Foundations of Real Estate Financial Modeling

It includes individual and group training to help professionals practice and test their expertise in creating models for investor purposes.

In commercial real estate, financial spreadsheets are commonly used in tracking and forecasting a property's expenditures.

Professionals and institutions use a real estate financial model to analyze the risks and returns of a property and help investors, like owners and lenders, make justifiable investing decisions on the real estate property.

REFM Model for Success offers a world-renowned financial modeling program for commercial real estate professionals and students. The REFM program helps professionals to advance their skills in modeling real estate transactions.

Generally focused on excel, REFM Model for Success provides an excel focused financial modeling training program. This includes individual and group training to help professionals practice and test their expertise in creating models for investor purposes.

Students have the on-demand opportunity to develop their skills in modeling and gain valuable information on real estate transactions, pitching to potential investors, and creating proformas.

Around the world, students have access to on-campus training in real estate financial modeling. The participating universities, and others that are not listed below, are partnered with REFM Model for Success to give students a head start in commercial real estate:

- University of Southern California

- The University of California, Los Angeles

- The Wharton School

- Harvard Business School

- London Business School

Three Types of Real estate financial Modeling

There are three widely used types of models for specific uses of real estate financial modeling. The categories range within the different asset classes of the commercial real estate industry.

Some of the major proponents of the deal-making process would require using property valuation and cost estimates, which concludes why we have provided the three widely known financial models.

It is important to understand the overall job objective and the overlap of skills related to each model in the:

- Acquisition Modeling

- Renovation Modeling

- Development Modeling

The various financial modeling projects used for real estate properties can help distinguish the different routes of calculating and forecasting property value to investors.

In creating these models, it is important to consider surrounding factors when valuing a property. For example, nearby schools, transportation routes, entertainment, and residency are a few elements that contribute to a property's value.

Moreover, providing detailed information about the property, its location, and its value to the land and surroundings will give investors a better understanding of its future outlook.

Each model has objectives to own, restore and build a purchased land or property. As the main objectives for creating the models, each offers to add additional value to a property, fill in tenant vacancies, and provide calculated assumptions.

Everything You Need To Build Your RE Modeling Skills

To Help You Thrive in the Most Rigorous RE Interviews and Jobs.

Acquisition

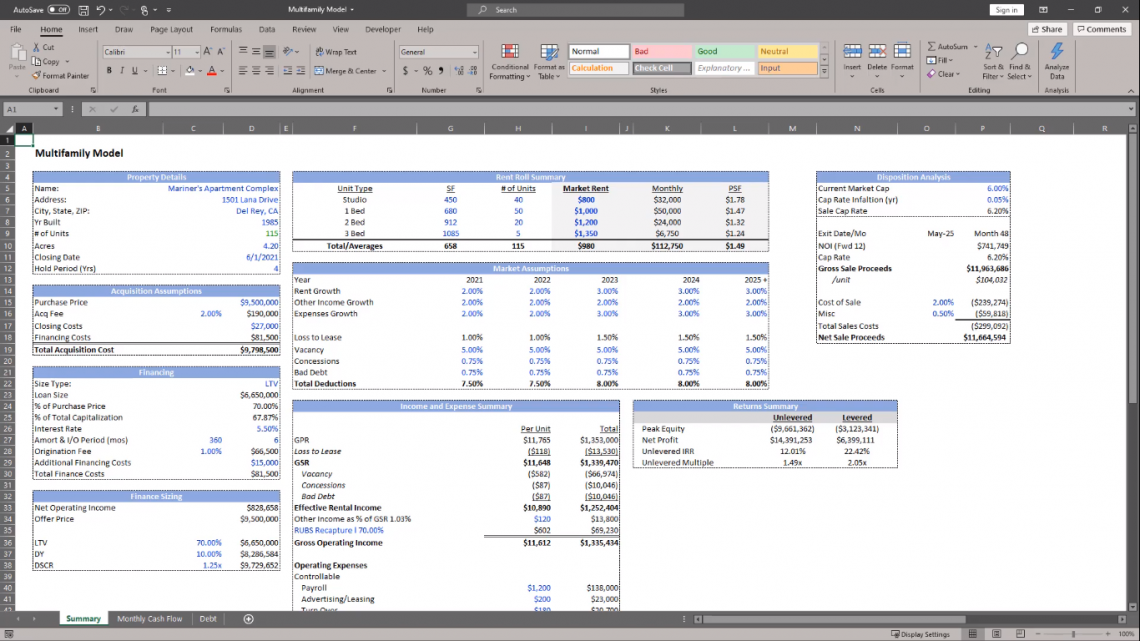

Let's start with acquisition modeling and its contribution while analyzing the risk and return for property investors.

