REFM

The course is designed to equip Real Estate professionals with the right skill set to thrive in the industry.

The REFM certification is a unique course in the finance industry that stands for Real Estate Financial Modeling. Most people in the Finance industry interested in Real Estate tend to obtain this certification.

The REFM certification has been around for at least a decade now. It's been offered since 2011.

This certification is rooted in Microsoft Excel, a computer program that Microsoft Inc. Excel licenses. It is a generic computer program that allows professionals to input, manipulate, and transform a vast amount of data into meaningful information.

The software is used for quantitative tasks such as financial modeling, as in the Real Estate Financial Modeling course case.

Several professionals use this software when dealing with vast amounts of quantitative data. As a result, Real Estate professionals are not an exception; their profession demands them to produce financial models.

This renowned certification measures proficiency in operating skillfully and handling Microsoft Excel for the defined real estate transactions and tasks.

Many companies in Real Estate are looking for candidates with professional certifications. Therefore, professional certification is considered a plus on a resume. Thus, the demand for Real Estate professionals has increased and become competitive.

Though the certification is considered the main stamp of competency and proficiency, other private parties also offer alternative courses in Real Estate.

Overview of the certification

The Real Estate certification program has several aspects that must be considered before applying or registering.

The REFM certification program is a multi-level program. The candidate requires to start level 1 before he/she can proceed to another level. Each level demonstrates the professional's technical prowess, skill, and competence.

The certification has a flexible duration, and it can be done in a week or month, all subject to the candidate's degree of preparedness. The course has three levels.

Additionally, each level takes about 4 to 5 hours of study, and the exams take an hour each (meaning each level is 1 hour long).

Unlike other certifications like the Charter for Financial Analyst (CFA) or Financial Risk Management (FRM), the REFM is cheap and does not cost as much. It is $149 per level of the exam. Therefore, the total cost of all the certification levels amounts to approximately $399 or $400.

The Real Estate certification course covers various subjects or topics. Below is a list of the topics covered in the course.

- Building Mortgage Payment Schedules with an interest rate aspect.

- Property Income Forecast and Expense Cash Flow.

- Internal Rate of Return and Net Present Value calculations.

- Valuation of Ground development site based on the residual concept.

- Net operating income forecast of an asset.

- Cost Allocation is in line with the bell-shaped curves.

- Calculating interest rates for several tranches of financing.

- Critical analysis of factors affecting a transaction.

Financial models are simply spreadsheets built using Microsoft Excel to forecast data about a company's history, present, and future. The software puts information in a grid of cells and columns.

Several professionals, including Finance, Accounting, Statisticians, and Engineers, use this software. In addition, the software is renowned for its wide application; therefore, it is no surprise that finance professionals use it.

Preparation For REFM certification

Exam preparation is of great importance; whether it is the REFM, CFA, or FRM, preparation for the exam is the first step to passing it. Similar to any other exam, the need to prepare for the exam should be way before the exam week.

It is not in dispute that people prepare for exams differently. However, below are general preparatory steps that candidates can take to pass the exams.

1. Study the Material notes given

The exam candidate needs to read and understand several concepts tied to the subject of Finance. These topics range from Cash Flows, Internal Rate of Return, Net Present Value, and others.

2. Need to learn Excel functions

The competition required the candidate to learn the program's functions. Microsoft Excel, like any other software, has a steep learning curve. This means there is a need to learn more about the functions and, generally, the program's User Interface.

3. Need to know Shortcut Keystrokes

The Real Estate certification exam evolves around building financial models. Microsoft Excel is a dynamic software package with many areas that need to be understood. In addition, shortcut keystrokes are an invaluable tool for exam candidates.

4. Practice against time

Like other exams, this exam puts a time constraint on the candidates, giving them a challenging edge.

Therefore, a person intending to write this exam must practice the exam questions with time. This allows the candidate to feel the real exam and prepares him to be fast.

