FP&A Role

A process was routinely done to support a company's financial stability and its chosen commercial initiatives.

A crucial business activity supporting an organization's financial strategy is financial planning and analysis, a subset of business planning and analysis.

It was routinely done to support a company's financial stability and its chosen commercial initiatives.

It involves forecasting, budgeting, and analysis, and FP&A analysts are typically charged with giving senior management data on the same for them to make decisions that are business-focused about:

- Operations: It provides a roadmap for getting your business to the strategic planning goals.

- Finances: It provides the CFO with a projection of the company's profit and loss(income statement) to the CFO.

- Strategy: It's the determination of your goals and vision for your business.

FP&A in a contemporary company involves more than just reporting and forecasting. It lets a company analyze financial and operational data to maximize its future performance.

Corporations use these data-driven insights to inform strategic decisions to connect the various departments and divisions. As a result, FP&A contributes significantly to formulating operational and strategic decisions.

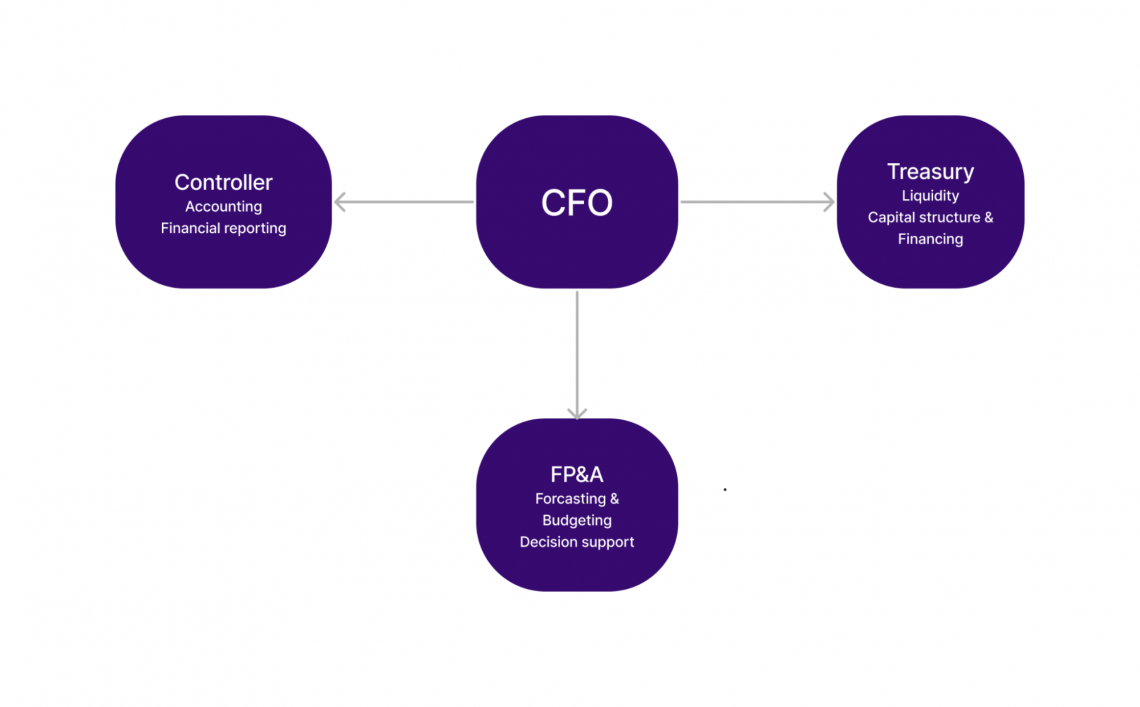

Controller: Controller's duties are accounting and financial reporting. The Controller is responsible for producing the three primary financial statements and ensuring they adhere to GAAP and other legal criteria. Then report it to the CFO.

Treasury: The Treasury Department is in charge of managing the company's liquidity as well as its debt (amortizations) and equity.

Managing the company's liquidity and financial investments, maximizing its capital structure, and keeping an eye on its debt and equity concerns are essential jobs.

Understand the Financial planning analysis

Companies require financial planning and analysis regardless of the state of the economy. Therefore, FP&A is critical for planning strategic goals during times of growth.

The analysis assists in determining what course controls and adjustments will keep the company on the path and in optimal fiscal health during leaner or more turbulent times.

