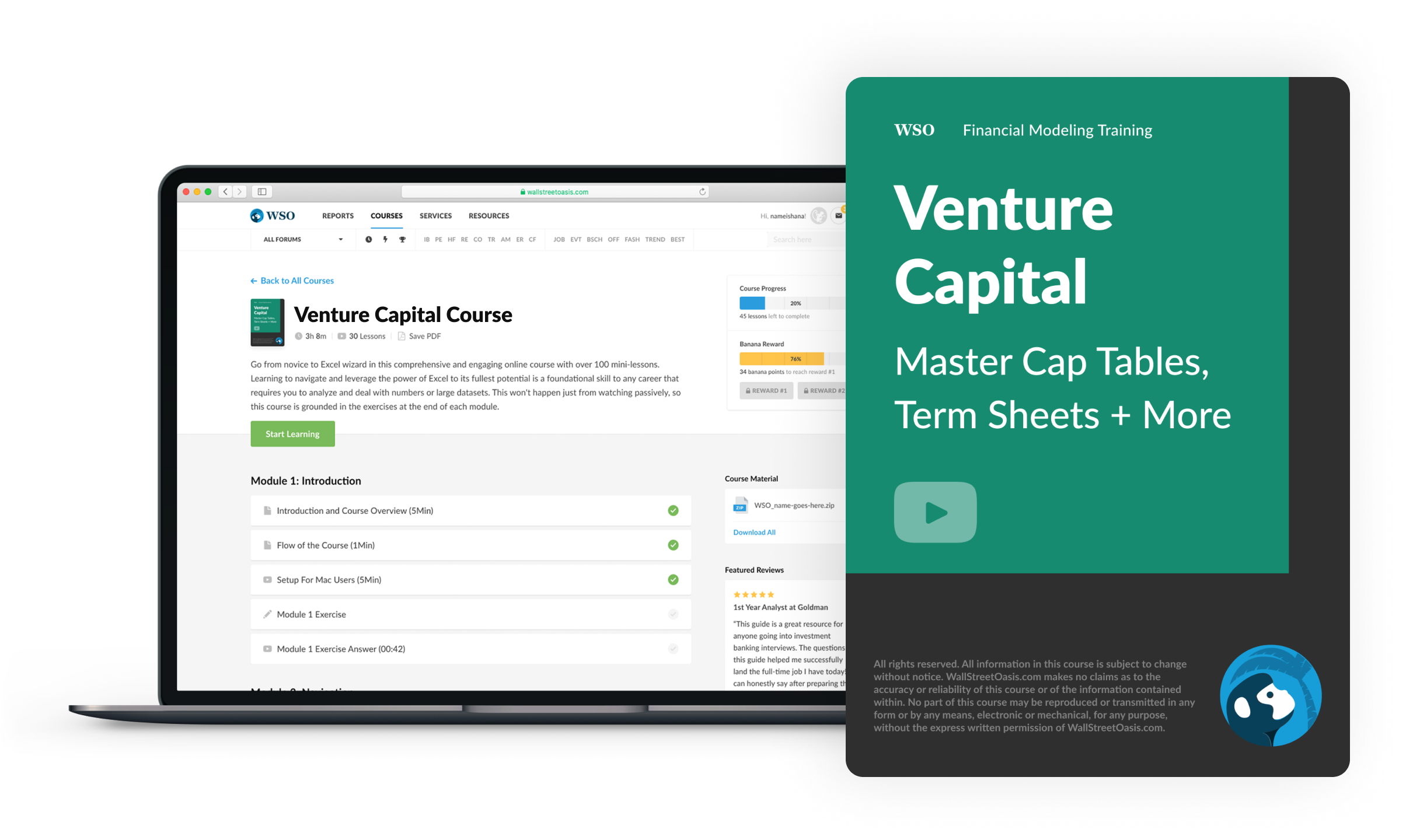

VENTURE CAPITAL COURSE

Introducing...

110+ Lessons - Master Cap Table Modeling + Term Sheets

From Elite Venture Capitalists with Proven Track Records...

HERE’S JUST SOME OF WHAT YOU’LL GET IN THIS COURSE

History Of VC To Today (8 video lessons)

In this module, we use 8 video lessons to explore the history of Venture Capital. This includes examples of the most successful VC-backed companies, where VCs are investing now and how the power law functions in practice.

Fund Structures (4 video lessons)

In this module, we use 5 video lessons to break down how a traditional venture fund is structured. This module also includes a discussion on how a fund operates and how money flows through it.

Various Roles in VC (7 video lessons)

In this module, we use 7 video lessons to explain the various roles within a Venture Capital Fund. This module will also discuss the skills and duties of each position.

