Investment Banking Associate

Investment Banking Associates are at the second level within the Investment Banking (IB) hierarchy.

Investment Banking Associates are at the second level within the Investment Banking (IB) hierarchy. Therefore, most Bulge Bracket (BB) Investment Banks look for candidates who recently obtained their MBAs (or other prestigious graduate degrees) from a top business school or analysts who have proven themselves to occupy the associate position over the years.

The role is most suitable for candidates with high problem-solving skills, top-of-the-line analytical ability, and interpersonal skills in a client-facing environment.

An associate might still be considered a junior-level position, but they have much more responsibility than an analyst. Associates act as liaisons between analysts and VPs coordinating the requirements of a deal and ensuring the process runs efficiently.

The job entails a lot of travel as most IBs have international clients. This is one of the reasons to account for the long work weeks notorious in the industry. However, the attractive salary packages and immense exit opportunities make it one of the most sought-after professions in finance for young professionals.

Associates can continue their climb up the IB ladder to make their way to VPs or transition to a career in private equity or hedge funds.

Note

An associate can aim to become a VP within 3-5 years.

Institutions prefer candidates with prior experience in corporate finance, banking, or accounting for this position. It shows employers a solid base in interpreting and understanding financial statements, an essential skill for the role.

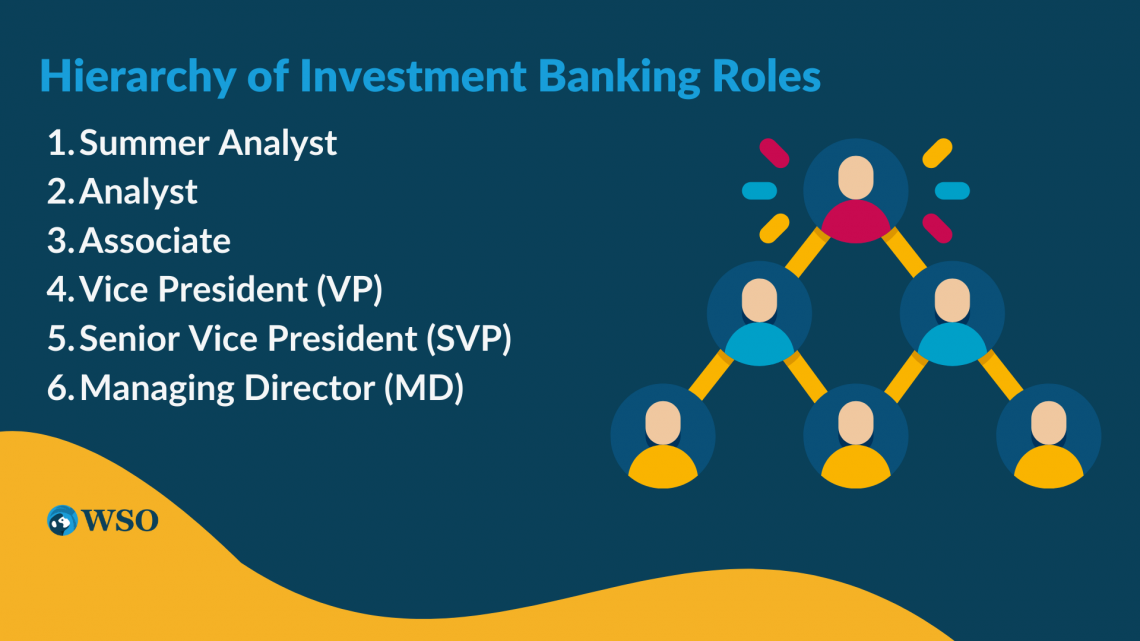

Hierarchy of Investment Banking Roles

The IB ladder can be quite confusing for someone new to the industry. Though the structure is fairly universal, it can vary from firm to firm.

The following bullet list breaks down the typical hierarchy of Investment Banks from the most junior (Summer Analyst) to the most senior (Managing Director) roles.

- Summer Analyst

- Analyst

- Associate

- Vice President (VP)

- Senior Vice President (SVP)

- Managing Director (MD)

As mentioned, Senior Associates and Senior Analysts positions may also exist depending on the corporate structure. At the associate level, bankers start transitioning to a more industry-specific specialization rather than wide coverage. At the VP and SVP levels, you are expected to be a professional in your area of expertise.

Summer analysts are usually penultimate or final-year undergraduate students. Analysts are hired as fresh undergraduates or young professionals before they complete their master's degrees.

Associates vary from analysts that have been promoted to fresh graduates. Any senior role or beyond is for professionals.

Note

Though banks target graduates, statistics show that the average age for an associate is 40 years old in the United States! No matter how old you are, a career in Investment Banking is always a possibility if you are willing to stand out from the rest of the competition.

Investment Banking Associate Job Description

An associate is seen as an individual experienced in the IB industry. This gives them much more responsibility, even if they are straight from graduate school.