The acquisition is the occupation of acquiring or gaining a property's ownership to sell it with minimal renovations.

After acquiring the property's ownership, calculate the net operating income (NOI) / the cap rate to determine the property's value.

The property's value would include physical attributes like the site's location and the building's conditions.

According to the First National Realty Partners, the next step involves taking the calculated value of the property to create the assumptions of the financial model:

- Income growth rate

- Expense growth rate

- Vacancy rate

- Purchase price

- Capital expenditures

- Financing

To go into further detail for a few assumptions, let's look at the significance of income growth rate, expense growth rate, and capital expenditures.

The income growth rate is the increase in income or revenue of a property, typically given in percentage. Over a monthly period, the revenue growth rate is calculated to establish the success rate of a given property.

The expense growth rate determines the expected growth of property expenses over the following years. The Commercial Loan Direct notes that the expected growth considers the operating expenses of the cash flows.

After acquiring the land or property, all expenses made by the buyer or business are considered capital expenditures. The acquisition costs include factors like the purchase price, the costs of maintenance, and the costs of minimal renovations.

The following steps can now assemble the leveraged and unleveraged basis of the property's overall expenses. First, the leveraged basis will determine how the property's operations needed much-borrowed capital. The higher the debt, the higher the leveraged property is.

To determine the amount of funding going towards the property, you should look at the unleveraged basis. Funding is not borrowed money-it is the use of the money invested into the property by its equity shareholders.

To finish off the acquisitions model, analyze the calculations to configure the risks and returns of the property. The final stage of creating the model will determine the best investment strategy for its potential investors.

