Self-Employment

Someone self-employed only works for themselves.

Someone self-employed only works for themselves. Perhaps they get their money and wages from their own business or trade. Being self-employed means you have control over your hours, it is your rules, and you get to keep all the money. Well, somewhat.

Some occupations that count as self-employment include freelancers, writers, people who started their businesses, agents, investors, etc. These are just some of the few fields you can do as self-employed.

Some benefits of being self-employed are that you are your boss, which many Americans desire. You keep most of the money you make, you come up with your hours, and there is no one to answer to.

As with positives, there are also negatives; for example, your salary and wage may not be steady when you are self-employed. In some months, you might make more, while in others, you might not. You have to pay higher taxes, and if there is a loss in business, it is your loss too.

Before becoming self-employed, we must consider how well our business will do. Are we okay with not having benefits and a set salary? How much will their day-to-day costs be, and if the company is slow, how will it affect our monthly expenses?

In this article, we will discuss self-employment and how self-employment works regarding finance and statistically how successful and recommended this line of work would be.

Key Takeaways

Being self-employed means you have control over your hours, it is your rules, and you get to keep all the money.

SEA is one of the loans available for displaced workers.

Most self-employed jobs are based on how much client base you have. Jobs such as freelancing are based on how many clients you bring in. The more clients, The more money.

As you are self-employed, be ready for the possibility that you will have more tax incentives to pay since you work for yourself.

Self Employment and Tax

Being self-employed can be a wonderful experience; however, you should also know a few things about taxes. As a self-employed person, you would have to pay for two forms of employment. One is the self-employment tax, and the other is the income tax.

Self-employment tax is a tax for self-employed people. It is straightforward. It is for Social Security and Medicare taxes that you are paying. To understand how much self-employment tax you must pay, you must look at your net profit and loss.

Net profit is the total amount you make in your business, including what is left over for you. Your profits can vary each month. Sometimes you can have windfall growth in income. In that case, your net profit has increased, and so have your taxes.

In contrast to the net profit, the net loss is the money you have lost during the month rather than gained. In business, there are always losses and profits; however, you're also likely to get taxed less when incurring a loss.

You can calculate your net profit or loss by subtracting the business expenses from the business income for the month. If the costs exceed your income, your business has a net gain for that month.

You will have to report your income if you're making a profit of $400 or more. It is still recommended but unnecessary if it's less since you're making less than the average threshold expectancy.

You can use the worksheet found on 1040-ES to estimate how much taxes you must pay quarterly. This is very useful if you want to record how much you will be required to pay or give an estimate. Self-employed individuals are expected to pay the government about 15.3% of their tax bracket, which goes to Social Security and Medicare.

Note

Before starting a business, the taxes you will be paying are something to consider because they will be heftier than the usual taxes you'd pay working for someone. However, the taxes vary depending on how much you can make.

Self Employment Assistance

Many Americans do end up using their unemployment allowance. There is only so much money the government can give to someone unemployed.

Now, you may need help. However, there is nothing to dread. Our government can supply you with something called the SEA allowance.

The SEA allowance or Self-Employment Assistance is basically for someone getting their feet off the ground and wanting to start building their own business. You would get a weekly allowance that the government would provide you with while you work on a business.

If you would like this employment assistance, you would need to:

Have no job and are wholly laid off

No income at all

It would help if you were older than 18, used up about 13 weeks of your unemployment allowance, were new to the program, and had been dislocated as a worker. This is just what you need to qualify if you would like to get the loan; there are more requirements.

This program is set up for people who have been displaced and have not found a job that suits their skills or experience and would like to start their own small business where they will be given a chance to build their empire and will be livable workers.

This is a beneficial program for those who can apply and are eligible. You're on your way to opening up your own small business and being able to have your income and wages.

If you are a first-time owner, you'll need to present the location of your business or take the place you intend to have; you'll have to work full-time, you will have to be active, and you will not let someone else do it for you.

Finally, this loan is a beautiful opportunity for people who want to avoid working for others again, with the risk of getting misplaced. It allows workers to be able to expand and explore new horizons.

Self Employment and Loans

Like any other job, we require money and time to continue growing while self-employed. Money is what drives people to be able to work hard and establish a good business outlook. In this part of the article, we will look at the different loans we can avail of when we are self-employed.