As this position evolves, industry leaders will be able to address the modern demands they face through technological proficiency, effective communication, and the ability to tell the story behind the numbers.

The financial closing process combines budgeting, forecasting, reporting, and analytics to predict which investments, resource allocations, and other decisions will best achieve a company's goals.

The idea has always been there; recent advancements in cloud software have enabled finance and accounting teams to provide business owners with precise information and in-depth analysis to align business goals and plans across an organization.

Financial planning and analysis teams make recommendations that directly impact their companies' success because they are tasked with consolidating, forecasting, analyzing, and reporting on data to support decisions that drive the best business results.

It is therefore critical that FP&A experts incorporate best practices not only in their core tasks and in revealing and communicating actionable insights to their companies' key decision makers.

Specific Financial planning and analysis responsibilities include

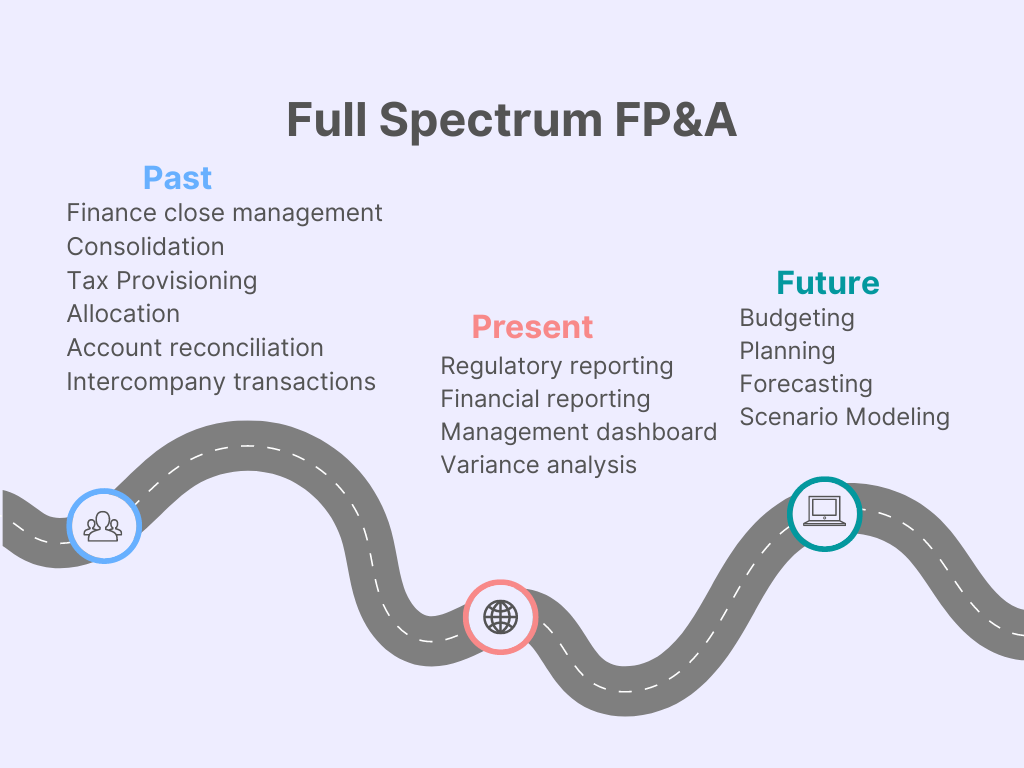

In recent years, their role has changed. For example, FP&A analysts used to focus on recording and reporting financial results and using historical financial data to forecast future sales and earnings.

However, the flood of data available today and the technology that enables analysts to use it allowed them to shift from more activated tasks to value predictions and analytics that strongly affect the business's direction.

1. Forecasting and Planning

In financial planning and forecasting, analysts use data from the past to create estimates of future performance and trends, which helps to make decisions about managing the business and whether it is on track.

Forecasting financial outcomes involve projecting sales, cash flow, and other factors.

It is frequently applied to forecast future income, outlays, and investment costs. In addition, financial forecasting models are frequently compared to the actual budget to evaluate performance in the past. Here are four examples of financial forecasting models:

- Anticipate planning

This forecasting model is the simplest one that is available. It uses facts from the past to predict what will happen in the future, providing guidance in forecasting revenue for the following three years.

