Barriers to Entry

It is a term used in the economics and business world that describes the restrictions and limitations of new firms attempting to enter a market or industry.

Barriers to entry is a term used in the economics and business world that describes the restrictions and limitations of new firms attempting to enter a market or industry. For example, high barriers in a particular industry mean the industry won't have much competition.

The lack of competition comes from fewer firms being able to compete and enter the market. These barriers include high initial fixed costs, strong regulation, or any other hurdles that prevent new firms from easily entering the market.

These barriers are good for existing firms because they protect their ability to generate revenue and profits. They also protect the market share of the firm.

Common barriers include the government giving special tax benefits to existing firms in the market, intellectual property protection, strong brand loyalty and identity, and high customer switching costs.

Industries that require firms to obtain special licenses to sell the products are also barriers.

Different types of barriers to entry

There are two types of entry barriers in a market, both of which we shall look at in detail.

1. Natural Barriers to Entry:

Economies of Scale: Economies of Scale mean that firms can spread fixed costs over larger production (infrastructure) and more customers. Economies of scale allow existing firms to benefit from lower costs and deter new entrants due to higher costs.

Network Effects: Network effects refer to the impact of when industries and firms gain more value due to an increase in users and customers. Existing firms with network effects in these industries will be more valuable than firms that don't have these effects.

High R&D costs: Firms with the ability to spend large amounts of money on R&D will alert new entrants that existing firms may have large quantities of existing resources.

For new entrants to compete, they would need the same amount of resources to match the spending of the existing firms.

High-startup costs: High costs to set up infrastructure to compete are known as sunk costs and can't be recovered when a firm leaves the market. The potential to lose lots of money may deter some firms from attempting to enter the market.

Control of important resources: When firms have control over a key resource, they can restrict other firms from being able to make the same products. If new firms can't obtain the necessary resources to make the products, they won't succeed in the market.

2. Artificial Barriers to Entry:

Predatory pricing and acquisitions: Existing firms may manipulate prices to push other firms out of the market. Firms may also buy out competitors and take over the company's controlling interest, leading to less competition.

Limit Pricing: Limit pricing refers to when firms set a low price and a high output to prevent potential entrants from making a profit. This practice deters entrants from joining the market due to the limited chance of being profitable.

Advertising: Advertising costs are an example of sunk costs. The higher that existing firms spend on advertising, the more of a deterrent potential entrants will face.

Brand: When firms have a strong brand, they will develop customer loyalty. This means customers will choose that brand over other brands even though they sell similar products. This is another obstacle that deters firms from wanting to join the market.

Contracts, patents, and licenses: When existing firms have special government protections and authorization, it makes entering the market even more difficult. New entrants will have to worry about obtaining these credentials while also trying to become profitable.

Loyalty schemes: Customer loyalty programs reward repeat customers who buy from the brand.

Firms that develop strong brand loyalty have an advantage over firms that don't because customers will always choose the brand they're loyal to, regardless of if there's no difference in quality.

Switching costs: Switching costs are the costs incurred by customers when switching from one product (or brand) to another. Firms with high switching costs will deter customers from switching to new entrants because they will lose something of value.

Understanding Barriers to Entry

It often corresponds with the particular market structure that is in place. Market structures that promote competition and diversity of products tend to have lower to no barriers to entry. An example would be perfect or monopolistic competition market structures.

On the other hand, market structures that tend to promote fewer players in the market and a lack of diversity of products will tend to have high to absolute barriers. An example of these market structures would be an oligopoly or a monopoly.

When barriers are considered to be high, it means that it takes a lot of resources to enter the market. Conversely, when barriers are considered low, it doesn't take as many resources to enter the market.

An example of how barriers to entry deter new entrants from entering a market is the following:

Imagine that a new beverage company is deciding between entering the soda market and the water market. Before it starts investing its capital, it must do an industry analysis between the two different markets and see which one offers a better ROI.

When looking at the soda market, Pepsi and Coca-cola control most of the market. Besides those two companies, there is not much opportunity to grow and make a profit. This would mean that the market has high barriers.

The new entrant would have to invest a large amount of capital (likely that it doesn't initially have) in competing slightly with the top competitors in the market.

