CFP® vs CFA®

A crucial decision in one's career

Many people who want to enter the realm of finance and investing question whether they should pursue a certified financial planner (CFP) or a chartered financial analyst (CFA) designation.

This decision is crucial to one's career because they are both time-consuming goals and require significant studying and professional work experience.

It is important to consider the possible career opportunities each path opens.

The certified financial planner certification typically leads to managing a client's finances and designing financial goals that are in the client's best interest.

The chartered financial analyst qualification often leads to a career in investment decision-making in investment banking, risk analysis, and portfolio management industries.

Below is a podcast with the CEO & Founder of Wall Street Oasis, Patrick Curtis, discussing the CFP and the CFA with one of his mentees, Victor. We learn why he is planning to get both designations for credibility.

While both paths open new doors for career development, another option is to pursue neither certification. This more cost-effective course enables you to allot time to other activities or goals.

This article will dive into:

- What a CFP is and how to earn the certification

- What a CFA is and how to achieve the charter

- Key differences between the two designations

Understanding Certified Financial Planner (CFP)

Financial planners are responsible for managing a client's finances with the client's best interest in mind. This is also known as their fiduciary duty.

Upon completing the exams offered by the Certified Financial Planner Board of Standards, Inc., an individual earns the title of a certified financial planner.

Not only must you complete the initial exams, but you must also continue your learning by participating in annual educational programs. This yearly requirement is designed to ensure financial planners maintain their skills.

Earning this certification requires hundreds of hours of studying, and you pass the rigorous exam. So even though becoming a CFP is difficult, the accreditation does open new career doors in the future.

Some topics financial planners assist their clients with are:

- Personal finances

- Retirement

- Investing

- Education

- Budgeting

- Insurance

- Taxes

Individuals tend to pursue financial planning if they enjoy helping others manage their finances. There is an ethical standard that certified financial planners must uphold, so they always have to be selfless and put the client first.

What Do Certified Financial Planners Do?

Finances can be difficult to manage for some people, which is why they seek the assistance of a financial planner. These planners essentially plan and organize the finances for every aspect of their client's life.

Financial planners will look at all financial information relevant to their clients, such as, but not limited to:

- Cash

- Assets

- Investments

- Properties

- Liabilities

Financial advisors will gather and analyze this information to estimate their client's net worth.

The client will work closely with the financial advisor to discuss their goals, concerns, and current financial situation. Some plans could include:

- Paying for a child's education

- Buying a house

- Opening a business

Some concerns could include:

- Rising inflation

- Not enough savings

- Too much risk in your portfolio

Financial planners tailor financial plans with the age of the client in consideration. For example, a client nearing retirement and a client who just graduated college will have different financial plans.

While some positions, such as investment advisors, have more defined roles, financial planners are generally all-encompassing.

It is worth noting, however, that some certified financial planners specialize in certain areas such as divorce or retirement planning. Others may only work with a certain clientele, such as small-business owners or retirees.

Financial planners are different from traditional financial advisors. Becoming a CFP requires more education and testing to ensure in-depth knowledge of financial planning.

Certified financial planners are bound to an ethical code that ensures they are always acting in the best interest of their clients.

CFPs can be paid fee-only or fee-based. Fee-based advisors receive a commission on certain services, while fee-only advisors collect a standard sum at their discretion for all services.

How to Become a Certified Financial Planner?

Becoming a CFP requires thousands of hours of work and education. There are four stages to earning your CFP designation.

1. Formal Education

To become a CFP, you must have graduated from an accredited university and be able to verify that you have a bachelor's degree or higher.

Secondly, there are financial planning course requirements that are considered prerequisites, but this can often be satisfied by becoming a certified financial analyst (CFA), certified public accountant (CPA), or holding a master's of business administration (MBA).

