FMVA®

A curriculum made to teach financial analysts the real-world applications of bookkeeping, excel, finance, financial modeling, valuation, and other essential skills

The Financial Modeling & Valuation Analyst curriculum teaches financial analysts the real-world applications of bookkeeping, excel, finance, financial modeling, valuation, and other essential skills required to build a career in finance.

The curriculum comprises 12 mandatory courses, each of which has a final certified evaluation test entirely online. The FMVA certification was created to fill a void in the market for certified financial analysts.

Employers frequently discover that recruits lack the whole skill set needed for performing superior financial analysis because traditional colleges tend to be primarily theory-focused.

Established professional credentials are also overly specialized in areas like accounting, alternative investments, or portfolio management and need applicants to acquire the necessary offline additional knowledge.

Aims

Learn programs that will help you develop your hard skills

Become an expert in financial modeling.

Discover how industry professionals evaluate a company in reality.

Make stunning pitch books and presentations for management.

Learn how to organize, evaluate, and make suggestions based on raw data.

Have the self-assurance to progress in your job

How to enroll & Requirements

Enrolling right away online is the first step to becoming a certified financial analyst. You can then begin scheduling the required classes and update your learning schedule. A list of the prerequisites is provided below.

Program requirements:

Five electives for preparation, including excel, finance, and accounting

Nine mandatory courses, including various financial topics.

Three out of a total of 9 optional courses are offered. Each of the 12 compulsory courses must be completed by candidates with a final exam score of at least 80%.

You'll instantly get a certificate of completion after finishing each course. In addition, you will receive official certification as a Financial Modeling and Valuation Analyst once you have passed the 12 compulsory courses.

Each candidate can go at their own pace through the course on the online platform that houses the FMVA certification.

You might be able to complete the certification at the time and pace that best fits your schedule of work or school, thanks to the course's flexible timetable.

Additionally, you can select your electives, which allows you to tailor the course to your particular educational requirements with greater assurance.

What Set of Skills does an FMVA Grant You?

It primarily teaches the following skills:

Accounting principles and procedures used, their applications, and learning the most prevalent methods of financial analysis (ratios, benchmarking, etc.)