Predictive analytics helps speed up the planning process by providing enhanced planning tools integrated into a single solution and augmented with artificial intelligence and machine learning. - Driver-based planning

This model is a management strategy that identifies the major business drivers of an organization and develops several business plans that statistically predict how various variables might impact the factors most crucial to the firm's performance.

They aid in developing business savvy, teamwork, and comprehension of how those drives result in results and outcomes that can be put into practice.

- Scenario planning and analysis

This is a planning method that businesses are increasingly using today. Analysts jump to conclusions about what might happen in the future during multi-scenario planning.

They anticipate the consequences and devise a strategy for each plausible scenario. Finally, these concepts and financial forecasts are used to develop the financial and operational plans required to meet the company's overall strategic goals.

The strategic plan, developed by top management with input from FPA, includes high-level targets such as revenue and net income for the short and long term. - Departmental collaboration

All different kinds of planning require cross-departmental collaboration. It ensures that plans take into account all data, variables, and expertise, and it helps to increase both accuracy and engagement.

Collaboration gives plans more credibility and aids in the formation of consensus. This is where xP&A links and coordinates projects across departments so the company can eliminate silos and operate as a well-oiled machine.

2. Profit and Loss

This team is responsible for compiling financial statements, such as profit and loss statements and management reports, as well as statements of cash flow.

These statements require collecting data from different departments and then verifying and consolidating that information. The financial planning and analysis team uses specific indicators to calculate key financial figures, like debt-to-equity and current ratios.

3. Profit Merging

Profit margins are critical to financial analysts as they help identify which products or services generate the most money for the company.

The Financial planning and analysis team is responsible for assessing the cost and revenue generated by each department within the company and finding new investment opportunities.

4. Budgeting

Financial planning and analysis's more forward-thinking responsibilities include budgeting and forecasting the company's future financial performance. Budgeting entails analyzing financial reports to allocate funds effectively.

Forecasting necessitates the development of financial models that consider trends within the company, the broader industry, and the economy that may affect revenue and profit.

Planning and forecasting are no longer just annual or quarterly events; more businesses are shifting to continuous planning and rolling forecasts, regularly evaluating the most recent numbers to make adjustments.

5. Assistance in making decisions

Financial planning and analysis reports forecasts and variances and uses that data as a characteristic of this method to improve performance, minimize risk, or capture new possibilities from both within and outside the company.

To that end, the FP&A team is typically tasked with producing a monthly "CFO" or "Senior Management" book that includes,

historical financial analysis, explanations for variations, an updated forecast with risks and opportunities compared to the current plan, and Key Performance Indicators (KPIs).

At its best, the report provides enough information to the CFO to clarify questions from various stakeholders. For instance, it may compare levers that can be yanked to maximize performance or meet specific goals.

technologies and tools

Data collection is the most difficult challenge that FP&A teams face. Because many FP&A teams do not have access to source systems, they spend most of their time collecting and processing data.

They are still drowning in a flood of Excel spreadsheets, which are prone to errors, take a long time to analyze information, and limit collaboration.

Furthermore, many senior executives who should be drawing strategic points from Financial planning and analysis insights do not have enough trust in the data or analysis to let it help lead their decision-making.

So automation, artificial intelligence, and the cloud are changing the game by improving the accuracy of plans, budgets, and forecasts and the power of financial analytics.

Planning, budgeting, forecasting, and performance management are some functions that have been the focus of financial planning and analysis.

The difficulties of the previous two years have demonstrated how crucial it is to make use of the opportunities presented by digital transformation as well as cross-functional planning and analysis for more effective collaboration outside of the conventional remit of Finance that include:

- Cloud: The FP&A market is moving more quickly away from established on-premises services and toward cloud alternatives.

Compared to the preceding generation of on-premises offerings, new solutions developed or extensively re-architected as cloud services are often simpler to use and maintain. As a result, the vast majority of new FP&A sales use the cloud as such:

Compared to the preceding generation of on-premises offerings, new solutions developed or extensively re-architected as cloud services are often simpler to use and maintain. As a result, the vast majority of new FP&A sales use the cloud as such: - AI and machine learning: creation, implementation, and promotion of better methods for using AI/ML and other relevant data science approach within Finance.

