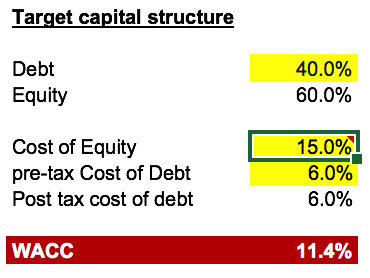

WACC Calculator Template

Calculate WACC based on capital structure and cost of various sources of funds

Download WSO's free WACC Calculator model template below!

This template allows you to calculate WACC based on capital structure, cost of equity, cost of debt, and tax rate.

The template is plug-and-play, and you can enter your own numbers or formulas to auto-populate output numbers. The template also includes other tabs for other elements of a financial model.

According to the WSO Dictionary,

"WACC, or Weighted Average Cost of Capital, is a financial metric used to measure the cost of capital to a firm. It is most usually used to provide a discount rate for a financed project because the cost of financing the capital is a fairly logical price tag to put on the investment. WACC is used to determine the discount rate used in a DCF valuation model."

A screenshot below gives you a sneak peek of the template.

Everything You Need To Master Financial Modeling

To Help you Thrive in the Most Prestigious Jobs on Wall Street.

More Resources:

We hope this template helps you excel at your job! Please check out the following additional resources to help you advance your career:

.jpg?itok=DxumzaOP)

or Want to Sign up with your social account?