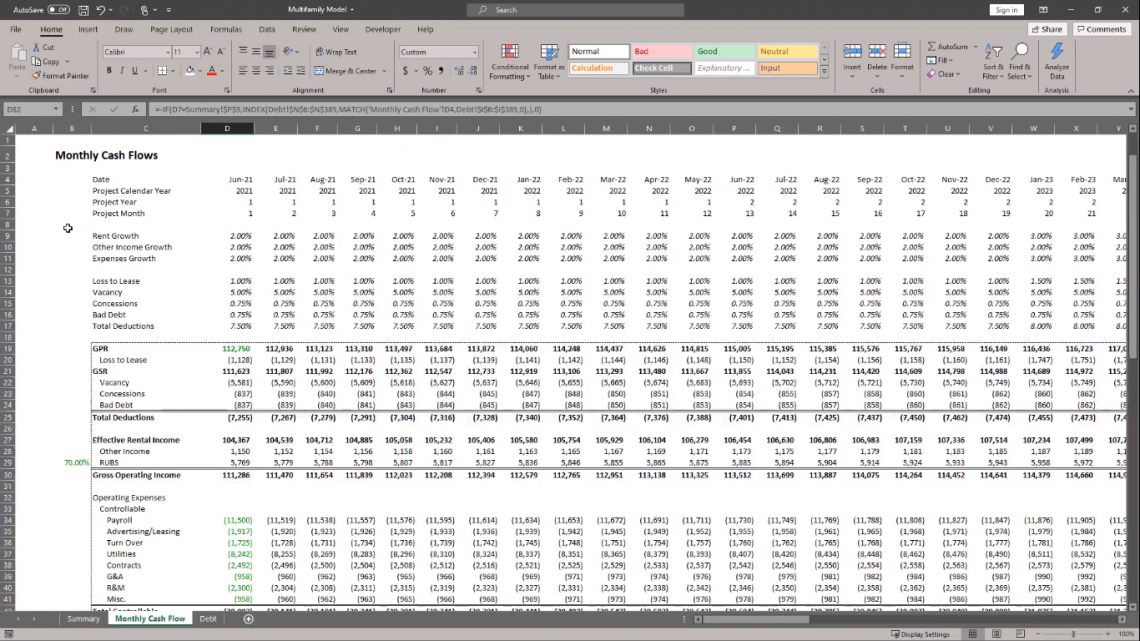

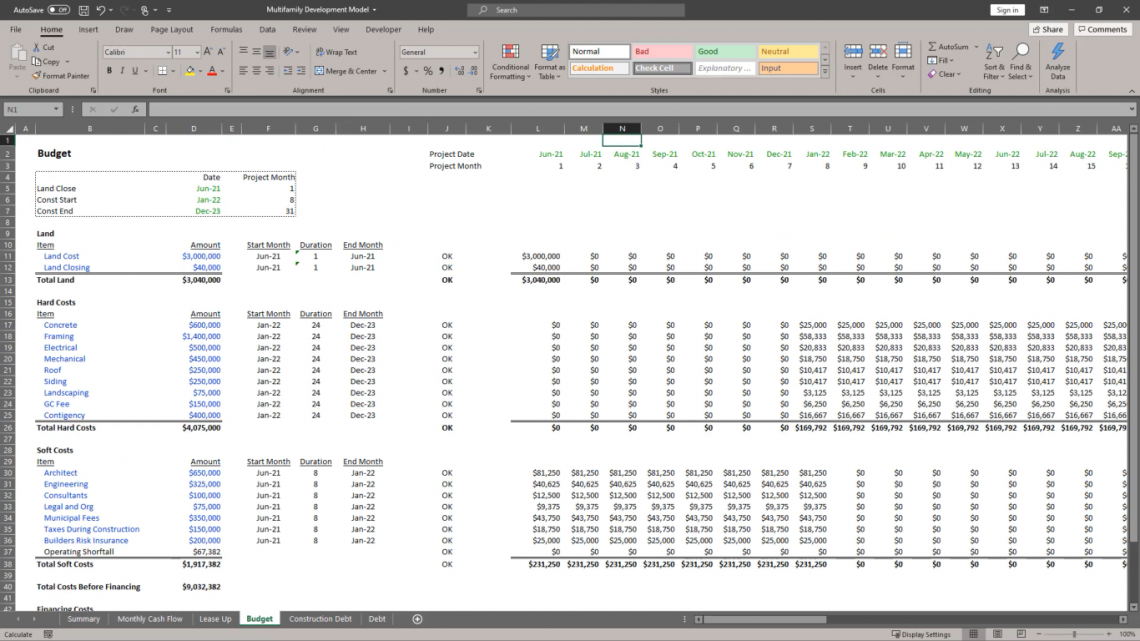

All in all, the depictions should entail what the final acquisitions model should include. At the bottom left-hand corner, you will notice the excel model has a summary tab, monthly cash flows, and debt category, as they all play a major part in acquiring a property.

You can watch our videos to follow the detailed steps on completing and understanding an acquisitions model.

Renovation

This form of modeling is relatively similar to formatting the financial model of a property. However, renovation requires a substantial amount of remodeling as compared to acquisitions.

