Private Equity Interview Questions and Answers

40 common private equity interview questions. Examples include technical, transactional, behavioral, and logical tests with sample answers

_02ccb.jpg)

Private Equity (PE) is often considered by professionals to be one of the most challenging sectors to break into within the finance industry. Vast amounts of talent from a variety of past professional experiences (investment banking, asset management, etc.) apply to private equity firms, seeing them as the golden exit opportunity due to generally better pay and (usually) better hours.

The competitive interview process is therefore designed to rigorously filter out potential candidates, with less than 1% of candidates receiving job offers.

Consequently, answering the technical, transactional, behavioral, and logical questions confidently and consistently is key to converting an interview into an offer.

The following free WSO PE interview guide is a comprehensive tool designed to cover every single aspect of the interview process, guiding you from the beginning to the end, therefore drastically improving your odds of landing your dream job.

This guide features a total of 40 of the most common technical, transactional, behavioral, and logical questions, along with proven sample answers that private equity professionals ask candidates during the hiring process.

We have also added dedicated sections on discussing previous deal experiences and featured a free LBO modeling test (video solution + modeling file) at the end of the guide to perfect your modeling skills! It is a great place to start your preparation before investing in our more comprehensive Private Equity Interview Course.

This resource includes 13 firm-specific questions from leading private equity firms (Blackstone Group, Kohlberg Kravis Roberts (KKR), etc.) and also proven sample answers to them.

This interview guide consists of 11 sections, each focused on different phases of the interview process.

Common First Private Equity Interview Questions

There are no excuses for not perfecting what is in your control. Irrespective of the firm, the position, or your region, you can be sure these two questions will be asked as they're a standard in the industry.

Anticipating both of these questions beforehand, crafting a compelling narrative around them, and selling yourself on it will make you stand out from amongst the pool of potential candidates.

Walk me through your background/resume

Dial-in a cohesive 90-second resume walkthrough that focuses on the positive and motivating reasons behind every shift (school to job, job to better job, most recent job to grad school).

There are two facets to answering this question immaculately. First, know your story and tell it like a master bard. When they ask you about yourself, they're judging whether they would want to work long hours with you. These questions hold serious weight; use them to make yourself a desirable coworker.

Second, have a few backup stories in mind. Stories that effectively portray you as a good teammate, a problem-solver, a go-getter. Have these stories ready and use them to answer whatever the interviewer asks you. Make sure your resume aligns with these. Tell them confidently and with clarity and relevance, and you'll be putting yourself in good territory.

Why private equity?

Given the variety of professional backgrounds that candidates come from, WSO has created a dedicated page to answer this question. WSO's "Why Private Equity?" page covers 9 sample answers tailored for students and professionals looking to break into private equity.

15 Common Private Equity Technical Questions

Technical questions are a critical component of almost every private equity recruiting process. Therefore, your interviewers will expect detailed and accurate responses to commonly asked technical questions, and your answers must demonstrate in-depth knowledge and expertise of the topic at hand.

The following section features 15 common PE interview questions, as determined by the WSO Company database and the Harvard Business School Venture Capital & Private Equity club members. A sample answer has been provided for every question.

At the end of these 15 questions, we also have provided you with eight exclusive firm-specific technical questions to kickstart your mock interview training.

WSO Pro Tip:

The 15 technical questions covered below are exclusive to the private equity industry. However, PE interviews often overlap with investment banking interviews as general finance/accounting questions can also be asked. To check out an additional 30 technical questions with sample answers, check out WSO's free 101 Investment Banking Interview Questions and Answers page.

1. Tell me why each of the financial statements by themselves is inadequate for evaluating a company?

Sample Answer:

Income Statement:

The income statement alone won't tell you whether a company generates enough cash to stay afloat or whether it is solvent. You need the balance sheet to tell you whether the company can meet its future liabilities, and you need the cash flow statement to ensure it is generating enough cash to fund its operations and growth.

Balance Sheet:

The balance sheet alone won't tell you whether the company is profitable because it is only a snapshot on a particular date. For example, a company with few liabilities and many valuable assets could actually be losing a lot of money every year.

The cash flow statement won't tell you whether a company is solvent because it could have massive long-term liabilities which dwarf its cash-generating capabilities.

The cash flow statement won't tell you whether the company's ongoing operations are actually profitable because

cash flows in any given period could look strong or weak due to timing rather than the underlying strength of the

company's business.

ae29.gif)

2. What might cause two companies with identical statements to be valued differently?

Sample Answer:

The financial statements do a decent job of painting a picture of a company's historical performance, but they do not essentially tell us all that we need to know about its future performance. Since the value of a company depends primarily on its expected future performance, the financial statements are insufficient.

Examples of important things financial statements don't tell us are:

- The future growth of the industry in which the company operates

- The company's competitive position including market share, relationships, patents, etc.