Advanced statistical tools can reveal business drivers and patterns used to create forecasts (FP&A). It discovers, promotes, and supports emerging trends and focuses on how these technologies. The Committee holds its regular meetings online to ensure a broad audience. - Embedded tools: It is an Automated Scheduling tool within a calendar and mobile display across phone, tablet, and virtual boardroom.

By leveraging tools for consultation and feedback, built-in collaboration and planning orchestration can promote involvement, accuracy, and efficiency in the planning process and FP&A organization. Through improved technologies and more effective procedures that enable better cross-departmental data management, the Office of Finance will enhance its collaboration with the rest of the company.

Through improved technologies and more effective procedures that enable better cross-departmental data management, the Office of Finance will enhance its collaboration with the rest of the company.

Automation is the crucial first step on the vital corporate journey to contemporary, sustainable FP&A procedures. As a result, organizations of all sizes and industries are adopting cloud technology at even more significant rates, increasing collaboration, agility, and efficiency. Companies that adopt these trends will develop to better support long-term business performance and financial health.

FP&A can have a direct impact on a company's

How are Financial planning and analysis professionals delivering on their promise of being an economic engine for their companies and the economy?

A recent economic study of the expanding FP&A role reveals numerous examples. For instance, Amazon's high-performing FP&A units were instrumental in creating Amazon Prime, which now has 200 million members.

Other revenue-driven FP&A initiatives include Chemours, whose team improved margins for industrial plants at the $6 billion company, and Lego and HP, which used real-time data to drive revenue during COVID-19.

1- Financial planning and analysis is the 13th fastest growing job in the United States.

The role of Financial planning and analysis is rapidly expanding and has enormous potential.

Indeed, LinkedIn announced in 2022 that financial planning and analysis is the thirteenth fastest growing in the United States.

All are in the value-creation business, intending to strategically lead companies through steps like scenario planning, modeling, and analysis. These positions range from FP&A Manager to Head.

2- Financial planning and analysis M&A work may yield six to seven-figure returns.

The growing influence of FP&As in merger and acquisition work demonstrates their importance. They remit to evaluate a business, and financial assumptions can result in six to seven-figure returns.

It can create such proposals, such as offering an initial discount on the value of the business now but paying it back as they begin to generate value for us.

This is yet another example of how FP&A at a mid-market company can generate returns in the six to seven-figure range.

3- Share prices fall due to poor forecasts

Forecasts based on manual data are costing businesses money. This frequently happens in large corporations. Over three years, only 1% of firms hit forecasts exactly.

This resulted in a 6% drop in their share prices over the same period, where a significant portion was due to investor reaction.

As core value stewards, FP&A professionals have a steadfast fiduciary responsibility to the company's stakeholders that they should take seriously to ensure that success isn't optional when choosing between short-term profits and the formation of long-term value.

4- Perform high-value work

Unfortunately, Financial planning and analysis admit that manual work is taking over their days, making it difficult to get to the research. Only 22% of their leaders spend time on high-value work, even though 55% want to.

Numerous studies have confirmed the economic impact of this. But unfortunately, this percentage of tedious manual labor has remained roughly constant over the last ten years in the profession.

This reduces the ability of FP&A teams to deliver real economic growth and harms morale.

Key takeaways

- Financial planning and analysis are becoming a trusted source of guidance and support within businesses, introducing perspective and confidence to financial decisions.

Expect solutions to evolve to meet new challenges as firms become more competitive and complex. So, that has now become a critical role to any large business. - FP&A tools will integrate with increasing data sources and business systems.

- Financial planning and analysis will undoubtedly develop and play a more prominent role within enterprises.

Although the positions will remain under the purview of Finance for the foreseeable future, an increasing number of planning choices across departments and organizations will depend on the knowledge and analysis of financial planning and analysis. - By following these best practices and developing strong FP&A teams, businesses may ensure their judgments are confident and well-informed.

Teams that follow best practices like those outlined above, operate transparently, effectively communicate with one another, and work during times of constant change will be in the best possible position for success. - Cloud-based platforms will become the preferred delivery method for FP&A software. AI solutions will improve the speed, accuracy, and efficiency of financial planning and anaprocessesesses'.

- Comprehensive planning and analysis (xP&A) will aid in the removal of internal and external barriers to collaboration.

Everything You Need To Master DCF Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Researched and authored by Ranad Rashwan | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

.jpg?itok=DxumzaOP)

or Want to Sign up with your social account?