Money is an essential requirement for a business, especially a new one. Unfortunately, most of the time, we lack the money to start a business. There are several types of loans we can avail of to create a new business, for example:

- Business loans

- Online loans

- Personal loans

- SBA loans

These are outstanding loans. However, one thing to be careful and wary of is that you are a risk to banks as an owner who wants to start their own business and brand.

Being a risk to banks is not because of who you are but because, as banks, they have their concerns and are looking for their profit too. If your company gets sued or you become bankrupt because you are not well-informed and organized, this can also affect the loan.

When you apply to a bank for a loan, one thing they will ask for that will help your case is making sure you have a format and a plan to present to the bank. You need to have a business plan that looks like it will work and is well presented.

On top of that, they will also be looking at your credit score, your tax returns, and your bank statements. They check all of this because banks must ensure you can repay the loan.

Note

Taking a personal loan may be beneficial. It has the same protocols as all the loans; However, this is not a business loan but more of a personal use loan. The loan amount is also smaller. However, getting a personal loan is a great start for small businesses.

Self-Employment Jobs and Expenses

There are many jobs that you can do while being self-employed. For example, if you want to do freelance work, build up your client base, make money, and turn it into a more significant business. It is enriching when you have the motivation and money.

However, when you are trying to be a business owner and want your own business, for example, you want to be a restaurant owner. Before becoming self-employed, you must consider the advantages and disadvantages.

For example, when visiting a restaurant, you need to consider the monthly expenses, utilities, furniture expenses, food expenses, workers' expenses, etc. Every cost needs to be included when you plan and organize it well.

There is also the need for customers. A bad review on Google or Yelp can negatively affect your restaurant's reputation and clientele. Your restaurant can also be quickly shut down.

A restaurant operator also needs several certifications before opening one.

When doing freelance, if your business is based on how many customers you have, then being on social media and having good communication skills and a customer base is also essential. With customers, your business would stay strong.Finally, in any business, you only make money by spending some money. It is wise to consider how expensive your expenditures will be and how much money they will be causing you. This is essential to think about the risks for these businesses.

Self Employment Conclusion

As you grow older, you may have many essential job opportunities that help you gain skills and learn valuable lessons while making good contact with customers. However, it is nice to control your surroundings when you are self-employed.

Many self-employed people want to be able to listen to themselves and not to other people. These are aspiring people with goals and motivation to become the best of who they are. You have unlimited options when you become self-employed.

This article aims to equip you with knowledge regarding the advantages and disadvantages of being self-employed so that you can embrace the opportunity and prepare for potential difficulties.

It feels nice to choose your hours and keep your profits at the end of the day. However, you will also be paying more taxes. Sometimes your business may do good, and sometimes it may do wrong. Income that's not stable may be another setback.

If you're motivational, want to be your boss, and want to work for yourself, then being self-employed is your option. Hopefully, this article can encourage you to start your enterprise while informing you how to begin.

Having a job where you work for yourself may sound discouraging, seeing all the prices and the risks you may face. However, this job can make you very successful and, in the long term, put you in an extraordinary standpoint in life. So good luck to all!

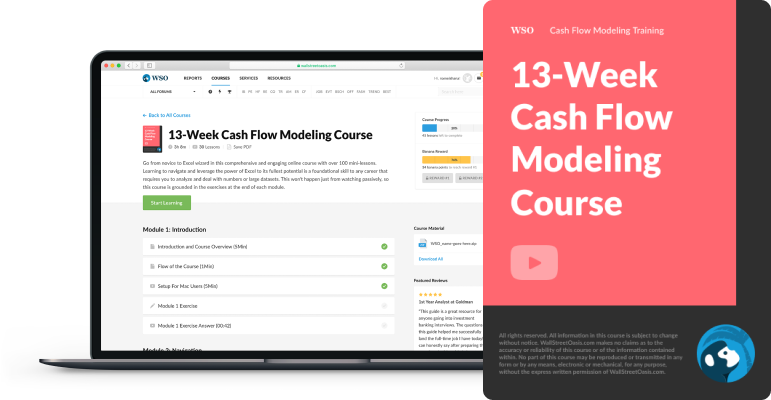

Everything You Need To Master Cash Flow Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Researched and Authored by Neili

Reviewed and edited by Mohammad Sharjeel Khan | Linkedin

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?