- The reputation and capabilities of the company's management team

- The quality of the company's future strategy

3. Why do private equity firms use leverage?

Sample Answer:

PE returns are calculated based on the return on their invested equity. Using leverage to do deals allows you to use less equity which means the ultimate returns are larger in comparison to the amount of equity initially invested. Another way to look at it is that the cost of leverage (debt) is lower than the cost of equity because equity is generally priced to an IRR of 20%+, whereas the annual interest expense on debt is usually below 10%.

Yet another way to look at it is that using a lot of debt makes the return on equity much more volatile and much riskier because the debt must be repaid before the equity gets any return. The high returns on PE equity may be seen as the fair return associated with the extra risk associated with high leverage.

WSO Pro Tip:

This question can also be asked as "How does leverage increase PE returns?"

4. How would you successfully close a deal if you and the seller disagree on the price of an asset due to different projections of its future operating performance?

Sample Answer:

The classic PE solution to this common problem is called an "Earn-out." This solution is often used because sellers are more optimistic about the future performance of a business than PE investors are willing to underwrite. In such cases, either party may propose that the sellers are paid a portion of the total acquisition price up-front, while a portion is held back (frequently in an escrow account) until the business' actual future performance is determined.

If the business performs as the seller expects, the seller is paid the remainder of the purchase price, which may sometimes run to months or years after the deal's close. Conversely, if the business under-performs compared to the seller's expectations, then the buyer keeps some or all of the earn-out money. This type of structure is a common way of bridging valuation gaps between buyers and sellers.

5. How would you calculate the change in Net Working Capital (NWC)?

Sample Answer:

The classic formula for NWC is current assets (excluding cash) less current liabilities. For a lot of businesses, it is sufficient to define NWC as:

NWC = Accounts Receivable + Inventory – Accounts Payable

Change in NWC is simply the difference between NWC in the current period less NWC during the previous period.

%20formula%2017d3.png)

6. How would you roughly estimate the available debt capacity for an LBO?

Sample Answer:

Debt capacity for an LBO is typically constrained by three primary ratios,

- Total leverage ratio,

- Interest coverage ratio, and

- Minimum equity ratio.

Any one of these ratios could be the governing constraint for a particular deal. For example, to estimate debt capacity for an LBO, you could take the lowest of the three under each of those ratios.

Total Leverage Ratio: The most common method for estimating this ratio is (Total Debt / LTM EBITDA). During normal times, Maximum Debt = ~5.0x(LTM EBITDA). During hot debt markets, this ratio can go up to ~6.0x, and during cold debt markets, it can fall to ~4.0x.

This ratio can also be higher or lower based on the nature of the target's business. Highly cyclical or risky businesses with few tangible assets are on the lower end of the range, while stable businesses with a lot of tangible assets (which can be liquidated to repay debt holders in the event of default) are on the higher end of the range.

Interest Coverage Ratio: The most common method for estimating this ratio is (LTM EBIT / Annual Interest Expense). The floor for this ratio is usually around 1.5x. Therefore, the maximum debt this ratio will allow is roughly calculated as:

Maximum debt = LTM*EBIT / 1.5 (Blended Interest Rate)

The blended interest rate depends on prevailing interest rates and how the overall LBO debt package is structured, but roughly 8-9% is a safe assumption.

Minimum Equity Ratio: Long gone are the days when PE firms could routinely buy targets for 5–10% Equity and 90–95% debt as a percentage of the total acquisition price. These days lenders demand that about 20–30% of the total acquisition price be equity. As such, you could estimate:

Maximum Debt = 0.75 * (Total Acquisition price)

7. What constitutes a good LBO target?

Sample Answer:

The truth is that there have been many good deals done with targets that failed most of the criteria in the section. The key is price. Almost any target would make a good buyout candidate at a low enough price. Is there any company you wouldn't buy for a dollar? I caveat my answers to questions like these by asserting that "deals which check all the boxes are usually very expensive" and "all problems may be overcome with a price."

8. Which industry would you invest in, and why?

Sample Answer:

This is another common way to ask the same question about how attractive an industry is. The trick to this question is that it's not simply about identifying a good industry but rather about identifying an industry that is improving. If an industry is already high-growth and profitable, the valuations of acquisition targets are also likely sky-high.

Investing is about buying undervalued assets rather than simply good assets. For example, if you identify a bad/mediocre industry that is about to improve, you could probably find a lot of undervalued acquisition targets in it. Therefore, look for industries that are experiencing some of the following:

- Acceleration in long-term growth driven by new technology, an inflection point in adoption, changing consumer preferences, etc.

- A shift in competitive rivalry may arise when competitors are beginning to compete on brand, quality, service, technology, etc., instead of price. For example, when a major competitor is exiting the industry.

- A shift in supply chain dynamics due to consolidation in the industry. This could lead to both add-on acquisition opportunities as well as better bargaining power relative to suppliers and customers.