Early-stage Fin Instruments (8 video lessons)

In this module, we use 8 video lessons to teach you different kinds of venture capital financial instruments. Learn about priced rounds and valuations, convertible debt, convertible equity, venture debt, etc.

Term Sheet (Control + Econ) (4 video lessons)

In this module, we use 4 video lessons to show you what a term sheet represents and you will understand the uses and differences of Economics and Control when it comes to term sheets.

Term Sheet (Modeling) (12 video lessons)

In this module, we use 12 video lessons to go through some important topics of term sheet, like pre-money valuation, ESOP, founder vesting, dividends, liquidation preference, Optional/Automatic Conversion, and anti-dilution.

Term Sheet (Rights + Provisions) (12 video lessons)

In this module, we use 12 video lessons to dive deep into important points that need to be considered in the term sheet, like voting rights, protective provisions, redemption and management rights, registration, among others. Understand each of them in detail.

Due Diligence (Must-Haves) (14 video lessons)

In this module, we use 14 video lessons to explain how the process of due diligence works, and the must-have points, like the product, value proposition, business model, market, team, and evidence.

Due Diligence (Finer-Points) (12 video lessons)

This module uses 12 video lessons to take deep dive into the process of due diligence, highlighting ARR builds, B2B software, and cohort analysis.

Due Diligence (Deep Dive) (10 video lessons)

This module uses 10 video lessons to take deep dive into ARR Build, B2B Software Segment, Cohort Analysis, and Unit Economics.

Post-Investment Management (7 video lessons)

Over 7 video lessons, you will learn about the key aspects of post-investment management. Discover how to deal with board matters and evaluate follow-on discussions, taking into account the opportunity cost. Moreover, you will understand how to measure the performance of your portfolio using different metrics and benchmarks.

Exit Options (7 video lessons)

In 7 video lessons, you will explore the exit funnel. You will also learn about the IPO process and the IPO waterfall. You will also go through a case study of WeWork. Next, you will learn about M&A. Finally, you will learn about wind-down and bankruptcy (worst-case scenarios for VC exits).

Startup Fundraising (3 video lessons)

Learn how to raise money for a startup. In 3 video lessons, you will discover the art of pitching to investors and how to craft a compelling pitch deck. You will also see some sample pitch decks from successful startups and get tips on how to avoid common mistakes.

Recruiting For VC (4 video lessons)

In this module, you'll learn about the best ways to network with VC firms and individuals, both formally and informally. You'll also get some key recommendations on how to prepare for interviews, pitch yourself, and stand out from the crowd. Plus, you'll find some useful resources to help you further your learning and research.

Waterfall Analysis (30 video lessons)

Over 30 video lessons, you will learn the ideal lifecycle of a VC-financed company, the exit proceeds and how they are allocated, the steps to perform the waterfall calculation, the key concepts and terms related to the waterfall analysis, an example of a waterfall analysis for a company, and how to use sensitivity analysis to evaluate the impact of changes in exit valuation and timing on the returns.

VC Sourcing (31 video lessons)

This module teaches you how to find and approach potential portfolio companies for your firm. You will learn the difference between inbound and outbound sourcing and how to use cold and warm outreach methods effectively. You will also discover how to track your networking activities and stay organized in your sourcing process. Moreover, you will see some examples of successful sourcing strategies.

WSO Venture Capital Course - Video Preview

Course Summary - Table of Contents

Below you will find a list of the modules and lessons included in this course.

- Course objective + Instructors + Additional Resources

- The Olden Days...

- ... to VC today

- Prominent Venture-backed Companies

- Stages

- Power Law

- Example 1: Power Law

- Example 2: MoIC/C-o-C Calculation

- Example 3: MoIC (Uber)

- VC Fund Structure & Module Overview

- Limited Partners

- General Partners

- 2:20 and Carry

- Example: Carried Interest Calculation

- Module Overview

- Deal Pipeline

- Analyst

- Associate

- Principal: Vice President

- Partner

- Other Roles

- Intro + Capitalization Table

- Priced Round

- Example: Priced Round

- Convertible Note

- Example: Convertible Note

- Convertible Equity

- Other types...