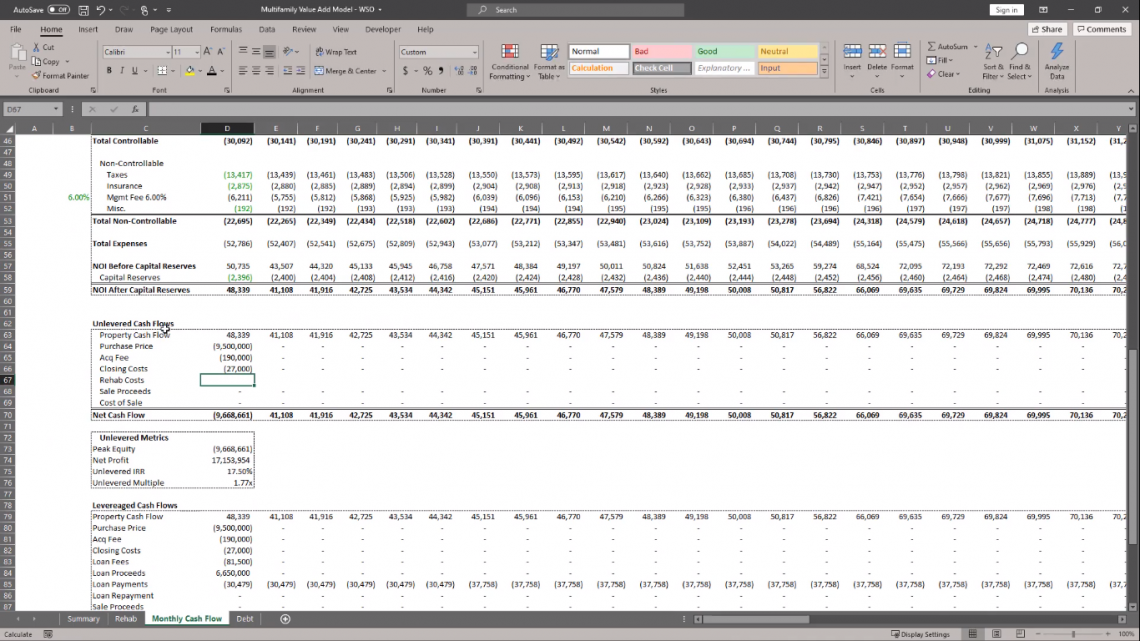

As you may notice, the model is similar to the previous model. However, the renovation premium and gross potential rent (GPR) post-renovation were added to the monthly cash flows. Additionally, renovation requires alterations in calculations as more value is added.

As you can see, the highlighted green portion represents the changes in the cash flow model due to major property renovations. Notably, the operating expenses see the biggest adjustments as renovations require additional costs.

Renovation involves the act of increasing the value of a property through capital investments. To achieve increasing a property's value, the owner of the project can undertake a few tasks:

- Sustainable energy appliances

- Up-to-date technology services

- Modernizing office space

- Paint colors

The tasks listed above can improve the property's use and profitability, as stated by the Litchfield Builders. In addition, for a few reasons, renovation can create a greener and safer work environment, provide the latest and most efficient uses of technology, and improve the space utilized by its tenants.

Similar to the acquisitions model, take the calculated property value and determine the valuable attributes of the property.

Other considerations that involve the renovation process are

- Renovation costs.

- Renovation period.

- Benefits following renovation.

- Loan Refinancing.

- Exit assumptions.

It would be best if you consider the project's timeline for renovating the property during the renovation process. Renovations, on average, can take about eight months to finish renewing a property. Also, consider that vacancy rates can rise or drop during renovation.

If a business has space readily available, this can increase vacancy rates. As opposed to the benefits following renovation, if the project takes longer than expected, the property can lose tenants, decreasing vacancy rates.

Additionally, the renovation costs and tenancy of a property will include the rehab costs of the project for the unlevered basis, as pictured below, and the levered basis.

As exit assumptions, renovations are constructed to add greater value to an existing property. Typically, assumptions post-renovation are estimated to achieve a low cap rate.

Development

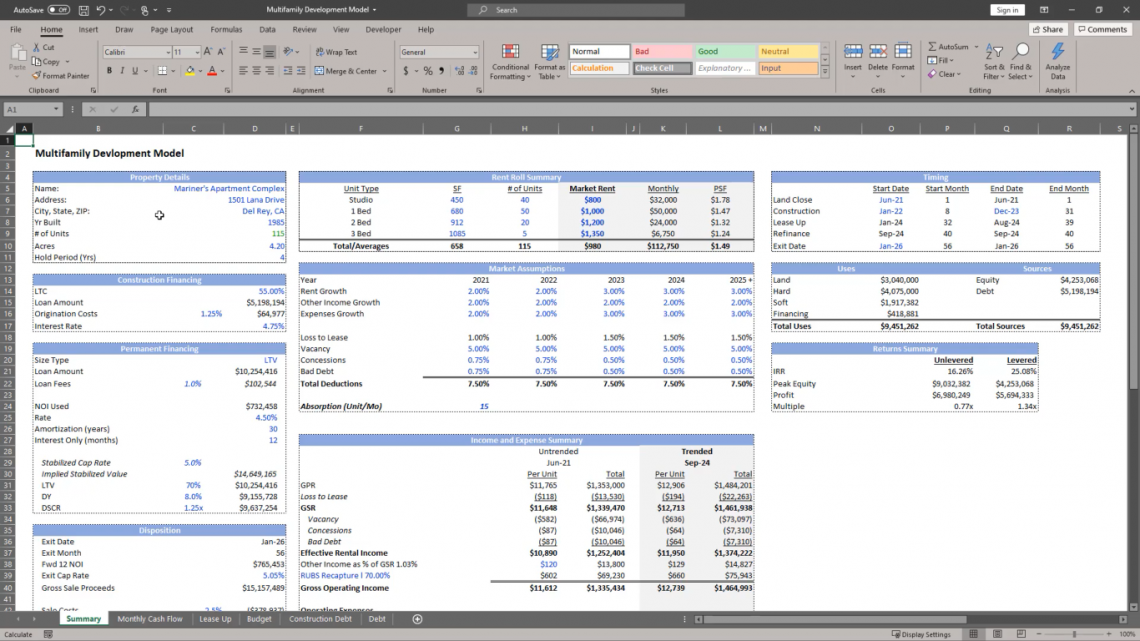

The third real estate financial model is development modeling. Again, the modeling aspects are similar to the acquisition and renovation categories, but there are a few major differences in the process.