- Barriers to entry are increasing due to patents, proprietary technology, brand, minimum efficient scale, etc., becoming more important.

- Threat from substitutes declining. The industry's products and services are becoming unique and essential to customers.

9. What are some common methods PE firms use to increase portfolio company value?

Sample Answer:

How much value PE firms actually add is an open question, but the following methods are frequently mentioned:

- Recruit better management and board members

- Provide more aligned management incentives (usually via stock option pool)

- Identify and finance new organic growth opportunities (new geographies, new product lines, adjacent market verticals, etc.)

- Find, finance, and execute add-on acquisitions

- Foster stronger relationships with key customers, suppliers, and Wall Street

- Support investment in better IT systems, financial reporting, and control, research & development, etc.

10. What company would constitute a good LBO candidate today, and why?

Sample Answer:

You always want to have one or two good pitches in your back pocket in case you get asked this question. Before selecting a candidate, refer back to the sections on the common attributes of LBO candidates and how PE firms make money. Try to find candidates that fit at least some of the following criteria:

- Has a lot of stable and predictable free cash flow to pay down debt relative to how much you would have to pay to acquire it. A free cash flow yield (FCF / purchase price) of 10%+ is a solid benchmark.

- Could benefit from a strategic overhaul which would be difficult to execute under current ownership.

- Is having significant operational difficulties which would require a lot of time, patience, and capital to address.

- Has a bad management team or governance structure that a PE firm could improve.

- Has a lot of room to grow either organically or via acquisition if backed with enough patient long-term capital.

11. In addition to TEV / EBITDA, what are some common multiples used in the industry?

Sample Answer:

TEV / EBIT

- EBIT is a better metric than EBITDA when comparing companies with different levels of D&A, which EBITDA doesn't capture. Different levels of D&A are commonly found in companies that have different levels of capital intensity (i.e., different levels of capital investment into PP&E).

Price / Earnings (aka P/E Ratio)

- This metric typically equals the market value (market capitalization) of the equity of a publicly-traded company over its LTM Net Income. This is the most common valuation multiple for publicly traded stocks. Keep in mind that this metric applies only to the equity value of the company rather than its TEV. This is because net income belongs to a company's equity holders since debt holders are paid interest before any money flows to equity holders.

TEV / Revenue

- This metric is used for companies that aren't profitable or have highly cyclical levels of profitability (such as commodity businesses).

There are many other useful multiples, but the above should cover you in the vast majority of interview situations.

Everything You Need To Break into Private Equity

Sign Up to The Insider's Guide on How to Land the Most Prestigious Buyside Roles on Wall Street.

12. What are some pros and cons of multiples?

Sample Answer:

Pros:

- Multiples are a quick way to gauge the relative value of companies of different sizes. They scale in a way that makes it possible to glean valuation information about a company from the valuation of other companies, which can be both larger and smaller.

- Multiples are less volatile and less prone to assumption-driven swings than bottoms-up valuation methodologies such as the Discounted Cash Flow.

Cons:

- If the market's valuation of the comps is wrong, then the valuation of your target will be equally wrong.

- No single comp is a perfect proxy for a different target company. Finding enough solid comps to average out the idiosyncratic differences can be difficult.

13. What are some pros and cons of LBO modeling?

Sample Answer:

Pros:

- LBO models are built from the ground up and do not depend as much on trusting the wisdom of the public markets (which can be very wrong).

- LBO models can capture the value of optimizing a company's capital structure (often by using more debt than the public market is comfortable with).

- LBO models can capture the value of operational improvements private owners could enable that would otherwise be difficult for a public company to execute.

Cons:

- LBO modeling requires making many uncertain assumptions about a company's operating and financial performance at least 3-5 years into the future.

- LBO modeling requires access to more data and entails a lot more work than valuations based on comparable multiples, precedent transactions, or market values.

14. What are some pros and cons of market value?

Sample Answer:

Pros:

- Market value is always up-to-date and is instantly available for public companies.

- It is determined by the individual decisions of a large and diversified investor base, so it reflects the collective work and judgment of many people.

Cons:

- The market can be wrong, sometimes by a lot, and if it weren't, then hedge funds and other public market investors would rarely beat the market.

15. What are some different types of debt covenants, and what are they used for?

Sample Answer:

Debt covenants are contractual agreements between lenders and borrowers (such as companies that have been bought via an LBO) that give lenders specific rights to help protect their investment.

Maintenance covenants:

Require the borrower to maintain a specific equity cushion or debt service coverage cushion to maintain their ability to repay its debt.

Incurrence covenants:

Prevent the borrower from taking specific actions which could be detrimental to existing lenders, such as taking on more debt or paying out cash dividends to equity holders.

Strict covenants can make the investment much riskier to a PE investor because a default on a covenant can result in the loss of the entire equity investment even if the portfolio company remains solvent.