- Recap

- Intro + Term Sheet

- Sample Term Sheet

- Economics

- Control

- Intro + Pre-Money Valuation

- Employee Stock Option Pool (ESOP)

- Example: ESOP Shuffle (VC-friendly)

- Example: ESOP Shuffle (Founder-friendly)

- Founder Vesting

- Dividends

- Liquidation Preference

- Example: Liquidation Preference

- Example: Liquidation Preference (Answer Key)

- Optional/Automatic Conversion

- Anti-Dilution

- Example: Anti-Dilution

- Intro + Voting Rights

- Case Study: Facebook

- Protective Provisions

- Redemption Rights

- Management/Info Rights

- Registration Rights

- D&O/Key Person

- Right of First Refusal (ROFR)

- Example: Pro Rata

- Drag-along vs. Tag-along

- Example: BMS >< Celgene Acquisition

- Miscellaneous

- Intro

- Module Overview

- Team

- Paypal Mafia

- Product

- Product Roadmap

- Market

- Example: Market Sizing (Top-Down)

- Example: Market Sizing (Bottoms-up)

- Value Proposition (or Pain Point)

- Business Model

- Example: Business Model

- Evidence

- Example: Evidence (⇡PMF and ⇣CAC)

- Intro

- Growth

- Competition and Moats

- Timing and Context

- Deal

- Strategic

- Conflict

- Intro

- Key Definitions

- ARR Build: Traction vs. Scale

- ARR Build: Growth, Patterns, Retention

- ARR Build: Customers

- ARR Build: ACV vs. ASP

- B2B Software Segment

- Cohort Analysis: Dollar Retention

- Cohort Analysis: Logo Retention

- Unit Economics

- Module Overview

- Board Matters

- Follow-on Decisions

- Follow-on Decisions: Opportunity Cost

- Portfolio Measurement

- Portfolio Measurement: TVPI

- Portfolio Measurement

- Exit Funnel

- IPO Process

- IPO Nuances

- IPO Waterfall

- Case Study: wework

- M&A

- Wind-down & Bankruptcy

- Module Overview

- Art of Pitching

- Sample Pitch Decks

- Pointers

- (Informal & Formal) Networking

- Key Recommendations

- Further Resources

- Ideal Lifecycle of a VC-Financed Company

- VC-Financed Exit: Simplified

- Exit Proceeds: Before the Equity

- Exit Proceeds: Equity Priority

- Perform the Waterfall Calculation

- Recap: What Happens at Exit

- Recap: Returns by Security Type

- Example: Inputs (Part 1)

- Example: Ownership and Share Counts (Part 2)

- Example: Summary Table With Share Counts (Part 3)

- Example: Beginning the Waterfall (Part 4)

- Example: Series B, Liquidation Pref, Step 1 (Part 5)

- Example: Series B, Liquidation Pref, Step 2 (Part 6)

- Example: Series B, Equity Share (Part 7)

- Example: Series B, Waterfall Comparison (Part 8)

- Example: Series A, Top of the Waterfall (Part 9)

- Example: Series A, Sharing Percentage (Part 10)

- Example: Series A, Liquidation Pref, Step 1 (Part 11)

- Example: Series A, Liquidation Pref, Step 2 (Part 12)

- Example: Series A, Equity Share (Part 13)

- Example: Series A, Waterfall Comparison (Part 14)

- Example: Returns, Quarterly CF, Series A (Part 15)

- Example: Returns, Series A (Part 16)

- Example: Returns, Quarterly, Series B & Blended (Part 17)

- Example: Returns, Annual Rollup (Part 18)

- Example: Sensitivity, Proceeds to each Round (Part 19)

- Example: Sensitivity, Convert or Not (Part 20)

- Example: Sensitivity, Analysis (Part 21)

- Bonus: Dynamic XIRR (Part 1)

- Bonus: Dynamic XIRR (Part 2)

- VC Fund Economics

- The VC Track Record

- VC Track Record Example (Part 1)

- VC Track Record Example (Part 2)

- Anatomy of a VC Fund's Economics

- Gross vs. Net Returns- Be Careful

- Intro to VC Sourcing

- Objectives

- What is Sourcing (Part 1)

- What is Sourcing (Part 2)

- What is Sourcing (Part 3)

- What is Sourcing (Part 4)

- Who is in Charge of Sourcing

- Sourcing is a Circular Process

- What Are Your Goals When You Source?

- Inbound Sourcing vs. Outbound Sourcing

- Cold Outreach vs. Warm Outreach

- Sourcing Companies Through Other Funds

- Example: Sharing Deals with Other Funds

- Example: Introducing Another Fund to a Company

- Example: Networking Tracking

- What Tools Should I Be Using?

- Example: Pre-Populated Market Map

- How Do I Stay Organized?

- Example: Sourcing Log - Tracker

- How Do I Know If It's a Good Company (Part 1)

- How Do I Know If It's a Good Company (Part 2)

- Who Should I Reach Out To?

- Where Do I Get Their Contact Info?

- Examples: Initial Outreach

- I Can't Get In Touch...Now What?

- I Scheduled a Call...Now What?

- Example: Call Question List

- I Had a Great Call...Now What?