2. CFP Exam

There are over 100 topics tested in the form of 170 multiple-choice questions. The general issues that are tested and their current weighting as of 2022 are:

- Professional Conduct and Regulation (8%)

- General Principles of Financial Planning (15%)

- Risk Management and Insurance Planning (11%)

- Investment Planning (17%)

- Tax Planning (14%)

- Retirement Savings and Income Planning (18%)

- Estate Planning (10%)

- Psychology of Financial Planning (7%)

Prospective CFPs test in two- or three-hour periods during a single day. Exams are typically offered in March, July, and November.

The test costs $925, but early applications have the potential for a discount, while late ones are subjected to a surcharge.

The tests are not graded on a curve, and the performance of other individuals does not affect your score. There are two outcomes to the test: pass or fail. The overall pass rate in 2019 was 62%. If you fail the test, you can retake the test four times over your lifetime.

3. Relevant Work Experience

Potential CFPs must complete their required hours of work experience either ten years before taking the exam or five years after taking it. Note that the hours can span before and after your test.

The hours of work experience requirement can be fulfilled by 6,000 hours of professional experience or 4,000 hours of apprenticeship.

4. Demonstrated Professional Ethics

The fiduciary standard is critical to the CFP designation, so prospective certified financial planners must maintain a spotless record of ethical behavior.

Understanding Chartered Financial Analyst (CFA)

The CFA Institute gives the chartered financial analyst designation. This certification is earned by passing the Level I, II, and III exams. These exams test ethics, money management, accounting, and security analysis.

Each exam covers different content and has a different format. For example, some questions are multiple-choice, while others are case studies.

The financial analyst exams are some of the most difficult, with Level III passing rates hovering around 9.5% over the past ten years.

While the exams are difficult, they are important as they ensure chartered financial analysts are knowledgeable in their field. This designation is world renowned because of its difficulty to earn.

CFA certifications began in 1963, and since then, more than 190,000 individuals have earned this designation. These analysts can be found in various industries across the globe, such as investment banking and risk management.

What Do Chartered Financial Analysts Do?

Individuals with CFA designations can be found in many financial and investment sectors. Some examples of industries are:

- Research

- Consulting

- Portfolio management

- Risk analysis

- Investment banking

- Sales and trading

Obtaining the financial analyst charter can significantly improve your resume when entering highly competitive fields such as investment banking or hedge fund management.

Most CFA charterholders are employed at large investment banks and mutual fund companies. A slim portion of charterholders, around 5%, work as financial advisors.

The CFA charter is often considered the most respected designation in finance. Yet, as a result of fewer than 200,000 people worldwide holding this designation, the hard work and countless hours of studying are recognized by companies.

The average total compensation for a chartered financial analyst is around $300,000.

The first exam costs $450, and the following two exams cost between $700 and $1,000, depending on how early you sign up to take the test.

It likely will take a minimum of three years to earn your financial analyst charter because you can only take each test once a year. The Level I exam, however, is offered twice a year.

How to Become a Chartered Financial Analyst?

Earning the designation of certified financial analyst is not an easy task. It requires hundreds of hours of studying and years of work to pass all three tests. There are similar requirements to the certified financial planner certification, but the CFA criteria are more intensive.

Additionally, unlike the financial planner certification, a potential charterholder must have two letters of recommendation from professional sources. It typically takes longer, with the typical candidate taking a minimum of three years to earn their certification.

There is an emphasis on ethical behavior, which requires analysts to maintain a moral standard with their work.

Before starting the journey to earn your CFA, you should consider your current financial situation and career goals to ensure it is the right decision for you. Then, consider the financial and time commitment and decide if earning the charter will outweigh the potential drawbacks.

Below are the requirements for earning the chartered financial analyst certification.

1. Education Requirements

A candidate must have four years of professional work experience, a bachelor's degree, or is in their final year working towards their bachelor's degree. Some other requirements include:

- Possess an international passport

- Must complete the exam in English

- Meet the professional conduct admission requirements

- Live in a country that offers the certification

2. Testing Requirements

Three tests must be passed in sequential order. The tests are difficult and require an average of 300 hours of studying per test.