8 Firm-Specific Hard Technical Questions

Having a detailed understanding of the answers to the 15 technical questions above is going to give you a competitive edge over the applicant pool. However, to achieve full technical mastery, it is critical that you expect technical questions that are specific to different private equity firms.

The following section features eight exclusive questions asked that actual interviewers asked candidates at some of the world's biggest private equity firms.

Did you know?

The following questions have been taken from WSO's company database, which is sourced from the detailed experiences of more than 30,000 candidates with PE interviews. The WSO PE Interview Course includes access to over 2,447 questions across 203 private equity funds (no other resource comes close).

The Blackstone Group Technical Questions

Sample Answer:

Calculate the enterprise value (EV) by discounting the projected unlevered free cash flows and terminal value to net present value. Calculate the equity value by subtracting net debt from EV.

Sample Answer:

An average secondary fund can expect to perform with an IRR of around 13% and a MOIC of approximately 1.5x.

Sample Answer:

A SaaS company can be valued with multiples focusing on Sales and looking at User Growth.

Kohlberg Kravis Roberts (KKR) Technicals

Sample Answer:

Some metrics which are important to analyze are:

- Cash on cash

- Equity multiple

- IRR

- Rent ratio

Ares Management Interviews

Sample Answer:

Factors that may cause different valuations are:

- Tenant credit quality,

- Lease term length

- Strength of leasing

- Cap structure of the building

Bain Capital Technical Interviews

Sample Answer:

Sample drivers may include:

- Patient number

- Healthcare quality

- Economy state

Sample Answer:

Revenue: Coffee/person, people/day, cost of coffee, any add-on pastries

Cost: Variable (cups, straws, water, coffee beans, etc.), fixed (rent, electricity), quasi-fixed (headcount)

Private Equity Case Interview Analysis

This was originally posted by @TheKing". This post has been edited and formatted.

In the large majority of your interviews, you will get asked to walk through a case study. So what is a case study?

While it varies from firm to firm, here's what it generally will look like.

- You get a copy of a CIM (Confidential Information Memorandum), usually from an old sell-side process.

- In my interview process, I ended up creating a two-page memo that more or less condensed the critical parts of the CIM, analyzed the pros/cons of the business, and included a SWOT analysis.

- So how do you ace this aspect of the interview? Remember, you're trying to determine whether or not the target company is a good candidate for a leveraged buyout.

Factors to Consider in the PE Case Interview

Below, the OP reviews the factors that you should consider when completing your private equity case study in interviews.

Historical and Projected Growth and Profitability:

Ensure that the company will be able to handle the additional debt brought on through an LBO while also providing for a strong return on investment through growth in revenue and profitability.

Diversity of Customers & Products of Target Company:

A company might have strong financials at first glance, but you'll want to make sure they aren't overly concentrated in one product area or with one customer. If there is any notable concentration, it had better be able to prove that it's got sticky customer relationships, so to speak.

Differentiating Factors of The Business:

This ties in with profitability and customers/products. Does the target company have specific technology or processes that will enable them to continue to grow and maintain margins going forward, or are they susceptible to margin erosion as competition increases?

Industry Focus for the Target Business:

Is the company in a growing industry? How will it handle potential economic turmoil? How well is the target positioned in its industry? Is it a leader?

Strength of Management for Target Company:

What's the management team like? Is it a founder-owned business? Has the team been together a long time? How built out is the team?

The strength of the management team is fundamental, and it plays a vital role in the middle market. Oftentimes, you'll look at companies with fragile management teams or owners looking to cash out and take a smaller role in the company going forward. These cases allow a PE firm to add value by placing solid professionals into management roles.

Exit Potential and IRR for Target Company:

A company can be an absolute cash cow, but you'll need to be able to exit the investment at some point over a reasonable time frame (generally five years) in order to generate a suitable return on investment for your investors. So you'll want to have some ideas as to where eligible buyers might come from.

Closing Questions:

Now, reading a CIM will get you pretty far. You'll learn a great deal about the target company, its growth prospects, its industries, and its alleged upside potential. But, the CIM is a sales document. So, while you can glean a ton of helpful information from a careful read-through of a CIM, you'll also want to have something of a skeptical eye. Invariably, you'll have questions and concerns that you'd like to raise with management in the next round of the sell-side process.

Here are a few examples of questions you might ask.

- What is the biggest challenge your company faces?

- Who are the most important members of your team, and why?

- What are your company's pain points, and how can we help to address them?

This is a great time to develop specific questions based upon issues you uncovered in your read-through of the CIM.

Private Equity Deal Experience

This was originally posted by @Candor, a private equity associate. This post has been edited and formatted.

- I will say that the three biggest areas to focus on are, first and foremost, the deals on your resume, secondly understanding everything there is to know about an LBO (on a theoretical and conceptual level), and third, being able to walk through paper LBOs/case studies.

