10Min)

- Unlevered Cash Flows (4Min)

- Unlevered Returns (2Min)

- Levered Cash Flows Part 1 - Loan and Amortization (7Min)

- Levered Cash Flows Part 2 - Rolling Up Cash Flows (3Min)

- Levered IRR, Profit, and Multiple (1Min)

- CoC, DY, YoC (1Min)

- Sources and Uses (2Min)

- Sensitivity Tables (6Min)

- Module 10 Intro (1Min)

- Development Inputs (6Min)

- Forecasting Property Cash Flow (5Min)

- Unlevered Costs (5Min)

- Levered Costs Part 1 (5Min)

- Levered Costs Part 2 (7Min)

- Sale Summary (1Min)

- Unlevered Returns (3Min)

- Levered Returns (3Min)

- Interview Questions (2Min)

- WALE (2Min)

- Expiration Chart (1Min)

- Passing Cap Rate (Entry) (2Min)

- Passing Cap Rate (Exit) (1Min)

- IRR (2Min)

- Sensitivity Tables (2Min)

- Rent Roll and Timing Pt. 1 (3min)

- Rent Roll and Timing Pt 2. (3min)

- Acquisition, Financing, and Sale (5min)

- Sources and Uses (2min)

- Returns and Annual Cash Flows (2min)

Our students have landed and thrived at positions across all top Real Estate firms, including:

Don’t Take Our Word For It

Hear from a few of our 57,000+ students...

Hear from a few of our 57,000+ students...

I like the course in general. It gives a good overview of real estate modeling with interesting examples. The course gave me insight in how to categorize incomes and expenses in a neat and structured way.

"Not having any exposure to Real Estate Financial Modeling, I found the videos to be helpful to listen to, Austin does a great job explaining what he does in each video segment. As someone who just graduated in May and taking no real estate courses in college (majored in Finance), it was easy to understand...Overall the course was great, it's very informative and saved me a lot of time from not having to look up in-depth and try to read how to make a financial model for different properties. Thank you for the early access, and I hope my review was helpful!"

I really enjoyed the course because of how detailed the modeling was and that the instructors provided a number of different cases covering a wide range of asset classes. The instructions were easy to understand, and speaking as someone who had worked in real estate in the past, I can testify that the models are detailed and practical in the actual work of a real estate fund.

Great explanation of the financial outcomes based on various assumptions and purchased buildings. The different modules make quite clear the variance between the valuations of, let's say, an office and a multifamily apartment complex. Detailed overview of all the predicted expenses and the expected increase over time. A comprehensive summary of the operations of different real estate businesses.

Since I have very little prior knowledge of real estate modeling, this first course already helped me to understand the basic concepts of this modeling approach. The instructor has a very good way of explaining the excel build and the links between different parts of the model.

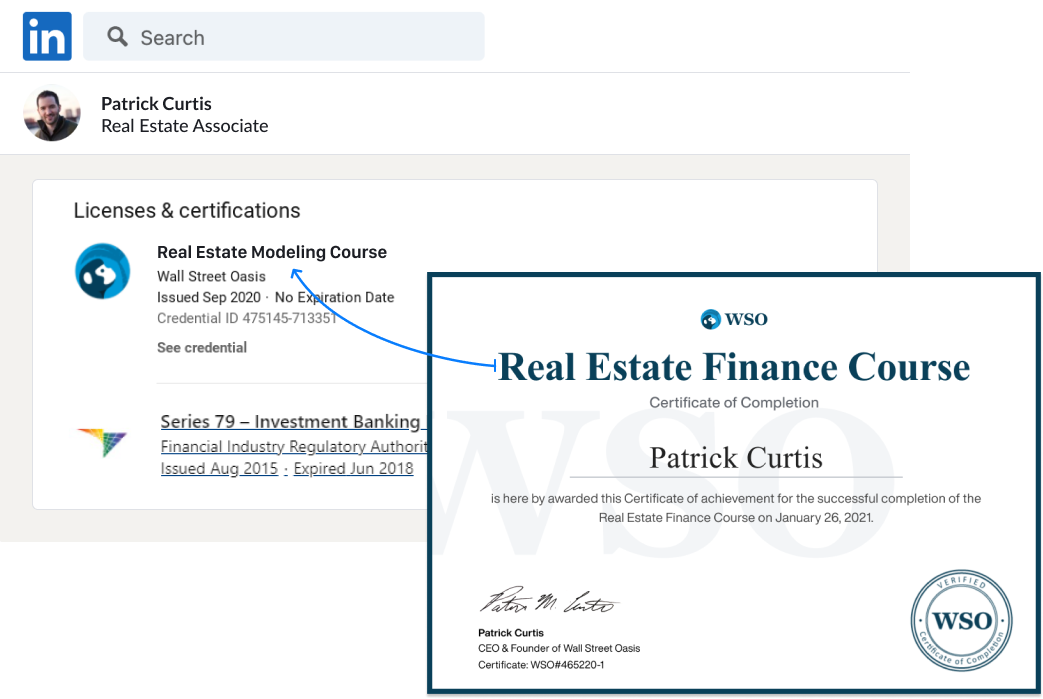

Get the Real Estate Modeling Course Certification

After completing the course, all students will be granted the WSO Real Estate Modeling Course Certification. Use this certificate as a signal to employers that you have the technical RE modeling skills to immediately add value to your team.

Demonstrate that you have put in the work outside of university courses to make yourself more efficient and master the most critical skills for success in real estate finance. Easily share to LinkedIn and other social media sites to highlight your skills and strengthen your profile as a candidate.

How Much is Your

Finance Career Worth?

What You Get | Value |

|---|---|

WSO Real Estate Modeling Course 40+ video lessons taught by an elite Real Estate private equity professional... | $500 |

4 Interactive Modeling Tests from Real life with Templates Realistic practice drilling the concepts with actual modeling tests you see in the toughest RE interviews... | $450 |

24 Months of Unlimited Elite Support from Actual RE Finance Pros Have a technical question? Easily drop a comment into any lesson and get a response from a pro within 48hrs. | $300 |

TOTAL VALUE | $1,250 |

Get Unlimited Lifetime Access To The WSO Real Estate Modeling Course For 76%Off

$1,250

$297

... or 3 monthly payments of $109

Secure checkout

100% Unconditional Money-Back Guarantee

12 Month Risk-Free Guarantee

Your investment is protected by our 12-Month Risk-Free Guarantee. If, for any reason, you don't think the WSO Real Estate Modeling Course is right for you, just send us an email, and we'll refund every penny. No questions asked. In short, you get a great return on your investment, or you get your money back. It's that simple.