Scenario Analysis

Analyzing future states of the world

Scenario analysis is the process of brainstorming likely future events and analyzing the impacts they may have on the investments in question. It is used in all sorts of cases; in fact, it may even be something you've subconsciously used before.

This practice is very useful in preparing for possible future events. Often, preparing for the adverse effects of a future event requires certain measures to be implemented today.

It is deployed across many industries, and financial institutions are no different and use it regularly. For example, these firms use it as part of financial modeling to manipulate variables and predict how an event may impact a company and to what extent.

It is a very useful tool, but it is important to note that it is not a perfect practice. It is very hard to predict the future, and there are still events that can take place that were not accounted for in the analysis. It can also suffer from incidents having externalities that a company was unable to foresee.

What is Scenario Analysis?

Scenario analysis is a technique that helps understand how a future event will play out and the possible outcomes and implications of it. This method can be applied to businesses, relationships, international affairs, and any other case requiring decision-making. It can help analysts to think through the different possibilities and make the best decision possible in any given situation.

It was implemented by the U.S. military in the mid 20th century and has quickly been adopted by other industries as a common practice. This increase in adoption is partly because technological improvements have made tools to build more detailed and accurate models depicting different circumstances more accessible and economically feasible.

While companies may analyze any range of circumstances, there are three that companies typically forecast.

A best-case scenario is meant to forecast the best possible outcome for a project or investment. A worst-case scenario forecasts the possibility that the worst-case possibilities converge to create the worst-case scenario. Lastly, the base case scenario is meant to anchor assumptions with a realistic forecast that falls somewhere in between the best case and worst case. While both best-case and worst-case scenarios are meant to show the extreme cases of possibilities, they should remain realistic to be of any use.

When to use Scenario Analysis

Scenario analysis is a useful tool for decision-making and problem-solving. It's especially helpful when trying to figure out how different events will affect your business.

Suppose you're considering investing in a new company, for example. In that case, one of the first things you'll do as an investor is to perform this analysis to see what would happen if the company doesn't deliver on its promises or does better than expected.

Businesses may also use it when releasing a new product to gauge what may happen if demand for the product is higher than expected or lower than expected. These circumstances may affect production costs and revenue, impacting several business operations such as meeting debt obligations.

This method can also be applied to other areas like dating and relationships: what would happen if we broke up? If we married? If we had kids?

As mentioned above, the U.S. military was one of the first entities to begin using this technique of analysis. It proved to be a useful tactic in anticipating potential threats and military successes.

The point is that this analytical technique helps to make decisions and solve problems by examining all possible outcomes and their implications.

Tools to Help with Your Scenario Analysis

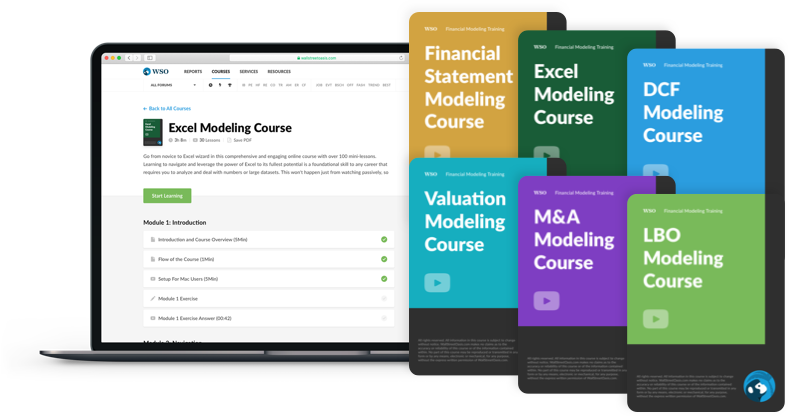

Microsoft Excel is the most used tool for financial modeling and by extension, any kind of financial analysis, including scenario modeling. All that is required for a simple analyzing various scenarios is the business's current balance sheet, projected cash flows, and income statement, as well as the investment decision for which we are modeling.