- Example: Recap Email to Your Team

- Best Practices (Part 1)

- Best Practices (Part 2)

Our students have all thrived at the top Venture Capital funds in the world, including:

Don’t Take Our Word For It

Hear from a few of our 57,000+ students...

Hear from a few of our 57,000+ students...

At a high level, I think it covers a lot of the key topics one would need to both understand VC as well as get prepared for an interview. Narration is great, the instructor seems approachable and explains things in an easy to use manner. I think it's definitely something that would be additive to someone preparing/interviewing for an entry level VC role.

Just wanted to say I really enjoyed the venture course on WSO. Really insightful and was able to get through it in two days with the format!

WSO delivers the most comprehensive VC course that I've seen to-date. From detailed deal structures to big picture investment concepts, this course provides a fundamental basis from which one can take on relevant VC job functions from day one.

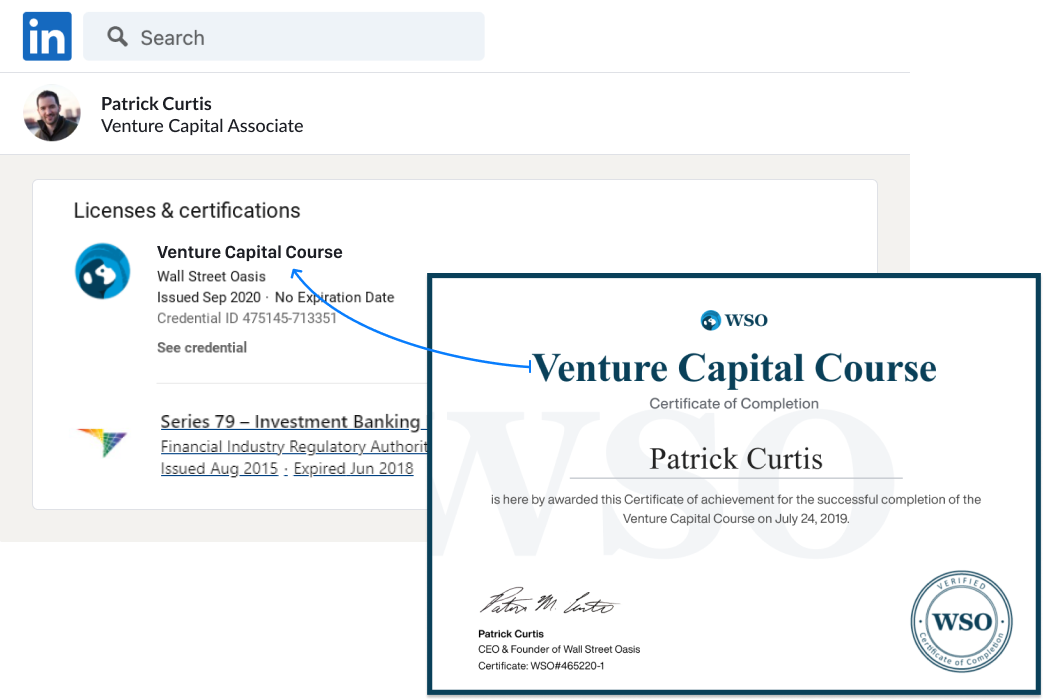

Get the Venture Capital Course Certification

After completing the course, all students will be granted the WSO Venture Capital Course Certification. Use this certificate as a signal to employers that you have the technical VC skills to immediately add value to your team.

Demonstrate that you have put in the work outside of university courses to make yourself more knowledgeable and master the most critical skills for success in venture capital. Easily share to LinkedIn and other social media sites to highlight your skills and strengthen your profile as a candidate.

How Much is Your

Venture Capital Career Worth?

What You Get | Value |

|---|---|

Venture Capital Course (Unlimited Lifetime Access) 110+ video lessons across 15 Modules created by a team of elite venture capitalists... | $500 |

Interactive Exercises + Cap Table Modeling Gain realistic practice drilling the concepts taught to actual VCs so that you can hit the ground running Day 1... | $450 |

24 Months of Unlimited Elite Support from Actual Finance Pros Have a technical question? Easily drop a comment into any lesson and get a response from a pro within 48hrs. | $300 |

TOTAL VALUE | $1,250 |

Get Unlimited Lifetime Access To The WSO Venture Capital Course For 60% Off

$1,250

$497

...or access today for only $170 (3 monthly payments)

Secure checkout

100% Unconditional Money-Back Guarantee

12 Month Risk-Free Guarantee

Your investment is protected by our 12-Month Risk-Free Guarantee. If, for any reason, you don't think the WSO Venture Capital Course is right for you, just send us an email, and we'll refund every penny. No questions asked. In short, you get a great return on your investment, or you get your money back. It's that simple.