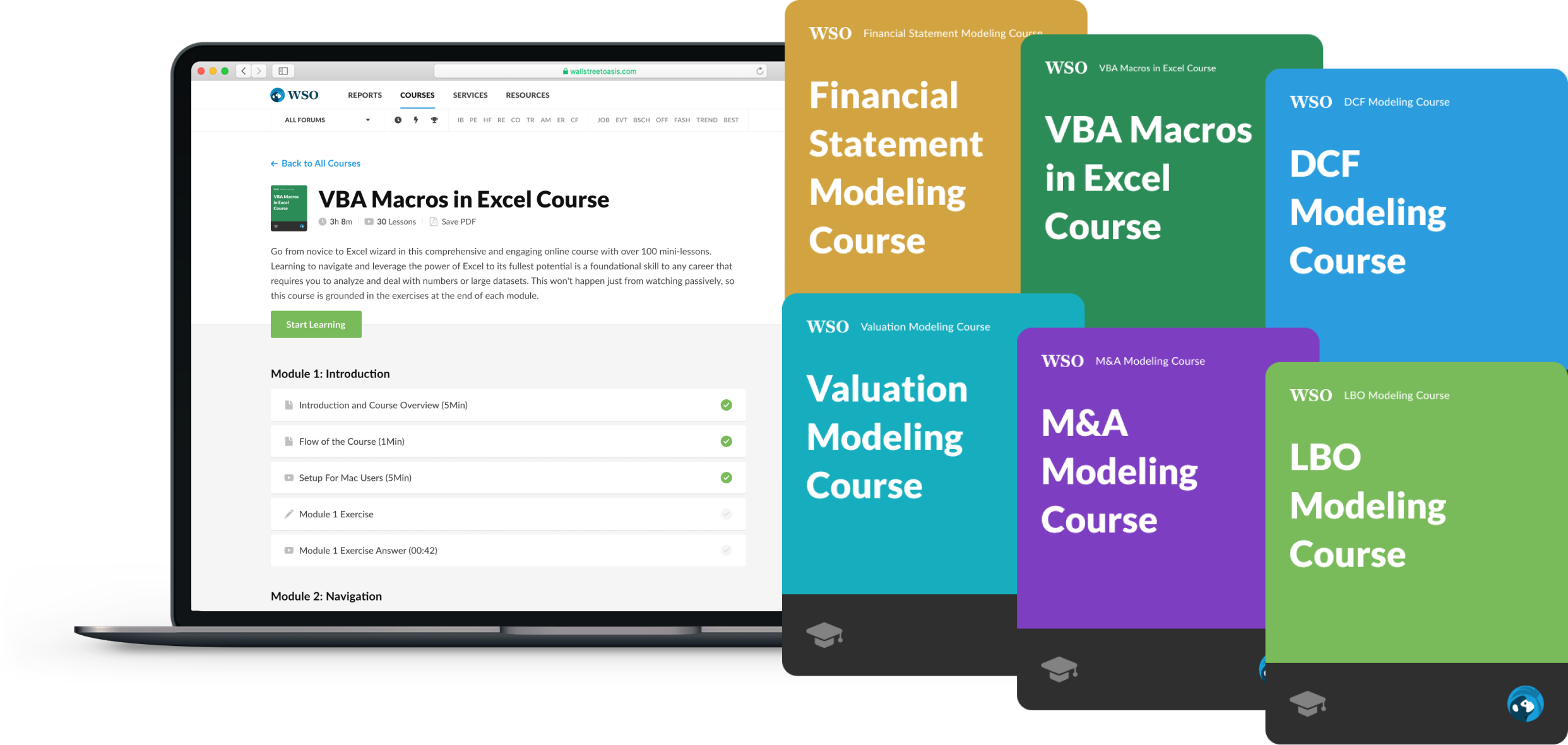

Building financial models from scratch (three statement model, DCF model, M&A model, etc.)

The process of valuing businesses and understandably producing voluminous data.

Create presentations, graphs, and charts.

Create suggestions that support business decision-making procedures.

Everything You Need To Master M&A Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Even if you already work as a financial analyst, obtaining an FMVA qualification could boost your self-assurance at work. Professionals can apply complex financial theory practically thanks to the certification's comprehensive knowledge and skills instruction.

This knowledge may enhance your ability to accept new assignments and offer creative solutions.

By including an FMVA certificate on your CV, you might potentially catch the attention of more companies and come off as more confident in job interviews.

a) Cost

The program has two options: Full Immersion ($847) and Self-Study ($497). The Full Immersion program includes additional resources, materials, services, and access.

One can choose the self-study option if their primary motivation for enrolling in the program is to develop their abilities in financial modeling at their own pace.

b) What Type of Jobs Positions Suit the FMVA?

Professionals concentrate on applying financial modeling theory to real-world applications as they advance toward achieving the certification.

Some professionals decide to enroll in a specific set of electives created for a particular industry. Each course imparts knowledge on a variety of subjects, including:

Accounting

Financial simulation

Valuing a company

Budgeting

Forecasting

Establishing executive presentations

Business tactics

Flexibility

on Executive-Level

The certification aims to give professionals useful skills that advance candidates' prowess in their sector.

After obtaining the certification, professionals may get promotions or positions of greater responsibility thanks to the executive-level skills that the courses may teach.

You could learn the following executive-level abilities: creating executive presentations, constructing financial models, creating graphs and charts, and delivering insightful and valuable recommendations.

Professionals who obtain their FMVA certification can earn more money, be promoted, or have a better chance of landing a job. In addition, new knowledge introduced to these sectors benefits the industries in which these individuals operate.

Innovative ideas are produced by personnel who successfully execute complex jobs and one-of-a-kind responsibilities for the organization and the entire industry.

Professionals with an FMVA certification often work in the following fields: property Banking on investments, business expansion, equity analysis, e-commerce, Accounting, Financial guidance Consulting, etc.

Obtaining the certification could give you a competitive edge when applying for new jobs. It does this in a variety of ways, such as:

Better credentials: The certification you add to your CV shows companies that you have the skills necessary to carry out the responsibilities of an open position successfully.

Salary raise: If you have substantial credentials, you might be eligible for a pay raise in your current position or a new one.

Fast-track career path: Your career may grow faster if you have the certification thanks to promotions, more responsibilities, or job offers for advanced positions.

Attract employers: Employers frequently look for candidates who commit to their sector and professional development by obtaining professional qualifications.

Everything You Need To Master Financial Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

or Want to Sign up with your social account?