5. Familiarize yourself with the Accounting functions

Participants from all over the world must be acquainted with accounting formulas. This is because the formulation of financial models is predicated on transforming financial statements.

It is not in dispute that each person has a different approach to an exam. However, the need to adequately prepare for an exam is non-negotiable.

Requirements and other details

There are certain requirements for candidates intending to write the REFM exam. These requirements must be met to register for the exams.

Below are the exam requirements set by the institution.

1. There is no Academic restraint.

Anyone willing to take the exam and want to build a career in Finance can register for the exam. This is different from other Finance Certification programs that require you to have a minimum undergraduate degree.

Therefore, compared with the CFA and FRM, the Real Estate certification program requirements are flexible.

2. The duration of exams is Flexible.

The program allows exam candidates to take all three Levels of tests in a single weekend. Of course, it all depends on the candidate's readiness level.

NOTE

The Real Estate Financial Modeling exams can be taken in any order. The candidate doesn't need to take level one if he wants to. This means it can go to level 2 directly without doing level one.

3. Cost of the Exam

The cost of the exam is $149 per level. This is for self-study candidates. However, candidates can choose a third-party Prep Provider. The total cost of all certifications amounts to approximately $399 or $400.

4. Test structure

The Real Estate Financial Modeling exam is a 1-hour exam structured in a multiple-choice way.

NOTE

The exam may include formulas, interpretation of formulas, and constructing functions.

Further, the candidate can consult Excel help during the exam. However, the consequence may be a failure to finish writing.

5. Test Scheduling

These Tests are available online daily (24/7/365). Alternatively, these tests can be administered at education centers.

6. Passing requirements

The tests are designed to be challenging; this is done to match the real world. Consequently, candidates must be fully prepared for this unique exam.

The minimum pass score is 70℅ , while a distinction requires obtaining 85℅ and above.

Benefits of the REFM certification

The Real Estate Financial modeling certification exams are designed to measure knowledge, understanding, and technical prowess.

The Real estate professional certification enables real estate professionals and students to prove their skills in solving analytical problems with Microsoft Excel.

Therefore, obtaining the Real Estate Financial Modelling professional certification has several benefits.

- The professional certification defines the competence of Real Estate professionals. This makes selecting the most qualified candidate easy. Therefore, employers can easily narrow down the candidates they seek.

- The certification identifies candidates that have obtained the certification title. In other words, it makes professionals stand out among other job applicants. Additionally, it is a huge score on the Resume.

- The certification raises the level of competence in the organization and shows a level of competence to the rest of the industry. Organizations having certified professionals are trusted in terms of skill and delivery.

- The certification encourages career development and enables professionals to pursue further studies.

- It demonstrates the focus and determination of the employee. The certification program indicates high achievement of the employee.

Therefore, the benefits can be split into employer and employee benefits. In a nutshell, the benefit that employers and employees gain is huge.

REFM vs. other programs

There are several other programs that universities, private institutions, and companies offer.

The following are the alternatives to the Real Estate Financial Modeling courses.

1. The Oxford University Real Estate Management course

The University of Oxford offers this 5-day course at £7500 inclusive of accommodation. The course is also offered online, just like the Real Estate Financial Modeling certification.

The program is designed for Real Estate professionals who are seniors in the industry. The candidates usually include Managers, Fund managers, Vice presidents, and other high-ranking officers.

The application is made online, just like in the REFM program.

2. Institute of Real Estate Management

The Institute of Real Estate Management offers an array of Real Estate certifications. These certifications include

- Certified Property Manager CMP

This program is designed to train Real estate managers. Therefore, it's a requirement that one must have 36 months of experience whether you were in a real estate management position, portfolio management, and any other related position. - Accredited Real Estate Manager ARM

The ARM is another Institute of Real Estate Management program that aims to make candidates competent.

Compared to the REFM, these other courses are broad and focus on management.

