Accounts Receivable

The money for goods and services that a company has delivered or used by customers but not yet paid for.

Accounts Receivable(AR) is the money for goods and services that a company has delivered or used by customers but not yet paid for. It is a current asset listed on the balance sheet due to unpaid sales transactions.

It is created when customers buy goods and services on credit, which requires payment within a short period. If a company has receivables, it has made a sale on credit but has yet to collect the money from the purchaser.

When an organization stretches out credit to the client, the deal is acknowledged when the receipt is produced, yet the organization expands a period for the clients to pay the sum after some time. The time span could differ from 30 days to a couple of months.

They are liquid assets because they can be used as collateral to secure loans to meet short-term debt and are part of the company's working capital.

Understanding AR

Some businesses allow paying the bill on credit to make the process easier. For example, a company sells laptops. Because the unit price for a laptop is high, some people may not have that large amount of money at the time that they want to buy the laptop.

In this situation, the customers can pay in credit and pay the bill at the end of the month. Although the laptop firm has not received money, they have already delivered the laptop to the customers.

It is customary for businesses to issue invoices to their clients and customers with specific payment terms. Most of these terms have a quick turnaround time, but they can extend up to a full calendar year before the final payment is due.

We write this money under the current asset to record this transaction. It is called accounts receivable.

This concept is essential in the accounting and finance field. For people who want to work in investment banking, equity research, and accounting, it is important to understand the cash conversion cycle and a company's cash flow.

Where to find AR? We can find annual or quarterly reports from a particular company on the balance sheet.

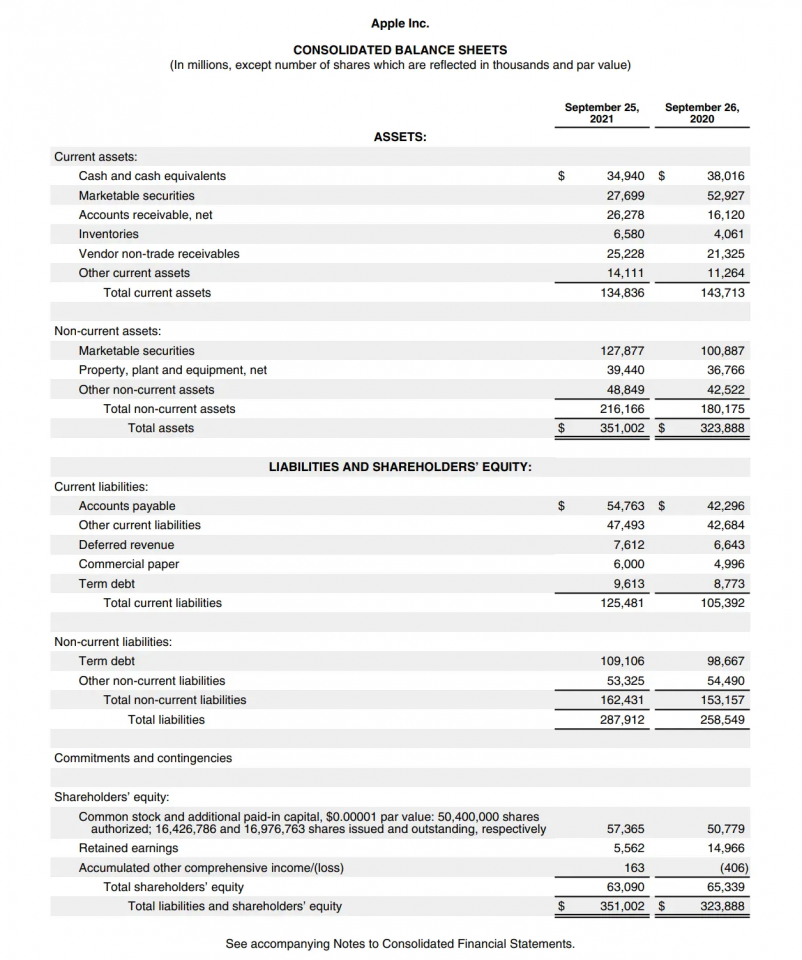

Let's get an example of Apple Inc.

Benefits and Risks

An important concept for business analysis that measures the ability of a company to cover short-term obligations without additional cash flows.

Tracking your receivables is crucial to managing your cash flow. While your sales might be going well, if your receivable continues to grow and your customers aren't paying you fast enough, you could probably go bankrupt.

Fast growth is challenging for small businesses. Suppose many customers pay on credit while your company sells and delivers the product. In that case, it will be hard for your company to pay the operating expenses in the future.

Tracking receivables is crucial for a business to collect the money that is owed to you.

Some of the risks are:

1. Bad Debt

If a company has a high AR and is uncollected for a long time, it would probably be a bad debt. It means that the company that owes money to you goes bankrupt or cannot pay the invoice.

2. Cash Flow Deficiencies

AR is just a number written on the balance sheet, but the company has no cash inflow from the transaction. The company needs cash to operate and pay its expenses. If the AR is too high, a company may run short of cash to pay the expense in the long run.

Everything You Need To Master Valuation Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Accounts Receivable vs. Accounts Payable

AP is an accounting term used to describe the money owed to vendors or suppliers for goods or services purchased on credit. It will be recorded on the balance sheet as liabilities.

These two concepts are regularly compared as part of liquidity analysis to determine whether there are sufficient funds in AR to settle outstanding liabilities. This comparison is commonly performed using current ratios, although quick ratios can also be used. Other differences between AR and AP are:

1. Receivables are delegated current resources, while payables are named current liabilities.

2. Receivables might be counterbalanced by a remittance for suspicious records, while payables have no such balance.

3. Receivables generally just include a solitary exchange receivables account and a non-exchange receivables account. At the same time, payables can involve many more records, including exchange payables, deals charges payable, personal duties payable, and premiums payable.