- In some of my interviews, we got REALLY granular into my deal experience, and it was good that I had prepped so thoroughly. So, you have to know everything about them.

- Preparation is crucial since deal experience makes up roughly a third of the interview process. Read about your deal and understand every facet of it in order to best prepare yourself for when the questions inevitably come.

- Read websites/articles about your deal and take notes. Read initiating coverage reports on the two companies involved in one of your deals. Read comprehensive research reports on the sub-industry that the companies are from.

This video from our PE Interview Course highlights why and how you should be prepared to walk through your prior deal experience.

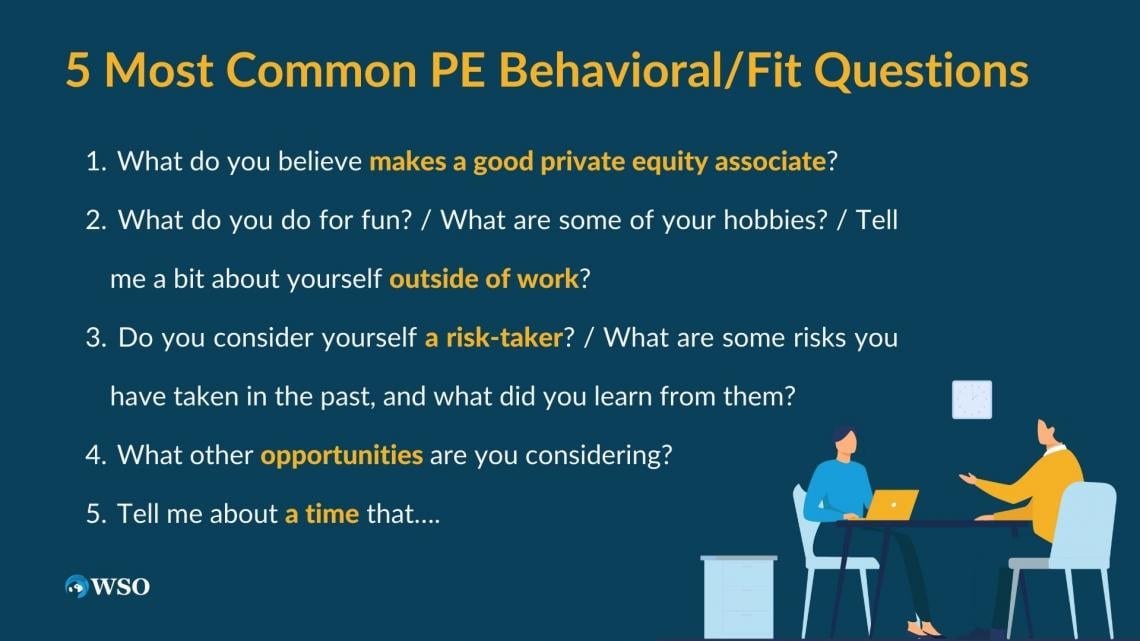

5 Most Common PE Behavioral/Fit Questions

Fit or "behavioral" questions are used to assess whether you have the right attitude, work ethic, personality, and values to fit in with a PE firm's culture. Most PE firms take fit extremely seriously because most firms usually have only a handful of investment professionals who must collaborate over long hours and under tight deadlines.

This section walks you through 5 of the most common types of fit questions and suggests approaches for answering them. The suggested strategies and sample answers are meant to be illustrative. Always remember, you need to adapt your answers to be true to yourself and your own words.

1. What do you believe makes a good private equity associate?

The interviewer is trying to assess whether you really understand the job you are interviewing for. Your goal should be to answer the question and subtly make your case for why you would be good at it. It would be best to tailor your answer to each particular firm instead of giving one standard response.

For example, suppose a firm like TA or Summit requires a lot of proactive sourcing work from associates. In that case, you need to mention that and describe what makes someone good at sourcing (positive attitude, a lot of energy, curiosity, and gregariousness, ability to handle rejection, creativity, etc.). If a firm requires associates to engage with portfolio companies and help with operations deeply, you need to mention the requisite consulting toolkit.

Sample Answer:

The role of an associate can vary a lot from deal to deal, but I understand there are some common elements. For example, associates may be called on to develop investment themes, triage incoming deals, support deal diligence, and execution, and engage with portfolio companies at various points in the deal process. In addition, some common tasks that Associates are expected to perform are reading incoming CIMs, building LBO models, doing trading multiples analysis, competitive position analysis, and industry growth forecasting.

2. What do you do for fun? / What are some of your hobbies? / Tell me a bit about yourself outside of work?

A question like this is a clear sign that the interviewer wants you to go off your resume and reveal a few of your interests and personality. The interviewer is trying to gauge whether they are a well-balanced person who would fit in with the firm on a personal level and be fun to be around for long stretches of time.

