Free Cash Flow To Equity Model Template

Build your company's free cash flow to equity model

Download WSO's free Free Cash Flow to Equity (FCFE) model template below!

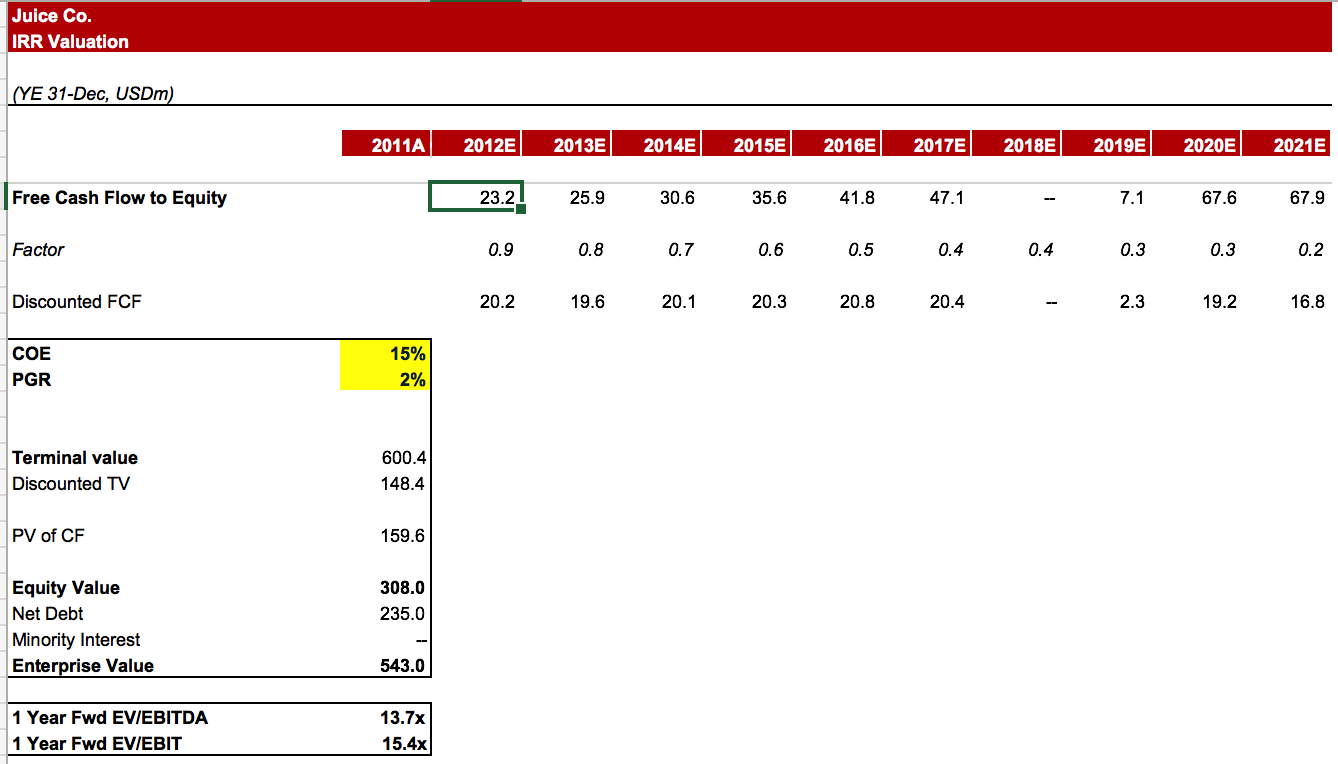

This template allows you to build your own company's free cash flow to equity model, which drives the final company valuation by discounting the effects of debt and creating an unlevered version.

The template is plug-and-play, and you can enter your own numbers or formulas to auto-populate output numbers. The template also includes other tabs for other elements of a financial model.

According to the WSO Dictionary,

"Free cash flow is a measure of how much money is available to investors through the operations of the business after accounting for expenses of the business such as taxes, operational expenses and capital expenditures. Free cash flow comes in 2 forms, levered and unlevered.

Free cash flow is extremely useful in LBO modeling as it shows how much cash the company will have to pay off the debt used to finance the buyout. Unlevered FCF is the more commonly used of the two."

A screenshot below gives you a sneak peek of the template.

Everything You Need To Master Valuation Modeling

To Help you Thrive in the Most Prestigious Jobs on Wall Street.

More Resources:

We hope this template helps you excel at your job! Please check out the following additional resources to help you advance your career:

.jpg?itok=DxumzaOP)

or Want to Sign up with your social account?