They would also face factors like brand loyalty, which means that customers are likely to pick Coca-cola or Pepsi over their product because they've been buying and consuming it for a long time.

On the other hand, the water market offers a different opportunity.

There are many firms in the market offering pretty much the same product. But unfortunately, not one or a couple of firms control the rest of the market.

If a new entrant can offer water at the same or lower price than these competitors, they will likely buy our product since most water tastes the same. Also, there is not as much capital investment as there is in the soda industry.

The product doesn't need to take months of testing and research to find the perfect taste, like in the case of soda. For the most part, the entrant collects, filters, and packaging the water to arrive at the final product.

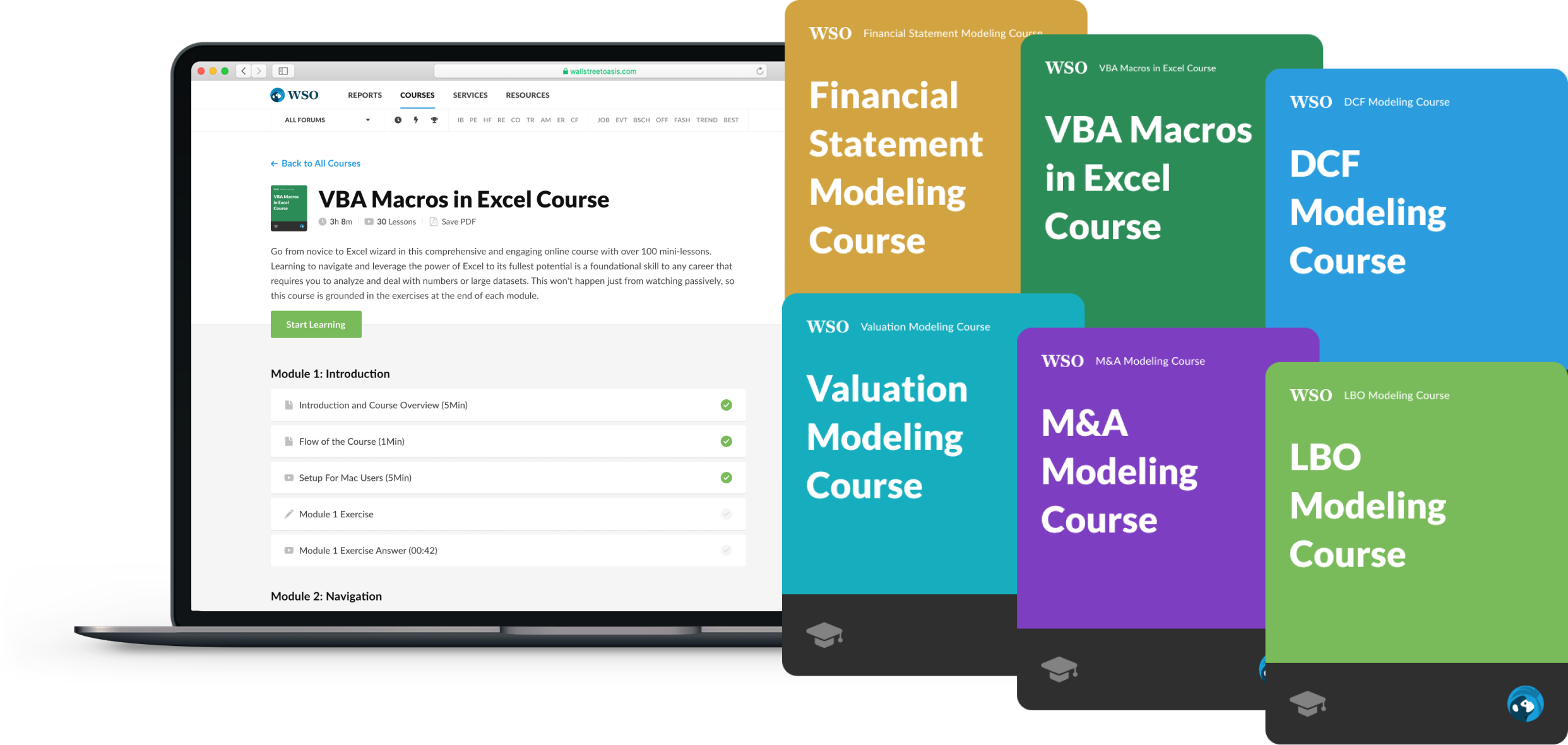

Everything You Need To Build Your Accounting Skills

To Help You Thrive in the Most Flexible Job in the World.