Numerous payables are expected to make items available to purchase, which may bring about receivables.

For example, if Company A sells 100 laptops with a bill payment of $100k to Company B and promises to do so at the end of this month.

After Company A has delivered 100 laptops, Company A will record the amount of $100k on an AR, and Company B will record accounts payable with $100k.

Thus, payables are typically required to produce receivables.

This is a part of the balance sheet for Apple Inc. (AAPL) 2021. The balance sheet shows the accounts receivable row under current assets, which was $26,278 million on September 25th, 2022, and $16,120 million on September 26th, 2021.

Related Calculations

Because it gives the business owner a sense of how successfully the company manages its revenue and assets, the accounts receivable turnover ratio is helpful for businesses.

A higher turnover ratio indicates that a business has done a better job of getting paid over time by customers for the goods or services it has provided.

There are a few calculations related to this topic:

1. AR Turnover / Receivable Turnover / Debtors Turnover Ratio:

- Measures how efficiently and quickly a company converts its AR into cash within a given accounting period.

- The formula for calculating the AR turnover rate for one year looks like this:

AR Turnover = Net annual credit sales/ Average AR

2. Current / Working Capital Ratio

- The measure of liquidity - whether your company can pay short-term obligations with available cash or other liquid assets that can be converted into cash within a year.

- The formula for calculating the current ratio for one year looks like this:

Current ratio = Current Asset/ Current Liability

3. Days Sales Outstanding(DSO)

- It shows how long, on average, it takes customers to pay your company for goods and services.

- The formula for calculating the DSO looks like this:

DSO = Accounts Receivable for a given period/ Total Credit Sales Number of days in the period

It may be tempting to relax the restrictions you have in place for giving your consumers credit (also known as your credit policy or terms). This is only a temporary solution, frequently makes things worse than they get better, and might lead your business in the wrong direction.

How to improve AR?

If you want customers to pay cash more quickly or need more cash to grow, you can improve your AR in the following ways:

1. Offer discounts to customers to pay quicker

The discount is an incentive for customers to pay the bill faster.

For example, the company could offer a discount of 3% to pay in 5 days. More customers will expect to spend less and pay the bill in 5 days.

2. Give penalties for late payment.

Besides giving discounts for the ones who pay earlier, we should provide penalties for the customers that pay later than a given period, such as paying 30% more.

3. Use collection service

Instead of chasing the customers daily for the overdue payment, the company can use a collection service, which will contact the customer and remind the overdue payment for you.

4. Make a line of credit from the bank.

While waiting for the payment, the company can establish a line of credit from the bank to ensure the company cannot go bankrupt in the long run.

It's excellent to have a large customer base. However, if any of them pay slowly or not, your business may suffer. One of the main causes of cash flow or liquidity issues for businesses is slow consumer payments.

How to Record?

After understanding the theory behind AR, we should learn how to record them. But first, we should know two different accounting methods, accrual basis accounting and cash basis accounting.

Accrual basis accounting is an accounting method based on revenue recognition principles and expense recognition principles.

- Revenues are recorded when earned.

- Expenses are recorded when they are incurred to generate revenue

- Regardless of when cash is received or paid,

Unlike the accrual basis accounting method, cash-basis accounting is based on cash flow.

- Revenues are recorded when cash is received

- Expenses are recorded when cash is paid

- Regardless of when the revenue is earned, or the costs are incurred,

Let's get to record in journal entries:

1. Record sales of services on a credit

When selling a service to the customer, the seller typically creates an invoice in the accounting system. It creates an entry into that credit sales account and debit AR account. The system will credit AR and debit cash when the customer pays the invoice.

For example, Company A buys equipment from Company B on credit for $ 1 million and promises to pay in 10 days. The journal entry is like the following:

| Debit | Credit | |

|---|---|---|

| Accounts Receivable | 1,000,000 | |

| Sales | 1,000,000 |

After Company A pays the bill, the journal entries are like this:

| Debit | Credit | |

|---|---|---|

| Cash | 1,000,000 | |

| Accounts Receivable | 1,000,000 |

2. Record sales of goods on credit

While selling goods to the customer, the seller will not only record sales on a journal entry but also record credit in inventory which is on the assets of the balance sheet, and debit in cost of goods sold while it is on the expense of income statement.

For example, Company B sells a machine that costs $500,000 to Company A for $1 million. The journal entry is like this:

| Debit | Credit | |

|---|---|---|

| Accounts Receivable | 1,000,000 | |

| Cost of Goods Sold | 500,000 | |

| Sales | 1,000,000 | |

| Inventory | 500,000 |

After Company A pays the bill, the journal entry is like this:

| Debit | Credit | |

|---|---|---|

| Cash | 1,000,000 | |

| Accounts Receivable | 1,000,000 |

3. Record the discounts for early payment

As we mentioned before, a company can use a discount for early payment as an incentive to make customers pay earlier.

For example, Company ABC sells a machine to Company DEF for $ 1 million, and Company DEF promises to pay in 20 days. Company ABC offers a discount of 3% to pay in 5 days.

In 5 days, Company DEF will pay the full amount. We should record like following for Company ABC:

| Debit | Credit | |

|---|---|---|

| Cash | 970,000 | |

| Sales discount | 30,000 | |

| Accounts Receivable | 1,000,000 |

Everything You Need To Build Your Accounting Skills

To Help You Thrive in the Most Flexible Job in the World.

Researched and authored by Bill Tang | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?