Associates may be responsible for the following:

- Financial Modeling

Using Microsoft Excel to prepare Mergers and Acquisitions Models (M&A), Discounted Cash Flow Models (DCF), and Leveraged Buyout Models (LBO), to name a few. Associates require advanced modeling skills while being able to guide their junior analysts if required. - Preparing Pitch Books

Use Microsoft Powerpoint to prepare pitch books, a company's summary covering all important aspects. In addition, it provides an outlook of the firm, which is then presented to potential clients. - Client Management

Associates need to have great people skills as they are in client-facing environments. This includes being on call if a client ever needs anything.

With the stressful job also comes the opportunity to build relationships with industry leaders at a very young age which can be leveraged during exit. Investment Banking is the gateway to Private Equity, which is the end goal for most young finance professionals.

Note

Give yourself a head-start, and check out WSO's hand-crafted Financial Modelling courses for coverage of M&A Modelling, LBO Modelling, and Financial Statement Modelling.

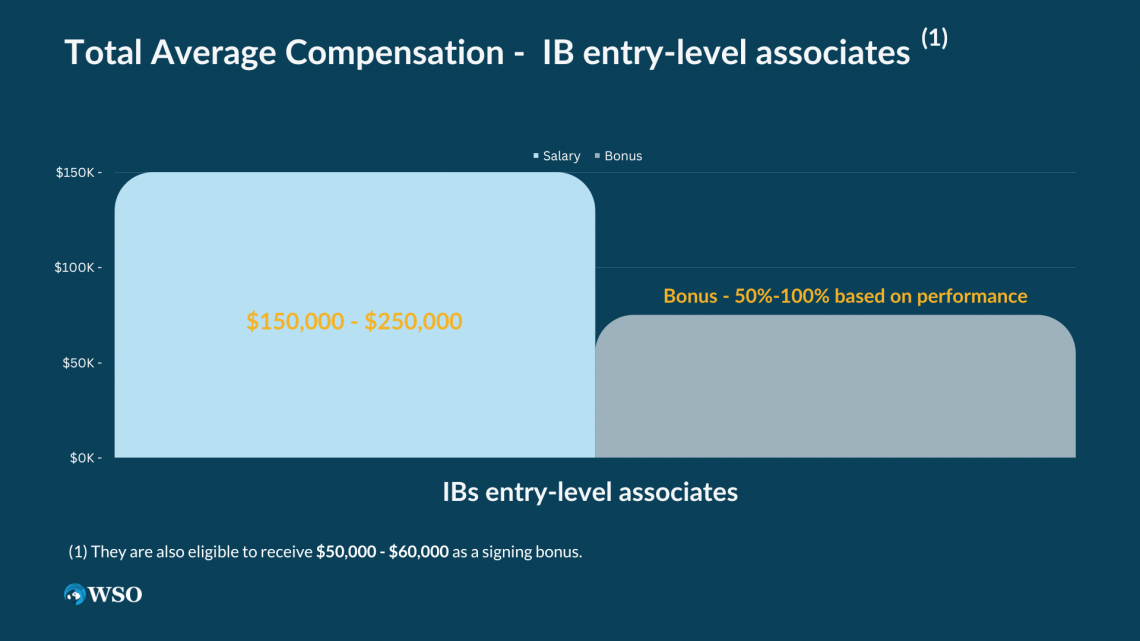

How much does an Associate make?

The IB industry is known for being hyper-competitive. However, as challenging as it may be to become an Investment Banking Associate, it is equally lucrative.

At BB Investment Banks, entry-level associates can earn between $150,000 - $250,000 as base salary with a bonus of between 50%-100% based on performance. They are also eligible to receive $50,000 - $60,000 as a signing bonus.

Investment Banker Salaries have various components that may influence net pay, such as stock bonuses and stub bonuses.

These bonuses and base salaries rise about 100%-150% as you get promoted and earn higher positions. At VP and above, employees are also eligible for stock benefits where the company's performance can affect their bottom line.

But be cautious. IBs know they are paying you a lot, so they tend to get the most value out of you. Though company culture and size can influence lifestyle, most Associates give up a few years of their lives and dedicate themselves to their careers.

How many hours does an Associate work?

Associates, on average, work less every week compared to analysts. However, a career in IB implies that your work hours will always sound crazy to your friends and family who are not in the industry.

Average associate work weeks range from 60-70 hours compared to the 80-90 hours analysts put in. Expect to work (or at least be on call) during your weekends; the markets never sleep!

Work-life balance is non-existent (dependent on the firm but always above average standards). Your closest friends are other Associates at your bank, and your social life revolves around a specific circle.

Here is WSO user "Kevin Gnappor's" account of how Investment Bankers can maintain this lifestyle;

"To the question of whether it gets better or if the hours go by when a deal drives you, sleep is the last thing on your mind. Adrenaline keeps you awake, and you manage to blow through whatever you need to get through."

