Annual Return

The return earned over a period of time due to activities such as investing

Annual return is the return earned over a period of time due to activities such as investing. The term refers to the amount of money earned over a period of one year.

It includes the increases in share prices, dividends, and so on. Generally speaking, when the total capital value at the end of the year is lower than the initial capital value, we consider capital loss and investment return to be negative.

When the sum of capital values at the end of the year is higher than the initial capital value, we consider capital to be profitable, and the return on investment to be positive.

It is used to determine the growth in the value of financial products such as stocks, funds, and bonds. It is one of the many factors taken into consideration by investors and financial institutions. When investors choose financial products, they focus on annual returns.

A higher return will always be appreciated by investors. Companies and financial institutions aim to create financial products with the highest annualized returns so that more people purchase them and they receive commissions.

When people want to check the stock market, they also pay attention to the annual returns of stock indexes. For example, we can easily find the returns of the NASDAQ, S&P 500, and Dow Jones in 2021 on the Internet: 21.39%, 26.89%, and 18.73% respectively.

This data shows us the rate of return in the stock market, making investment analysis easier. Investors can compare the same stocks at different times to determine their returns.

People can compare the annualized returns of different stocks over the same period, and even compare their returns over different periods to determine which stocks or products are better.

How do You Calculate Annual Return?

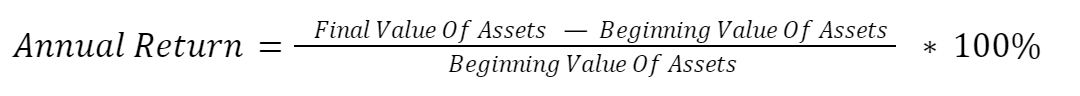

In general, when we calculate returns over the course of a year, we calculate our return by adding up the returns we made during the year through investments in stocks, funds, derivatives, etc.

Then, subtract the assets you owned at the beginning of the year from your year-end assets. Finally, to get the return you earned on your investments during the year, divide the number by the value of your assets at the start of the year.

When comparing multiple products, we may prefer to put the numbers together and compare them directly, in the form of year-end returns. Such numbers can give us a more intuitive picture of that year's revenue.

In this case, we can take the assets at the end of the year minus the assets at the beginning of the year, divide the difference by the assets at the beginning of the year, and then figure out the year-end return.

For example, when we compare multiple funds. Their year-end returns may be different due to the differing sizes of the funds. However, when we translate this into year-end returns as a percentage, it becomes clearer which funds are generating the most returns.

Annualized Return

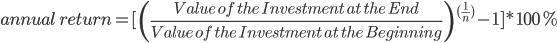

When we need to calculate returns over many years, we use the formula for annualized returns, which combines returns over many years. If we only look at the one-year yield of a product, sometimes it will be too one-sided to understand the yield of a product.

In order to show the return of an investment more objectively, people generally add the return rates of multiple years together to get the overall return rate in a period of time. The time frame can be years or even decades.

If we keep doing what we did before, we just add up the returns over the years and then divide by the number of years included. This would yield an average return over several years. Annualized return is needed if we want to know the overall investment return during this period, so let's factor in compounding.

There are usually two ways to figure out the annual return here.

1. We can decide which method to use depending on the information we have. The assumption of the first formula is that when we know the annual rate of return and the number of years we need to calculate.

-1}*100%](https://www.wallstreetoasis.com/files/inline-images/wall-street-oasis_finance-industry-resources_web_online-annual-return_6.png)

In this equation, "a" represents the rate of return and "n" represents the total number of years to be calculated. Plug the corresponding number into the formula to calculate the annualized return over that period of time.

2. This method assumes we know the total value of the investment at the end of the cycle, allowing us to calculate the annualized return by comparing the value of the investment at the end of the cycle to the value of the investment at the beginning of the cycle.

This method can be used when we know the value of the investment at the end of the cycle. You plug in the numbers and get an average annual return for the whole period, allowing investors to see earnings more clearly.

Examples

Now, let's take a look at a few examples to apply the above formulas.

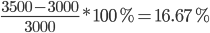

1. At the beginning of the year, Company A made foreign investments totaling $30 million. At the end of the year, the assets are now worth 35 million dollars.

So, using the first formula, we can calculate that Company A earned an annual return of 16.67% on its foreign investment this year. Using the formula can quickly help us figure out the annual rate of return.

This approach is only for the simplest case and can only describe returns for one year. If we're talking about a longer period of time, we need to use an annualized approach.

