Treasury Stock

Refers to the outstanding stock brought back from the shareholders and stockholders by the issuing company.

Treasury Stock refers to the outstanding stock brought back from the shareholders and stockholders by the issuing company. It is also known as treasury shares.

Shares that are repurchased can either be canceled or kept for reissue. Such shares are referred to as treasury shares if they are not canceled. A repurchased share is technically a company's share that has been purchased back following issuance and full payment.

Treasury shares are similar to unissued capital, which isn't shown as an asset on the balance sheet because an asset should likely provide income in the future.

This also has some limitations, such as these treasury shares do not allow the firm the opportunity to vote, exercise preemptive rights as a shareholder, receive dividend payments in cash, or be entitled to assets in the event of company liquidation.

There are two methods for accounting for treasury stocks:

- Cost method

- Par value method.

Retained earnings do not get affected by these stocks.

It is not recorded as an asset in the company's books of accounts but rather considered as a deduction in the company's shareholder's equity. Hence, it creates a difference between the number of shares issued and outstanding.

Treasury stock has a debit balance in the company's books of accounts and is considered a contra-equity account. It is reported at the end of the shareholder's equity section of the balance sheet and gets deducted.

Understanding Treasury Stock

The company's brought back shares from the shareholders are known as treasury shares. It is repurchased by the same organization that issued it. A fixed interest rate is paid on the treasury shares for six months until they mature.

When more shares are issued from the company's treasury stock, the ownership percentage of the existing shareholders is reduced. Certain restrictions or limitations exist to the number of shares the company can hold as treasury stock.

Treasury shares do not have voting rights as they are considered unrealized income and do not need to pay dividends. The journal entry to record such a transaction is as follows:

The company should hold treasury shares as it helps restrict outside ownership and have enough stock as a reserve to issue to the public when capital needs to be raised.

Usually, the cost method is used for accounting purposes of treasury stock. These are considered one of the safest investments of the company.

Treasury securities are categorized in the following:

- Treasury Bills

- Treasury Bonds

- Treasury Notes

This can also be resold to the shareholders at the same, higher, or lower price than the purchase cost. Private companies may also hold treasury shares. There is no claim for treasury shares at the time of liquidation of the company.

Shares are brought back for several reasons, such as reselling, preventing outside ownership, increasing share price, and enhancing the company's financial performance through analysis of the financial ratios.

Treasury shares vs. Common stock

There needs to be more clarity regarding both treasury and common stock terms used in the security market. The following are some differences between treasury shares and common stock.

| Basics | Treasury shares | Common stock |

|---|---|---|

| Meaning | Amount of shares brought back from the shareholders by the company. | Amount of shares issued by the company to the public. |

| Dividends | Do not need to pay dividends. | Need to pay the dividends. |

| Voting rights | No Voting rights were given. | Voting rights are given. |

| Ownership | Owned by the issuing organization. | Owned by representatives, administrative workforce, contributing organization, or public. |

| Reporting | Reported as a decrease from the total share capital of the organization. | Reported on the liabilities and capital side of the balance sheet under share capital. |

| Intention | The purpose or the intention to repurchase the shares is the weakening position of the company. | The purpose or the intention is to increase assets for the company. |

Advantages and Disadvantages

These shares have a few advantages and disadvantages, which are important to understand in the long run and must be kept in mind if investing in treasury shares in the future of the business.

A few advantages of treasury shares are

- It helps the company keep some reserved funds for use when in need.

- Boosts the undervalued price of the shares in the security market.

- Buyback shares also enhance the company's financial ratios for a specific period, like Return On Assets (ROA) or Return On Equity (ROE).

- It restricts outside ownership.

- Considered one of the safest investments for the company.

A few disadvantages of treasury shares are:

- No voting rights.

- No proper rights of the shareholders can be exercised.

- Certain restrictions on the number of shares to buy back.

- Not entitled to any dividends.

- Not entitled to any assets at the time of company liquidation.

Examples

The following are treasury shares and their allocation in the financial statements.

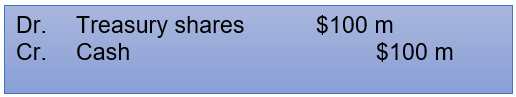

1. A manufacturing company buys back shares for $100 million from its shareholders.

It will be reported as a decrease from the total share capital in the liabilities and capital side of the company's balance sheet. Hence, these shares are considered the company's safest investments to use when in need.

Buyback shares are the easiest option for the company to make some funds reserved and saved for future company investments in the long run.

It will be reported as the following journal entry:

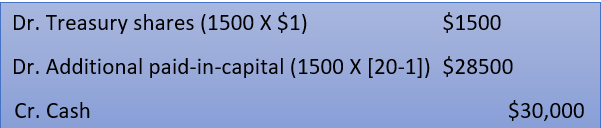

2. Monex limited had 5,000 shares at the par value of $1 per share, and each share had been issued at a value of $10.

The company decided to repurchase 1500 shares at $20 per share for a total value of $30,000.

Explain the calculation and how it is presented in the balance sheet and journal entry.

This will be recorded through the following journal entry ( cost method):

It will be recorded through the following journal entry (par value method):

- These refer to the shares brought back from the company's shareholders.

- It is referred to as one of the safest investments of the company.

- Company may resell the shares to the shareholders at a lower, equal, or higher price.

- It is a contra-equity account with a debit balance.

- It is recorded as a reduction in the total share capital under the company's balance sheet.

- There is a limit on the number of shares to be held in treasury.

- It helps reserve some funds to be used when in need and enhances the company's performance through financial ratio analysis.

- The main purpose of repurchasing the shares is the weakening position of the company in the market.

- They are not entitled to dividends and voting rights, unlike common stock.

- There is no claim for such shares at the time of the company's liquidation.

FAQs

Yes, they can be resold to the company's shareholders at the same, lower, or higher price than the treasury shares.

The three main limitations are:

- No entitlement of dividends

- No voting rights

- No shareholder's rights can be exercised

The treasury stock is reported under share capital as a deduction in the company's balance sheet.

Yes, private companies may also hold the shares in the treasury.

When a company issues more shares from the treasury, the ownership percentage of the existing shareholders is declined.

Treasury stock is a contra-equity account and has a debit balance.

The journal entry is:

Dr. Treasury shares XXX

Cr. Cash XXX

Everything You Need To Master Excel Modeling

To Help you Thrive in the Most Prestigious Jobs on Wall Street.

.jpg?itok=DxumzaOP)

or Want to Sign up with your social account?