Key Takeaways

- REFM is a course in the finance industry that stands for Real Estate Financial Modeling. The course is specifically designed to equip Real Estate professionals with the right skill set to thrive in the industry.

- The certification has a flexible duration. It's all subject to the candidate's degree readiness. The course has three levels, namely, levels 1, 2, and 3, respectively.

- The program costs about $149 per level of the exam. Therefore, the total cost of all the certification levels amounts to approximately $399 or $400.

- The exam candidate must be prepared and read and understand several concepts tied to the subject of Finance. These topics range from Cash Flows, Internal Rate of Return, Net Present Value, and others.

- The Real Estate certification exam involves building financial models using Microsoft Excel. In addition, the candidate must learn Excel shortcut keystrokes.

- This exam puts a time constraint on the candidates, which gives them a challenging edge. Therefore, a person intending to write this exam must practice the exam questions with time.

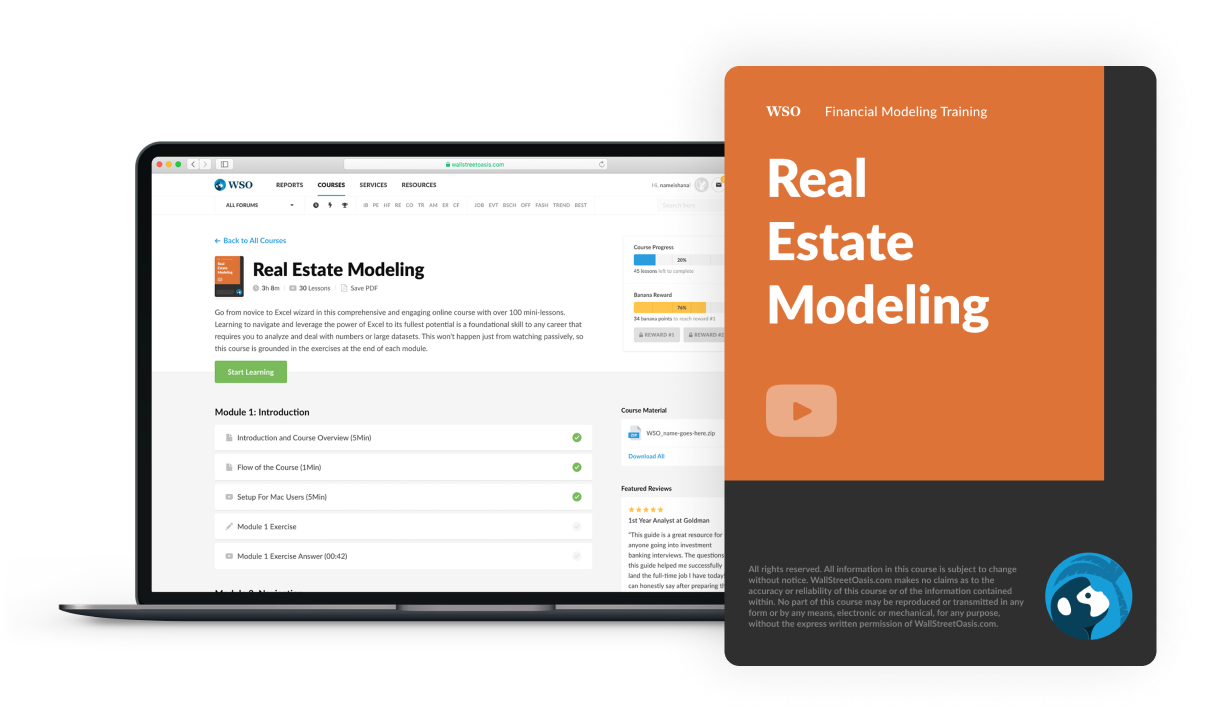

Everything You Need To Build Your RE Modeling Skills

To Help You Thrive in the Most Rigorous RE Interviews and Jobs.

or Want to Sign up with your social account?