Cost Structure

Refers to the combination of costs that allow the business to create and deliver value to its clients and customers through goods and services

A company's cost structure combines costs that allow the business to create and deliver value to its clients and customers through goods and services.

It differs heavily across companies, products, services, and customers. However, there are two main types commonly seen in business:

- Value-driven structure: Quality is the primary consideration. Generally, these are luxury goods with high price tags.

- Cost-driven structure: Price is the primary consideration. These companies prioritize low price tags over the quality of the goods and services they provide.

Each distinct structure is some combination of three different kinds of costs:

- Fixed cost: These costs do not vary with increasing output. Instead, there is one price to pay, no matter the number of goods and services produced.

- Variable cost: These costs depend entirely on the output produced. The more goods and services delivered, the larger the total variable cost.

- Mixed cost: This is the most complicated of the three, as it combines both types of expenditure. This entails a price with both a fixed aspect and a variable part.

Usually, a company will allocate costs into specific categories. This allocation helps see how profitable a particular project will be.

Through the allocation of these costs, cost pools are created. A cost pool is a set amount of money spent on a category of expense. One example of this is marketing.

After all, this has been done, pricing can be set to achieve the desired profit margin.

Another added benefit of a company reviewing its cost structure is that points of inefficiency can be found, allowing for the maximization of profits.

When analyzing investment opportunities, a detailed structure is beneficial in forecasting profits.

Creating a forecast of profits is necessary to evaluate a company when performing a discounted cash flow analysis, one of the most commonly used valuation methods.

Types of cost structure

As previously mentioned, there are two structures: value-driven and cost-driven. Value-driven refers to companies that seek to provide high-quality goods. On the other hand, cost-driven refers to the cost structure that aims for the lowest production.

Each cost structure has its pros and cons as well as target audiences. However, you will see that these two structures are the extremes.

Due to each polarization, it's essential to keep in mind there is not a one-size-fits-all cost structure.

There are millions of companies around the world, and the goods and services of each fit each differently. This is why a company analyzing its cost structure is critical.

The efficacy of each cost structure varies from business to business. Many companies are in the middle of these two, offering mid-range quality and prices.

Each organization, however, generally leans towards one more than the other. As a result, a company will either focus slightly on delivering quality or providing low prices.

Value-driven structure

This structure focuses on high-quality goods. Usually, this results in high costs for producers due to expensive inputs, skilled workers, and long production times.

One might assume that pushing for quality instead of cost leads to low margins, but the truth is the opposite. Of the two structures, value-driven allows for more significant markups.

Certain companies aiming for high-quality products command astronomical price tags compared to other products in their categories.

Some of these luxury brands bear prices higher than what would be justifiable due to their recognition. Product scarcity is also common among value-driven structures.

Examples of companies with value-driven cost structures are Rolex and Gucci.

While producing a Rolex is more expensive than a Casio, Rolex's profit margin is significantly more significant due to their perceived scarcity and brand recognition.

A Casio watch could sell for $25, whereas a Rolex watch could sell for $10,000. But, of course, that doesn't necessarily mean that a Rolex is 400 times better.

As you can tell, quality isn't the only driver in the price for the goods and services of value-driven companies. The con of these quality products is that the customer base is reduced to higher-income individuals and those willing to spend more.

Cost-driven structure

A cost-driven structure aims to create goods and services that fulfill their purpose for the lowest price possible.

The production cost savings are then passed onto the consumer, making the products cheaper than their competitors. In addition, the low price point allows for a much larger customer base, targeting anyone who wants to save money.

The con of this structure is that the goods and services produced tend to be of lesser quality, possibly lasting less time.

It also can lead to a negative brand perception if consumers become frustrated with the poor performance of goods or services. There are two other common ways a company can decrease production costs other than sacrificing quality.

- Economies of scale: These are savings from producing more significant amounts of a given product or service.

- Economies of scope: When a large array of different products or services are produced, costs can decrease due to the crossover of materials, machines, etc.

No Name is an example of a company using a cost-driven structure. As a result, they produce lesser-quality groceries and household products at a price point significantly lower than competitors.

Types of costs

We'll look deeper at each cost type, reviewing the basics of calculating each.

As mentioned previously, calculating costs permits financial analysts to perform valuations.

Everything You Need To Master Valuation Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

A better comprehension of each charge will be developed by looking at the most common costs for each category.

With over 210 million companies globally, one can only imagine how much their cost structures vary. From small "mom-and-pop" shops to multinational conglomerates, each has costs that permit the production of their goods and services, which are the building blocks.

Keep in mind that these are only the most basic kinds of costs. A litany of other cost types has been created throughout history with varying levels of recognition, like sunk costs and opportunity costs.

Both of these costs are more for theoretical than practical use. In this article, however, we will only review the three most common costs present in modern-day business: fixed, variable, and mixed costs. So first, we'll look at the simplest, the fixed price.