The final product is formatted similarly to the others, but the financing and costs categories differ, as construction includes various subcategories.

Development is purchasing land to build a new property. After developing a new property, tenants must fill in the occupancy rates.

To fund the development project of a property, developers look to raise funds through debt and equity.

As stated, parts of the development model are similar to acquisitions and renovations in terms of creating assumptions and calculating the returns of the property.

However, the development of a property calculates the purchase price differently. Therefore, you will determine the purchase price through construction and land costs instead of computing the NOI.

Also, considering the amount of time it takes to develop a commercial property should be calculated in the assumptions and purchase price.

Practice your excel modeling skills and try one of our courses today.

Main Components of real estate financial modeling

Learning the standard real estate financial modeling terminology will also benefit your understanding.

To help build confidence in creating real estate financial models and knowing the significance of each, we will be briefly discussing the following terminologies:

- Cap rates

- Net operating income (NOI)

- Loan to value (LTV)

- Loan to cost (LTC)

- Amortization period

The cap rate is a measure of a property's profit and return. A cap rate of five to ten percent is considered good. A property with a cap rate lower than five percent is more costly. While a cap rate greater than ten percent is less expensive.

The total difference between gross rental income and operating expenses is the net operating income (NOI). As mentioned earlier, the NOI is often calculated in the real estate acquisition and renovation models.

When analyzing a property's market value, you will look at the loan to value (LTV). The loan to value is a lender's given amount of debt financing. For example, commercial, term, or renewable loans are used to fund property operations and maintenance.

Likewise, the loan to cost (LTC) views the lender's given amount of debt financing but determines the cost of developing a property rather than its value.

Lastly, the amortization period offers an overview of the length of time needed to pay off the mortgages of a given property. The time allocated can be calculated in increments of months or years.

Another key component to know about real estate financial models is the types of properties analyzed. The most commonly seen properties analyzed in acquisitions, renovations, and development models include a few major asset classes, some of which are:

- Office

- Industrial

- Retail

- Hotels

For reference, Adventures in Commercial Real Estate provides a library of real estate financial models for download.

The numerous fields covered in excel modeling include office, retail, industrial, single family, self-storage, debt, equity waterfall, hotel, and many more.

Practice Resources for real estate financial modeling

In addition to using Wall Street Oasis real estate financial modeling courses, these top three websites provide extra practice to advance your skills in excel modeling:

- Break into CRE

- REFM

- Udemy

Whether you are already a professional in the industry or a student looking to get a head start in your career, honing your excel abilities can make you stand out as an individual.

Many real estate transactions involve using excel modeling in each project. Organizing, efficiently creating and calculating assumptions, and presenting your findings are crucial parts of the modeling process.

Real estate financial modeling can help you and investors determine the best-fit investment strategy for a given property or its potential value for a land working on developing a new property.

Tenants, as well, are benefited from the real estate transaction process. Many businesses seeking to expand to new locations are involved in filling vacancy rates and providing profit for institutions and developers.

Furthermore, real estate financial models are utilized to analyze the risks and returns of a property being acquired, renewed, or newly built.

Key Takeaways

- Examining the risks and returns of a property can include the ownership, renovation, or newly developed property's use.

- The acquisition and renovation models regularly determine the net operating income and cap rate.

- The development model calculates the construction and land costs to determine the property's expected value.

- When creating real estate models, projects must also consider the tenancy rates, vacancy rates, and investor profitability.

- Studying the common terminology used in various real estate models can help advance your comprehension in creating one.

- If you are interested in learning more about property forecasting, numerous resources such as A.CRE and Break into CRE are available online.

Everything You Need To Build Your RE Modeling Skills

To Help You Thrive in the Most Rigorous RE Interviews and Jobs.

Researched and authored by Caira Sotingco | Linkedin

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?