Put the CV away and talk about the things that make you fun and interesting. This is your opportunity to connect with your interviewer and demonstrate your likability in addition to your professional competence. So pick something interesting, and don't be afraid to get a little personal (this question practically begs you to get a little personal).

You probably want to avoid highly controversial topics, but you have more leeway here than most candidates realize. Sports, hobbies, talents, funny situations, unusual life stories, exciting achievements, outside passions, etc., are all fair game here. The most important advice is: be interesting. Be a real-life person that your interviewer will remember.

3. Do you consider yourself a risk-taker? / What are some risks you have taken in the past, and what did you learn from them?

Your attitude toward risk is important in a PE context. PE firms look for people who take the responsibility of managing other people's money very seriously but who are willing to take prudent risks to generate returns. Your interviewer is looking for a willingness to take risks tempered by a careful and reasoned approach to balancing risks with rewards.

There are a couple of common ways to approach answering this type of question: You could tell a story where you took a well-calculated risk, and it paid off, or you could tell a story about a bad risk you took and how it taught you to be more careful. In either scenario, you want to affirm your belief that some risk is required for success but that you're the type of person who measures twice before cutting once.

4. What other opportunities are you considering?

This question is tricky because, as always, you want to be honest, but you don't want to necessarily reveal your entire hand or have to answer even more awkward questions like "what is your first choice if you had your pick." It is usually best to try and keep your answer to such questions vague in hopes that the interviewer will drop the subject, and frequently they do.

Suppose you are interviewing with some direct competitors and don't want to go into details. In that case, you can say something like, "I'm involved with some other processes, but I'm not under any time pressure, and I'm most excited about seeing where the process with [interviewing firm] leads first."

In the rare case that your interviewer presses you to reveal names, try to reveal a couple that you suspect the firm will respect but won't feel like they'll definitely lose you if you get a competing offer. You can then try to give one or two credible reasons why you are most interested in the firm you are interviewing.

PE firms hate it when their offers get turned down, so you're less likely to get an offer if the firm doesn't think it has a great chance to sign you.

5. "Tell me about a time that…."

There are countless variations of this question, from "Tell me about a time you acted with integrity" to "Tell me about a time that you had difficulty dealing with coworkers." It is key to have a well-rehearsed response for each of them and a general guideline to follow.

Ideally, you can develop 6-8 stories that cover the 30-40 basic questions, with slight modifications. DO NOT wing it. For every possible question, map out the story using the SOAR framework.

Address the Situation (10-15 seconds), Obstacle (10-15s), Action (60-75s), and Result (15-30s). Stories for these questions should span 1.5 to 2 minutes and focus on what's important.

5 Firm-Specific Behavioral/Fit Questions

Knowing the culture of each private equity firm before walking into an interview is key to clicking with the interviewer and walking out with an offer.

The following section features five exclusive questions that interviewers ask in the world's biggest private equity firms during interviews. This aims to help you jumpstart your training for the respective private equity firms you are interviewing for.

The following questions have been taken from WSO's company database, which is sourced from detailed PE interviews experiences of more than 30,000 people.

WSO Company Database

Gain Access to Exclusive Data on Compensation, Interviews, and Employee Reviews.

Kohlberg Kravis Roberts (KKR) Behavioral Question

1. What is your biggest failure/mistake/regret? Why? What did you learn from it?

Honest self-reflection is a hallmark of good PE investors. Everybody makes mistakes. What matters is your ability to admit them and learn from them. Your interviewer wants to see that you're not afraid to own your mistakes and that you're able to prevent them from recurring.

Much like the weaknesses question, you need to pick a real mistake, but not one so big that it will disqualify you. If you've ever missed a deadline, messed up some analysis, damaged a relationship, been suspended from school, or let a big opportunity pass you by, you're probably on safe ground to answer this question. Don't be afraid to own it.

On the other hand, if you've been arrested or fired or exhibited serious character flaws, you're playing with fire. Ditto if you've ever actually been accused of lighting a squirrel on fire (you know who you are). Sometimes discretion is the better part of valor. Choose which mistake to disclose wisely.

Whatever mistake you choose to discuss, do so without equivocation and in a way that makes clear you take total responsibility. Then, spend the second half of your answer discussing what you learned from your mistake and how you made sure it wouldn't happen again.

The Blackstone Group Behavioral Assessment

2. Why are you interested in Blackstone?

The interviewer wants to make sure that you are truly serious about their firm and that there is likely to be a good fit between you and the firm. Your goal should be to demonstrate your clear interest by showing you've spent time researching the firm and have specific reasons to be interested in it.

Before you go into an interview, dig up some of the basic information about it:

- Its origin, age, fund size, office locations, industry focus, investment criteria, etc.