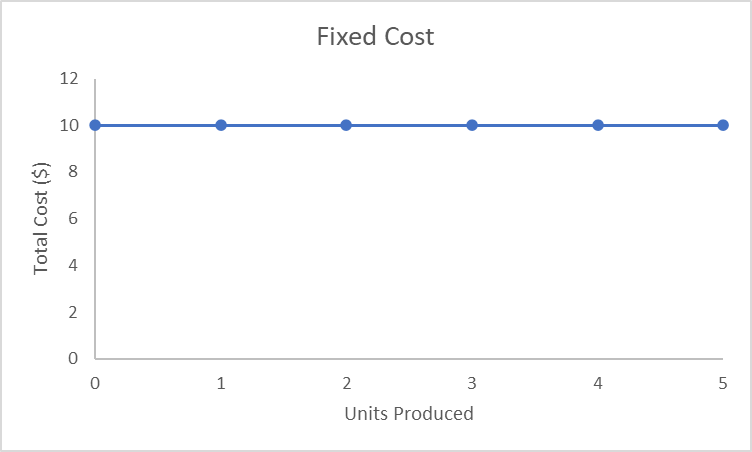

Fixed cost

The fixed cost is the simplest of the three costs that will be covered. The essential characteristic of a fixed price is the flat rate that is charged.

This means that when using an input with a fixed cost, the amount paid in exchange for the information does not vary based on the number of goods or services outputted.

A fixed cost in an equation is simple: fixed fee = flat rate. As viewable in the chart above, the price stays at $10 no matter how many units are produced.

The most common forms of fixed costs are almost universal for every business. Office rent, for example, is a fixed cost. At the end of every period, generally a month, the pre-agreed upon fixed amount is paid.

This ignores the production that occurs within the building entirely. Whether $1 or $1,000,000 is produced in the facility, the rent paid will be identical. This characteristic is the telltale sign of a fixed cost.

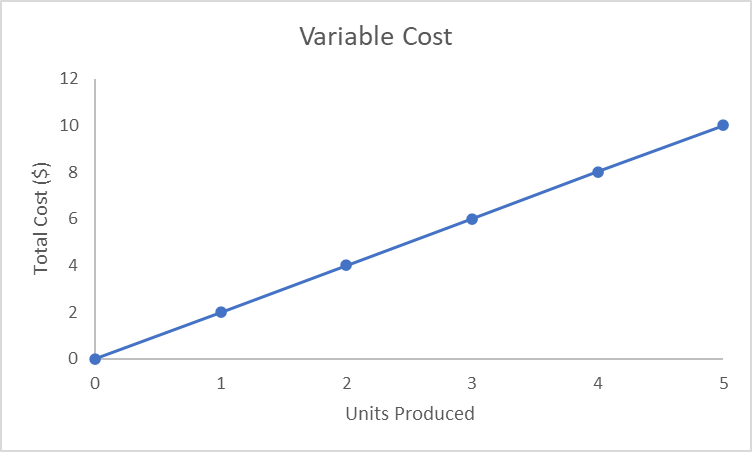

Variable cost

A variable cost is a little more complicated. As the name implies, the amount paid for input with a variable cost relies entirely on how many units of a good or service is produced.

The equation to calculate the price of a variable cost for a given output is the following: variable cost = price per unit * units outputted.

Looking at the chart above, we see costs increasing by $2 for every new unit produced.

Breaking down this equation, one of the easiest ways to tell that a cost is variable is that when the output reaches zero, the price from that input also does.

The most common variable cost is employee hours. For example, if an organization operates for 100 hours, it must pay employees for 100 hours of work.

If an organization does not operate for a period, no wages must be paid, assuming the salary is hourly rather than annually.

Nearly all other variable costs are business-specific. For example, LCD screens would be a variable cost for a laptop manufacturer, increasing the total variable cost by the screen price for every new laptop.

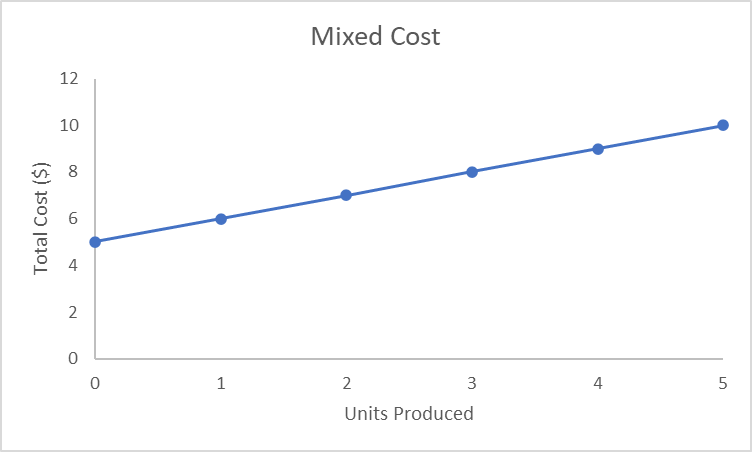

Mixed cost

A mixed cost or semi-fixed cost is the most complicated of the three. It is a combination of both variable and fixed costs.

You can imagine a mixed cost as a simple linear equation with an intercept and a slope.

The intercept, i.e., the fixed part of the mixed cost, shows us the minimum flat rate. The slope, i.e., the variable region of the composite price, shows how much each new unit will add to the total cost.

The formula for a mixed cost will look like this: Mixed cost = Flat rate + cost per unit * units produced.

The example above shows that the flat rate is $5, increasing by $1 for every new unit produced. A typical example of a fixed cost is electricity. Generally, a company will pay a baseline amount for electricity in their facility.

As more and more is produced, electricity use will likely also rise. This means that total electricity costs increase when each new unit is made.

Everything You Need To Build Your Accounting Skills

To Help You Thrive in the Most Flexible Job in the World.

Researched and authored by James Fazeli-Sinaki | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?