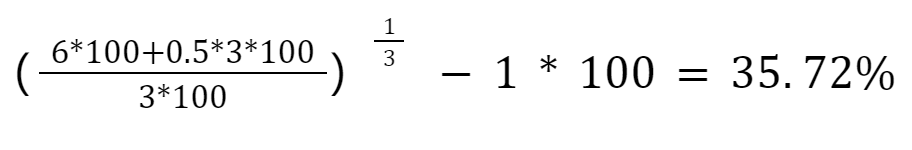

2. Bob bought 100 shares of a company the year before last at a price of $3 a share. He received a dividend of $0.50 per share during the three years he held the stock. The stock is now trading at $6 a share. He now wants to know what his return will be in three years' time.

In this situation, we can't use what we had before. We need to take compounding into account. Now that we know what the stock is worth at the end, we can start doing the math:

Bob ended up with a strong return on his investment.

As you can see, this method allows investors to calculate their annual returns as quickly as possible.

3. Mike wants to buy shares of a fund. He has his eye on two funds. He wants to invest in one of these two funds. They are not the same size, so Mike is going to calculate their returns over the last three years.

He downloaded the two funds' returns over the last three years from their websites.

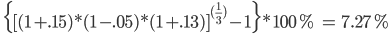

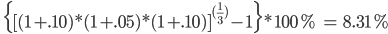

Fund A rose 15% in the first year, fell 5% in the second, and rose 13% in the third. Fund B increased by 10% in the first year, 5% in the second year, and 10% in the third year. According to the previous formula, we can calculate the returns of the two funds respectively:

Fund A:

Fund B:

From these two results, we can quickly see that Fund B did worse than Fund A in two of the last three years. However, the annualized return over three years is higher than fund A.

Through this formula, we can use compounding and get the most accurate annual rate of return, rather than simply averaging it out. This method can help investors select investment targets. If ordinary investors see only one year of high returns, they may impulsively invest.

This analytical approach can quickly help investors get the most accurate information, help them think calmly, and analyze the final conclusion.

Everything You Need To Master Financial Statement Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Features

Depending on the characteristics of annual returns, it can be used in different situations. It can help one establish investment goals, compare different investment goals, and so on. Investors use its features to help them profit.

1. Determine the performance of the investment object

When there are doubts about the continued profitability of a current investment, investors can compare past returns to recent ones. This helps determine the trend of the rate of return.

Analysis can then help investors determine further operational plans.

2. Helps investors set up psychological expectations of returns

By calculating this number, we can clearly understand the annual return of the targeted investment in the past period. This helps investors determine whether they can get satisfactory returns.

It gives investors a psychological expectation of possible returns, allowing them to choose investments with a forecast of future returns, rather than being ignorant of the risks ahead

Although when one invests, they invest in the future of the asset, having a certain understanding of the past rate of return helps analyze how well the asset generates returns.

3. Compare investment targets

Past returns can help investors conduct a certain degree of analysis when they are faced with many investment choices. Annual returns can be analyzed, not only for a single investment, but also for two or more investments over the same period.

By doing separate calculations, you can work out the returns for both assets (if comparing two). The resulting annualized rate of return would have an element of compound interest, giving a better picture of returns on different benchmarks. This helps investors compare different assets more easily.

4. Tip: do not let it be the sole criterion

Returns in the past should not be the only metric to judge the quality of an investment. However, the rate of return still can, at least partially, help investors analyze possible future investment returns.

In some cases, an investment's return may fall through at no fault of its own. For example, when a pandemic comes, global supply chains are affected, hurting all manufacturers' production.

This may cause a given company's annual returns to fall.

Maybe government policy changes, leading to the industry's annual rate of return to collectively decline. So, annualized returns should not be the only factor in judging investments.

We need to consider more indicators and macro aspects to judge the quality of the investment.

Conclusion

Annual return can help judge a target investment. Generally, the stock market is expected to return around 10% annually. However, annualized returns can vary by industry and market. We need to consider a number of factors in our analysis.

For example, emerging industries may have higher annual returns than some traditional industries, perhaps because the market believes that emerging industries can create more value in the future.

We need to analyze the data and the market in different situations to come up with answers. Gaining financial and accounting knowledge can help us make better choices when facing numerous investment opportunities.

Use the information that numbers provide to help analyze. It is only one of many indicators and does not play a crucial role. After gaining financial knowledge, we need to combine more indicators to discern the quality of an investment.

Everything You Need To Build Your Accounting Skills

To Help You Thrive in the Most Flexible Job in the World.

or Want to Sign up with your social account?