- Bios of some of it investment professionals, especially those likely to interview you

- Existing and past deals/portfolio companies

- How they describe themselves / how they see themselves / what makes their investment process or culture unique

Great resources for learning the above include:

- The firm's website is first and foremost. It frequently has an "about the firm" section, IP bios, investment criteria, existing portfolio, and past deal examples or case studies

- CapIQ and other similar data providers also frequently have some of the above data

- Google the company's name for news articles, especially press releases on new investments and exits

- Search for WSO threads about the company and read the WSO database entries on the company

- If you have friends who work there or have worked there - they can, of course, be a great resource

Bain Capital Fit Question

3. What would your friends/roommate/previous manager say about you?

When faced with this question, some candidates find it difficult to praise themselves and fail to highlight their best qualities. Other candidates go overboard and describe themselves in absurdly glowing terms. Remember that a PE firm is looking for confidence mixed with some humility. The sweet spot for this question is to describe yourself in a few reasonable positive terms that you hope are present in you or that others see in you.

You don't need to feel pressured to balance positives with negatives with this question unless explicitly asked to list weaknesses. Look at this question as an opportunity to sell yourself to the interviewer. In order to drive the point home, feel free to bring up stories or examples about some praise you have received.

Warburg Pincus LLC Behavioral Interview

4. What are your long-term career goals? / Where do you see yourself in 5 years?

The interviewer is trying to make sure that you see PE as a meaningful phase of your career and that you have reasonable expectations for what the role you're interviewing can offer you.

PE requires a lot of hard work and dedication; it is not a job for someone to try out on a whim. PE firms spend a lot of time interviewing candidates and making their decisions very carefully. They don't want to hire someone who might not be fully committed.

You do not need to pretend to know with certainty that you will be in PE for the rest of your life, but it helps if you think PE at least factors prominently in your future. On the other hand, it's also important to have reasonable expectations. If you're sure that you're going to go from a new associate to a full partner in five years, you might end up disappointed by a relatively long climb up the ladder. Be honest if you're not 100% sure you will definitely stay in PE.

That's not a deal-breaker, especially at firms with pre-MBA associate programs which don't necessarily give offers to all "graduating" associates for partner-track positions. It helps, however, if your alternate plans include options that will be enhanced by your PE experience because then the PE firm remains comfortable that you will remain committed to your work for the duration of your employment.

For example, a PE firm would be more likely to hire someone whose career alternatives include public markets investing, entrepreneurship, or general management than they are to hire someone whose real dream is to be an engineer, or doctor, or journalist.

Apollo Global Management Fit Questions

5. Tell me about a time you had to convince someone significantly out-ranking you to do something they did not want to do. What was your thought process? What was the outcome? How could you be sure it was the best option at the time?

This question is obviously a personal one, and the answer will vary for different candidates based on their previous experiences. We recommend being open about your thought process with the interviewer rather than making the common mistake of emphasizing more upon the final outcome.

Remember, the interviewer aims to evaluate you as a person here and understand your typical thought process to assess how you will fit into the firm, make sure to therefore be open and focus on what you were thinking at the time of the incident.

Everything You Need To Break into Private Equity

Sign Up to The Insider's Guide on How to Land the Most Prestigious Buyside Roles on Wall Street.

5 Logical Puzzles - Interview Brain Teasers

Logical puzzles, brainteasers, and riddles are an important part of the interview process as they allow the interviewer to determine your critical thinking abilities.

For this section of the interview, interviewers aren't focused on whether you get the correct answers or not. Instead, they are interested in your thought process while solving the riddles you are presented with.

Given this, it is vital to walk your interviewer through your thinking as you progress through the riddle, who may even probe you with questions to assist you. Giving them a rundown of your thoughts and occasionally asking if you're headed in the right direction demonstrates your capabilities to reflect and approach a problem with composure.

However, it is still extremely useful to anticipate these logical puzzles beforehand to avoid being put on the spot and caught off guard in the interview. The following section has five commonly asked logical puzzles that you can prepare for beforehand to impress your interviewer.

1. What is the sum of the integers between 0 and 100 (inclusive of 0 and 100)?

Answer:

The trick to solving questions like this is making pairs that add up to something that is easy to count. In this case, 0 + 100 = 100, 1 + 99 = 100, 2 + 98 = 100, 3 + 97 = 100, etc. There are 50 such pairs because there are 50 numbers between 0 and 49 (including zero). 50 times 100 is 5,000. Don't forget the final 50 which didn't get paired up and you get 5,000 + 50 = 5,050.

2. How would you isolate exactly three gallons of water if you are standing in a river with a 5 gallon and a 2-gallon jug?

Answer:

Fill the 5-gallon jug to the top and pour water out of it into the 2-gallon jug until the 2-gallon jug is full. You will have exactly 3 gallons of water in the 5-gallon jug.

3. You have ten black marbles, ten white marbles, and two buckets.I am going to select one bucket at random and pull out one marble from it at random. How would you fill each bucket with marbles to maximize the odds that I select a white marble?

