What Do Investment Bankers Do?

Professionals that combine financial knowledge with powerful analytical skills and excellent persuasion techniques to support institutional clients.

Investment bankers are professionals that combine financial knowledge with powerful analytical skills and excellent persuasion techniques to support institutional clients. In addition, they help their clients raise capital and work through merger and acquisition deals.

Bankers can help their clients raise capital through capital markets. For example, they can help them issue debt or have equity offerings for investors. With mergers and acquisitions, bankers will advise on selling or acquiring companies, such as price and valuations.

Investment bankers carry many roles within the two largely grouped divisions. These roles include:

- arranging financing,

- equity financing,

- underwriting deals, and

- arranging private placements, etc.

These are a few roles the bankers will fulfill throughout their days and weeks.

Depending on the firm at which one banker works, they could wear many different hats or be assigned a specialized task. However, as stated earlier, all bankers' goals are to help their clients raise money or produce and execute plans for M&A deals.

Bankers have full days and will wake up at normal business hours; however, they will not leave work until most people are in bed or asleep for the night. However, some days can be relaxed with minimal work, and others can be stressful with more work than one can imagine.

The banker's days, fortunately, do begin a little later, so following the late nights working until 1 am to 2 am, bankers will not have to be at work until 9:30 or 10:00. Because they work so many hours, they also have many company perks such as free dinners paid by their firms.

Getting into investment banking (IB) can be very challenging. It can take a long time, filled with long days and nights working through college and internships. Most bankers will complete a bachelor's degree to become an analyst or a master's degree to become an associate.

What are the responsibilities of an investment banker?

These bankers are specialized professionals in finance and business; their main focus is to help their clients raise capital or work through a merger or acquisition. They can raise capital by issuing debt or selling equity in the client's company.

1. Helping with issuing debt

It is when a company sells a corporate bond, it will borrow money from investors by selling the bond (money goes into companies hands). Once the bond has matured, the corporation must pay back what it borrowed, plus an interest fee.

The hardest part of issuing corporate bonds is finding investors with loads of money to invest. This is the part where investment banking firms are used. They will have their bankers reach out to the investors they know about, and help companies find investors to fund their projects.

2. Helping with IPO

When companies want to issue stock to the general public, they will go through a whole process and eventually have an initial public offering (IPO). Investment banks are the go-to firms when people want to publicize their companies.

During an IPO, bankers will fulfill many of the same responsibilities for selling corporate bonds. They will help find investors for their clients, but they will also guide the companies through the entire process to be sure they reach success.

3. Valuation

When companies decide to buy another company, merge with another company, or sell their company, they will reach out to investment banking firms. Depending on which side the companies are on, they will need a sell-side or a buy-side banker.

M&A bankers will help their clients in the valuation of their companies or the companies they are looking to deal with. They will also help their clients with the stipulations that should be put in place, ensuring they are within the legal bounds and finding investors if needed.

What are the in-depth roles of investment bankers?

Investment bankers can play many different roles in the banks they work for. Some bankers may have a broad range of responsibilities, while others may be more specific. For example, some roles they might play include arranging financing, underwriting deals, and much more.

1. Debt Financing

If a client wants to begin a project they have been planning for and does not have the cash to do it; then the investment bank can help them generate capital. The firm can help them debt finance their project by selling corporate bonds.

2. Equity Financing

When companies want to transition from private to public, they will take their business to investment banks. Investment banks will help them prepare to sell company stock on their IPO day. Investment bankers will fill many roles in this situation.

Many companies will deal firsthand with the bankers; the bankers will help value the company into a single opening stock price for the IPO. They will also help find investors to buy the stock, some preferred and others common stock.

3. Underwriting deals

These bankers will also take part in the underwriting of deals for their clients. Meaning they will take on much of the risk of buying shares from the issuers and selling them to the public or institutional investors willing to buy.

The investment banks will buy the shares at a predetermined price, then sell the shares at a higher price to make a better profit. This is called an underwriting spread. Most of the time, one lead banker will work with a few others to complete this work.

4. Arranging Private Placements

Although investment bankers deal with many companies that want to go public, some companies prefer not to; in this case, they can raise capital through the help of private placements. As a result, bankers will need to have contacts available to help companies find capital.

For instance, if a company does not want to transition to a publicly traded company but still wants to raise capital, then bankers can help them issue bonds. These bonds can be bought by insurance companies, retirement funds, or other large institutions.