Industry-specific Barriers to Entry

Some industries have common barriers for new entrants based on the nature of the industry. For example, some industries face this through government intervention when the industry is highly regulated. Others may require a lot of infrastructure to start generating revenues and profits.

These industry-specific barriers are the reason why such industries have very few players. Most of these industries are either monopolies or oligopolies. When new entrants can't join the market, the few existing firms hold most of the market power.

The government sometimes can see this power and the lack of competitors as troublesome. Since these firms control the market, they can set the price to whatever they please. There are limited other substitutes that consumers can go to.

This is why the government sometimes brings lawful action against these companies. Sometimes when firms get too much power in the market, the government has to intervene to make the market a more fair and competitive environment.

One of the most prominent examples of this is the telecommunications industry. AT&T planned to buy and merge with T-Mobile. The government saw this as a concerning move for competition in the market, so they blocked the merger due to anti-competition concerns.

Sometimes the government may operate in the other direction. For example, they may enforce and implement barriers in industries that revolve around public safety.

So the government isn't always against barriers to entry and firms having lots of market power, but in most markets, the government tries to avoid these things limiting competition.

Pharmaceutical Industry

Before companies can produce generic pharmaceutical drugs in the United States, the FDA must grant the company permission. This is a longer process, usually taking around ten months.

Due to revisions, more complex drugs will take even more time and may need to complete multiple rounds of review.

It's uncommon for applications to be approved in the first cycle. About less than ⅕ of applications are supported during this time. Every application that companies have to send is expensive and time-consuming.

While new entrants are waiting to hear the news of their application review, already existing companies can replicate the product awaiting approval.

These existing companies are then able to create a temporary monopoly by filing a special market exclusivity patent that's in place for 180 days.

Companies trying to introduce a new drug into the market can expect to expend a lot of capital. In some cases, bringing a new drug into the market can take billions of dollars.

Another barrier is the time it takes to introduce a new drug into the market. For example, it can take up to 10 years for a drug to be approved by the FDA to become a prescription.

This means that even if a new entrant was able to scrap the enormous amounts of money needed to produce the drug, it might take up to 10 years before the company makes money. This would surely deter many companies from entering the market.

Electronics Industry

Existing companies in the electronic industry with large customer bases often experience economies of scale. These firms can spread their infrastructure (fixed costs) over their large customer base.

The average cost per customer will be lower in these types of firms than it would in a new entrant. New entrants would have a limited customer base, so they wouldn't be able to spread the cost of their infrastructure over it as much as the existing firms.

New entrants are then required to spend way more money on average for even a chance to compete with the existing competitors.

Another barrier to entry that is prevalent in the electronics industry is switching costs. Switching costs are costs associated with switching from one product to another firm's product.

Switching costs can be something like a contract with a termination fee or devices with software or data that make it hard to transfer to the new firm's devices.

FAQs

The government may create barriers to entry in a specific industry for many reasons. Sometimes certain industries have products that involve a risk to consumers' health. These industries must be heavily regulated to guarantee they aren't damaging people's health.

Governments may also create barriers to entry for other safety concerns. In the commercial airline industry, it is very hard for new entrants to break into the market. This is because the government creates obstacles for new firms to limit air traffic.

Industries that are highly regulated or require a lot of starting costs are considered to be high barriers-to-entry industries. Highly regulated industries often take a lot of time and capital to break into and firms may never see revenue for multiple years.

STS requires resources from companies that generally do not have a lot of resources early on. Without this capital, firms aren't going to be able to break into this market.

There are two different types of barriers to entry: Natural & Artificial. Natural barriers occur in monopolistic markets where the cost of entering the market is extremely high–usually too high for new firms.

Artificial barriers occur when existing firms implement different practices to restrict new entrants from attempting to join the market. Industries that are under heavy government regulation have experienced these artificial barriers with things like patents and licenses.

Everything You Need To Master Financial Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Research and authored by Alexander McCoy | Linkedin

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?