The most common way to do this is by using an Excel regression equation with a series of "what if" statements. For example, the assumption may be that sales will increase by 10 percent in the coming year. Then, the equation would calculate how this change in sales would impact the company's earnings per share.

It may involve analyzing a scenario that can cause several variable changes. Having tables organized and interconnected in Excel can be very helpful for changing variables and interpreting the effects of a particular event with efficiency and ease.

Everything You Need To Master Excel Modeling

To Help you Thrive in the Most Prestigious Jobs on Wall Street.

The best analysis only involves scenarios that have some likelihood of happening. Hence, it is prudent to look up news surrounding a company and what projects it has undertaken, and any current events that may have an impact on it.

For example, in 2021, the COP26 (an international meeting concerning climate change) took place. The outcome of this event had the potential to shake up the energy sector. Hence, a good analysis should include the likely decisions in response and their impact on both oil and renewable energy companies.

Generating Cases to be Used in Scenario Analysis

To generate cases to analyze, you should keep in mind the company's strengths and weaknesses as well as external factors in the business environment (like political, economic, technological environments) that may change in the near future. Looking at these factors will determine what type of circumstances would be most likely to happen.

One way to do this is by talking with your team members about their thoughts on the company's strengths and weaknesses. They may have a different perspective on the subject than you do, and this dialog could generate new ideas for possible events that haven't been considered before.

Another way to generate cases is by reviewing past events that have happened similar to the ones being analyzed. Reviewing past events will provide an idea of the outcomes and how the company handled them. This information can then be used when brainstorming future event possibilities, such as how the company might handle a strike or wage increase.

A common method of generating cases is using best-case and worst-case scenarios. This method is common because it is straightforward and makes it easy for companies to craft scenarios.

Worst-case scenarios are particularly useful in analyzing how well a company can handle its worst-case and whether or not it would be able to stay solvent in such a situation. Predicting that a company can survive its worst case is a very promising forecast because, more than likely, the reality will be at least slightly better than the worst-case scenario.

Steps to Performing Scenario Analysis in Financial Modeling

Scenario analysis in financial modeling is a technique that helps to understand how one event will play out and what the possible outcomes and implications of it are. It can be very helpful in making difficult decisions with high consequences.

There are five steps involved in performing this analysis as part of financial modeling:

- Choose what the drivers of this analysis are. Drivers are the current forces in motion that can affect the outcomes.

- Come up with likely scenarios. The drivers chosen may interact in different ways to produce a specific outcome. This step is all about looking for these links and theorizing about potential outcomes from these drivers.

- Develop assumptions about what might happen in each scenario. It will mean analyzing which variables it is likely to have the largest impact on. Again, it may be useful to look to the past for similar circumstances and see how they played out.

- Calculate the potential results for each scenario. This part will likely include using financial modeling to make the best forecast.

- Plan for the scenarios. The final step is to put the analysis into action by devising the best course of action for these events and making the best decisions if any of the circumstances come true.

For a great example, check out the video below from our free video course on financial statement modeling.

What are the Benefits of Performing Scenario Analysis?

Scenario analysis is a tool that every company should have in its arsenal. A company needs to be adaptable and react to big changes. Therefore, it can be useful to prepare companies for different cases. In addition, it has many potential benefits, including the following:

- Being able to anticipate future changes. These changes can have large impacts on a business, and they should be prepared to navigate these events.

- Helpful for analyzing risk. Many companies or projects are better equipped to handle risks than others. For example, a company may consider developing a new product, and if it has low fixed costs, it may be cheaper even if the product doesn't generate as much demand as expected.

- Helps to make better decisions in the present by considering future outcomes. Without considering the worst outcomes, a company may engage in risky behavior that could

Everything You Need To Master Financial Modeling

To Help you Thrive in the Most Prestigious Jobs on Wall Street.

More about financial modeling

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?