Bankers also help negotiate mergers and acquisitions. Again, these processes need to be planned and drawn out for the companies. Bankers will help make the plan and negotiate the terms of the contracts.

What does a day in life look like?

Investment banking is one of Wall Street's most desired careers, but it is also one of the hardest to accomplish and fulfill. The responsibilities of these bankers are extremely high and time-consuming, and one aspiring to be one needs to know what a day in life looks like.

This job is fast-paced, makes you want to pull your hair out of a career, and is not for everyone. If you are looking for a laid-back 9 am-5 pm finance job, this career is not for you. When companies reach out to IB firms, they must handle their business immediately.

1. The Morning Routine

Analysts and associates that have settled down in their positions can expect to have mornings filled with emails, text messages, and morning meetings with co-workers. Most nights prior will be late and filled with work to complete.

Thankfully, the mornings in IB are not early unless one works through the night. Morning mornings for investment bankers will not begin at 7 am but around 9:30 am or 10 am. This gives analysts and associates time to recover from the night prior.

Between the time analysts and associates begin to work and lunchtime, the work is less chaotic and more methodical. Many times out of the week, they will attend meetings or work on adjustments made by their senior management leaders.

During slow days, analysts and associates may be able to catch up on personal obligations or freedoms, but these days are few and far between. Often the only off days are on the weekend, and even then, weekends can become work days.

2. Afternoon Routine

Most lunches will usually last forty-five minutes to an hour if the day is not extremely busy. Most places do not mind if you go to a local sandwich shop, but most first firms have a free cafeteria for their employees.

Once the team members return to work, associates can expect to have models updated and submitted back to them by the analysts. If necessary, in addition, the associates may make more corrections and send them back to the analyst.

This can be stressful for all parties; associates badly wish to contribute to the deals being made. The analyst is stressed because of the models they must make and the revisions they must make for the managing directors.

The afternoon work can often be considered the "live deal" times. This is when the teams are most focused on the active deal. Most teams are assigned one deal at a time, and the senior bankers have to make sure that there are absolutely no mistakes made.

3. Evening routine

Workdays are normally split into two halves, before dinner and after dinner. Before dinner, most of the day is scheduled out because analysts need to make revisions to their models by the deadlines.

In the evenings, analysts and associates complete work that the vice president, senior vice president, and managing director have commented on or asked questions about. The comments or questions could cause massive changes to happen.

How does one become an investment banker?

It takes a very long time to become an investment banker, and it is a challenging task. Becoming a banker or a large investment banking firm takes, at minimum, a bachelor's degree. In most cases, they are looking for a degree in mathematics, finance, economics, etc.

In some cases, some firms pick those with computer science or engineering degrees. Although, it would be worthwhile to attend a college with a strong and well-known business plan. Ivy League schools are dominant in IB.

During college, students should complete at least one internship; most internships that get IB job offers are done with bulge bracket firms. Unfortunately, these internships are very hard to get into, and you almost have to know someone to get into them.

If one has completed their bachelor's degree and internships, and they are still unable to break into IB, they should consider getting their MBA. Once one gets their MBA, they could apply for an associate's position instead of an entry-level analyst.

If you cannot get into a leading school, you should consider doing your best throughout your bachelor's, completing a good internship, and landing a good job. Then, once you have done this and gained some experience, you should apply to an excellent MBA program.

When applying for internships and jobs in IB, knowing someone to help get you into the interview process is almost necessary. There are so many applicants for these positions that only the people who stand out and have a connection make it in.

Although this process can be long and painful, it is more than worth it on the other side. Those that make it in IB and continue out the other side will have great exit opportunities once they leave IB.

Summary

Investment banking is arguably one of the most prestigious positions on wall street. Many people who are trying never end up making it, and those who do work very hard to progress forward. Many bankers have long days and longer nights.

Many responsibilities include helping companies gain capital for projects and expansion and merging, acquiring, or selling their companies. These processes must be planned out and executed perfectly, but they must be done quickly as they cannot waste clients' time.

Responsibilities that bankers must fill include finance arrangements, such as debt and equity financing. Others include mergers and acquisitions, underwriting deals, and arranging private placements. These are the tasks they spend most of their time on during the week.

The days are long for those that work in investment banking. The days last into the late afternoons, and the evenings usually last into the early night. Normal work days are between 14 and 16 hours; this works out to be between 70-80 hours of normal work weeks.