Answer:

Put one white marble in one bucket and put the other 19 marbles in the other bucket. The bucket with the lone white marble will be chosen 50% of the time. When the other bucket is selected, the odds that white marble is pulled are still nearly 50%. By allocating marbles this way, you make the overall odds of a white marble being selected is nearly 75%.

4. A car drives from point A to point B at 60 MPH. It then returns from point B to point A at 30MPH. What is the average speed of the total round trip?

Answer:

A lot of people say 45mph, which is wrong. Average speed equals total distance over total time. In this case, let's assume the distance between A and B is 60 miles. The first leg of the journey takes one hour, and the return trip takes 2 hours. The total distance traveled is 120 miles and the total time the trip takes is 3 hours. Therefore, the average speed of the round trip is 120 miles / 3 hours = 40mph.

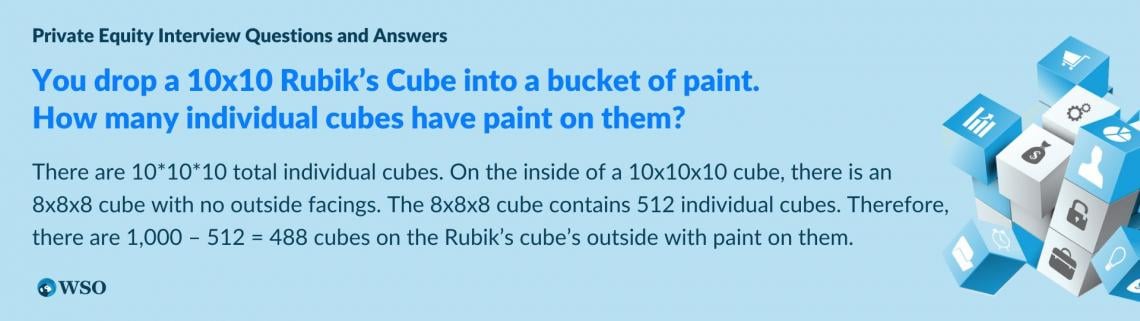

5. You drop a 10x10 Rubik's Cube into a bucket of paint. How many individual cubes have paint on them?

Answer:

The key is to gather that cubes on the edge of any one of the six faces have a side on two faces (3 faces for corner cubes), so you can't simply calculate the number of cubes on one face and multiply that by the number of faces. The most perceptive way to find the solution is to calculate the number of individual cubes in a 10x10x10 Rubik's cube and then subtract the number of all internal cubes with no facings on the outside.

There are 10*10*10 total individual cubes. On the inside of a 10x10x10 cube, there is an 8x8x8 cube with no outside facings. The 8x8x8 cube contains 512 individual cubes. Therefore, there are 1,000 – 512 = 488 cubes on the Rubik's cube's outside with paint on them.

Free LBO Modeling Test

Full WSO PE Prep Guide & Additional Resources

Many of the sample answers in the guide above were taken from WSO's very own PE Interview Prep Course, which features:

- 9 realistic LBO modeling tests (3 tiers of difficulty)

- 2,447 questions across 203 private equity funds

- 200+ pages of detailed interview and industry insight

Think about it - if this page can set you miles ahead of the competition, imagine what our complete course can do for you.

The WSO PE Interview Prep Course will walk you step-by-step through the interview process and place you in the most advantageous position to land the job.

Everything You Need To Break into Private Equity

Sign Up to The Insider's Guide on How to Land the Most Prestigious Buyside Roles on Wall Street.

Additional WSO Resources:

The following additional resources are recommended by WSO for taking a look at:

List of Private Equity Firms

The following are some of the biggest of the 1200+ private equity firms WSO has data on in its company database:

- Kohlberg Kravis Roberts & Co. (KKR) | KKR Overview | KKR Site

- Bain Capital | Bain Capital Overview | Bain Capital Site

- Carlyle Group | Carlyle Group Overview | Carlyle Group Site

- TPG Capital | TPG Capital Overview | TPG Capital Site

- Warburg Pincus | Warburg Pincus Overview | Warburg Pincus Site

- Audax Group | Audax Group Overview | Audax Group Site

- Partners Group | Partners Group Overview | Partners Group Site

- Summit Partners | Summit Partners Overview | Summit Partners Site

- TA Associates | TA Associates Overview | TA Associates Site

- J. C. Flowers & Co. | J. C. Flowers & Co. Overview | J. C. Flowers & Co. Site

- Providence Equity | Providence Equity Overview | Providence Equity Site

- Silver Lake | Silver Lake Overview | Silver Lake Site

Everything You Need To Break into Private Equity

Sign Up to The Insider's Guide on How to Land the Most Prestigious Buyside Roles on Wall Street.

Additional interview resources

To learn more about interviews and the questions asked, please check out the additional interview resources below:

f50a.jpg)

or Want to Sign up with your social account?