How to become an Investment Banking Associate

As mentioned, an associate role is generally reserved for people with some professional experience. However, never underestimate the role networking can play in your career. Using LinkedIn to connect with professionals in the field you want to enter can be invaluable to your career progression.

Try not to apply for positions without getting a referral from someone that works at the company you are aiming for. This can dramatically increase your chances.

There are a few methods that can help you start your career as an associate. One option is to perform extremely well as an analyst and expect to be promoted to the position. More than their degree, candidates need to show that they have had a passion for the industry and how they have shown it throughout their educational and professional careers.

Preferred Qualifications

IBs prefer candidates with an MBA specializing in finance or banking. However, an MBA is not the only way into the industry. Students with postgraduate degrees in Economics, Mathematics, Accounting, Computer Science, and Engineering can also be considered.

Engineering degrees prove that students have the analytical and mathematical ability required to solve complex problems, which is what the role searches for.

Your options are nearly none if you are an individual without a college degree. Your only option would be to network and hope you can prove to someone that you are worth the shot. Relying on the traditional path of entering is not feasible.

Being a part of your university's Investment/Finance Club shows Investment Banks you are aiming for a career in IB because you love it, not because it pays well. Obtaining a Letter of Recommendation (LOR) from in-house finance or business professors can also come in handy.

Most students already have amazing grades and degrees from top schools. You stand the best chance if you can differentiate yourself from the competition. You need to be able to answer the "Why you?" question.

Experience

Associates need to show a solid understanding of the world of finance. Experience in Corporate Finance, FP&A (Financial Planning and Analysis), and Accounting can show your employers that you know how the industry is structured.

Many undergraduates also work in M&A or Advisory, which embodies skills that can be easily translated to your career in IB.

You must also keep in touch with the markets by constantly updating yourself. Most professionals ensure they read a trusted financial market news source before they even reach the office to stay up to date.

Here are the world's most popular financial news reporting organizations to help you get started.

Common Interview Questions

Proper preparation is the recipe for success. WSO offers Interview Prep Packages and Resume Reviews to help you land your dream job. In addition, we have compiled a list of popular Investment Banking Associate interview questions from our forums to give prospects a clearer picture of what to expect.

Interviews can consist of multiple rounds, and you can be interviewed by people in various positions who decide if you are a good fit.

Most questions are soft-skills based. Banks understand you are young, and your skills can be trained. They want to get to know you and see if you can be molded beyond who you are today.

- Tell us a little about yourself.

- Why Investment Banking?

- Mention a time you had to analyze information from multiple sources and come to a conclusion.

- Was there a point in your life you had to lead a team? Did you run into any problems? If so, how did you manage it?

- What are the three main methods to evaluate a company?

- What are some ways a company can raise money?

Is the Associate role for me?

Suppose you are highly conscientious, looking for an intellectually stimulating environment to start a fulfilling career, and have the ability to exit into any field you want. In that case, the associate role might be perfect for you.

As a penultimate or final-year postgraduate student, this is the perfect time for you to apply for associate programs offered by the most popular Investment Banks in the industry.

- JP Morgan Chase - Chase Associate Program

- Goldman Sachs - New Associate Program

- Morgan Stanley - Financial Advisor Associate Program

Remember, you still need to be the crème de la crème, have amazing grades, and equally astonishing experience. The path to becoming an Investment Banking Associate is arduous. With hundreds of thousands of other people aiming for your desk.

You may wonder what you can do to bridge the gap between you and your role. First, invest in yourself using Investment Banking Training, which will polish your technical and soft skills.

Ask me anything - From a Post-MBA IBD Associate

An experienced community member hosted an AMA session open to all our other users.

Here are the top-rated questions and answers.

1. What hours do you work, and what kind of comp?

Hours are dependent on the amount of deal flow - as of now, I would say that I'm putting in anywhere between 75 - 100 hours a week. However, things are picking up, so I'm also anticipating more time working during the weekends than usual.

I don't want to get too specific here in terms of comp. However, you can think of first-year (base) comp around the 100 - 140 range. The stub bonus (as far as I've heard, applicable if you are in year 0) is, at this time, probably around the 35 - 55 range.

2. How did recruiting go for everyone interested in IB at your school?

Recruiting wasn't bad for my school/year – most people who wanted to get an internship in IBD managed to get one. The ones that didn't were usually just not prepared enough.

3. Were the interviews as technical as the analyst ones typically are?

You can expect Associate interviews to be just as technical as the Analyst interviews; after all, it is the job of the Associate to check the analyst's work at the end of the day, so a solid technical foundation is crucial.

Associates are also expected to be more 'polished' – essentially, they are expected to answer the behavioral and fit questions much more smoothly than their analyst counterparts.

After all, associates are expected to stay on for the rest of their careers, so they need to define why they want to do banking, for example.

Everything You Need To Break into Investment Banking

Sign Up to The Insider's Guide on How to Land the Most Prestigious Jobs on Wall Street.

or Want to Sign up with your social account?