More often than not, weeks can turn out to be between 90-100 hours worth of work. However, many people see this and are not minded because these jobs pay six figures straight out of college. These careers take lots of work, but getting into them is just as hard.

Most people chosen to become investment bankers have a minimum of a bachelor's degree in finance, economics, computer science, etc. In addition, students must complete at least one internship before they are even considered.

Once you have been on the job for a while, you can get promoted; however, if you could not make investment banking straight out of college. You can go gain experience at a good job. Then apply to a top finance school to get your master's, then enter IB as an associate.

This is how most people get into investment banking and the responsibilities and roles they play once they are in.

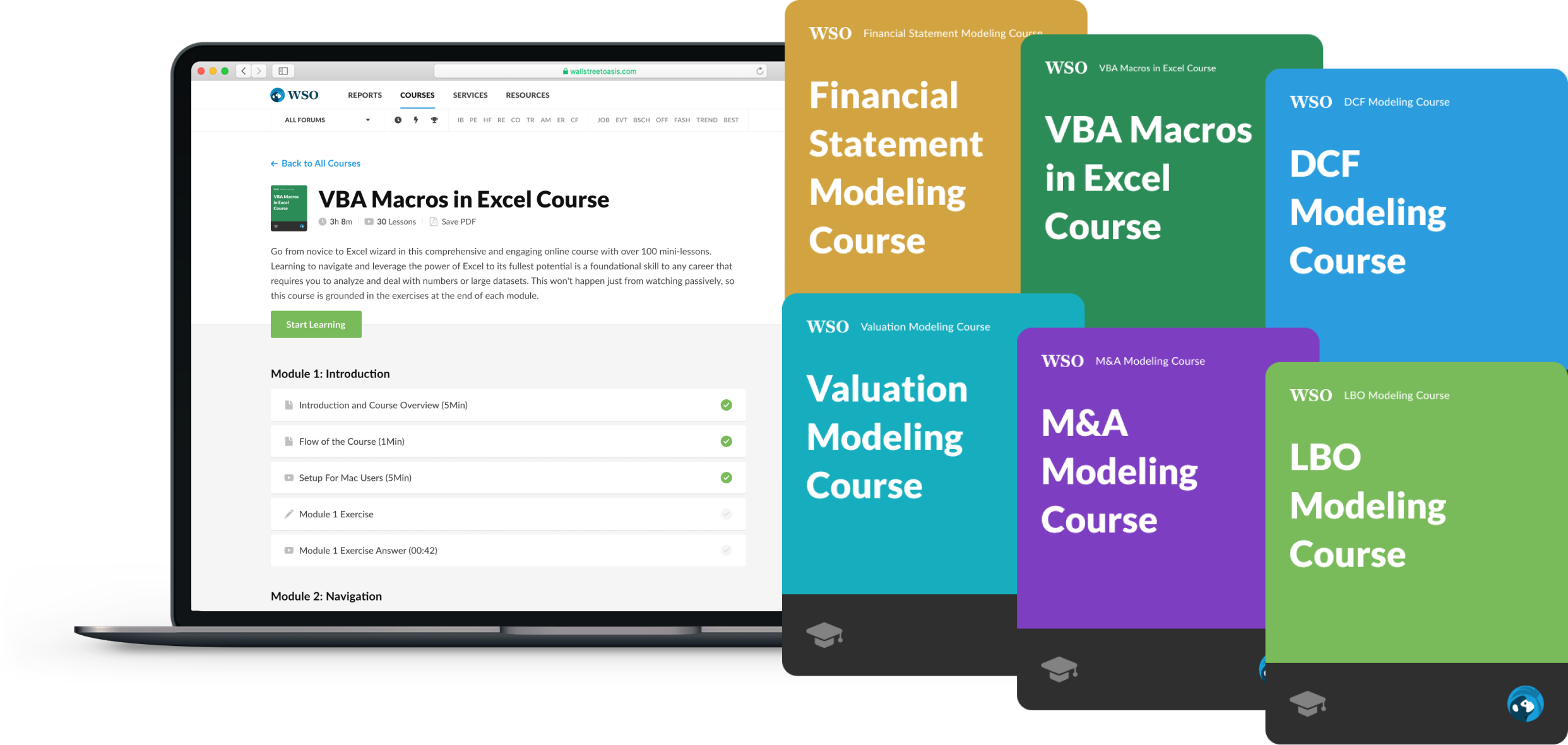

Everything You Need To Master Financial Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

.jpg?itok=DxumzaOP)

or Want to Sign up with your social account?