The Level I exam includes 180 multiple-choice questions and must be completed within the allotted four and a half hours. Some topics that are tested include:

- Economics

- Corporate finance

- Portfolio management

The Level II exam format is 22 small case studies and four multiple-choice questions per case study. In total, there are 88 questions. Test takers have 4 hours and 24 minutes to complete the exam with a break halfway through. Some topics that are tested include:

- Foundations of risk management

- Valuation and risk models

- Operational risk

Finally, the Level III exam includes structured essays and 44 multiple-choice questions. The time limit for this final exam is 4 hours and 24 minutes. Some topics that are tested include:

- Professional standards and ethics

- Private Equity

- Hedge funds & managed futures

3. Relevant Work Experience

Prospective CFA charterholders must complete a minimum of 4,000 hours of work experience over three consecutive years. The professional work experience must be relevant to investments and decision-making.

4. Letters of Reference

Two to three letters of recommendation are also required for CFA certification. These letters must be from professional sources in the investment industry.

CFP vs. CFA

Various key differences between the two certifications may convince you to pursue one or the other or neither. Therefore, it is important to research to ensure that the course you decide is the best decision for you.

Every individual's financial situation, career goals, and ambition is different. Your decision on whether to get a CFP or CFA should be based on what is most appropriate for your life or where you want to be in the future.

While both certifications are geared toward general industries, it is typically a good idea to have a concrete plan for what you want to do once you earn the certificate.

Pursuing both paths is a time commitment and financial expense, so you mustn't aimlessly study and take the tests.

Both certifications are demanding and often open doors that previously were out of reach.

Key Differences

While both are prestigious designations, each has its requirements and course content.

| Benefits | CFA Charter | CFP |

|---|---|---|

Organizing Body | CFA Institute | CFP Board |

Career Path | Investment analyst, strategist, consultant, portfolio manager, wealth manager | Financial planner/advisor, investment advisor, financial consultant, wealth manager |

Requirements | Bachelor's degree, Level I, II, III exams, 4,000 relevant professional work hours experience | Bachelor's degree, financial planning coursework, 4,000-6,000 relevant professional work hours experience |

Cost | Minimum $3,050-$3,950 | Minimum $825 |

Completion Time | 3-5 years | 1.5-3 years |

Recognition | Highly recommended for investment management careers | Required for a career as a financial planner |

Focus | Investment tools, valuing assets, risk management | Financial and investment planning |

Difficulty | Less than 10% pass the Level III exam | 62-66% pass rate |

Award for Completion | Professional designation | Professional designation |

Professionals (as of July 2022) | 178,000 | 181,000 |

Average Salary | $180,000 | $80,000 |

CFA vs. CFP: Which Is Right for You?

If you want a career in helping people and working more closely with clients, then a CFP certification could be wise. For example, with financial planning, you work closely with clients to allow their financial goals to come true.

On the other hand, with a CFA designation, you will likely work for a large investment bank and closely with corporations.

It is worth mentioning that many financial analysts also work with clients but focus more on managing investment portfolios and complex investing strategies.

CFAs typically excel in math and are more detail-oriented. Careers as a CFA often require quantitative analysis and honing in on a specific topic. Some skills that a CFA charterholder may have are:

- Financial modeling skills

- Analytical ability

- Decision-making skills

- Excellent communication

CFPs have a more holistic approach and know a decent amount about various topics. Some traits of CFPs are:

- Strategic thinking

- Sales & Marketing

- Relationship management

- Communication skills

Both certifications require a lot of studying, and you can be sure that once you pass either test, you will know the respective topics. However, if you are more restricted with time, you may consider the CFP certification because it is less of a time commitment and contains fewer tests.

There is no better option but a better choice for your specific career goals. For example, the CFP course would be a better option if you intend to become a financial advisor.

Additionally, it is important to consider the syllabi for both designations. Research both options and decide which topics are more intriguing to you because you have to study for countless hours for the exams.

Also, neither path may be the best option for you. For example, financial advisors and investment bankers do not have these designations. However, your chances of landing a position in these fields significantly improve with these designations.

Make sure to research your options and align your decision with your current financial situation. While you may have ambitious goals, ensure that you have the time and money to pursue either path.

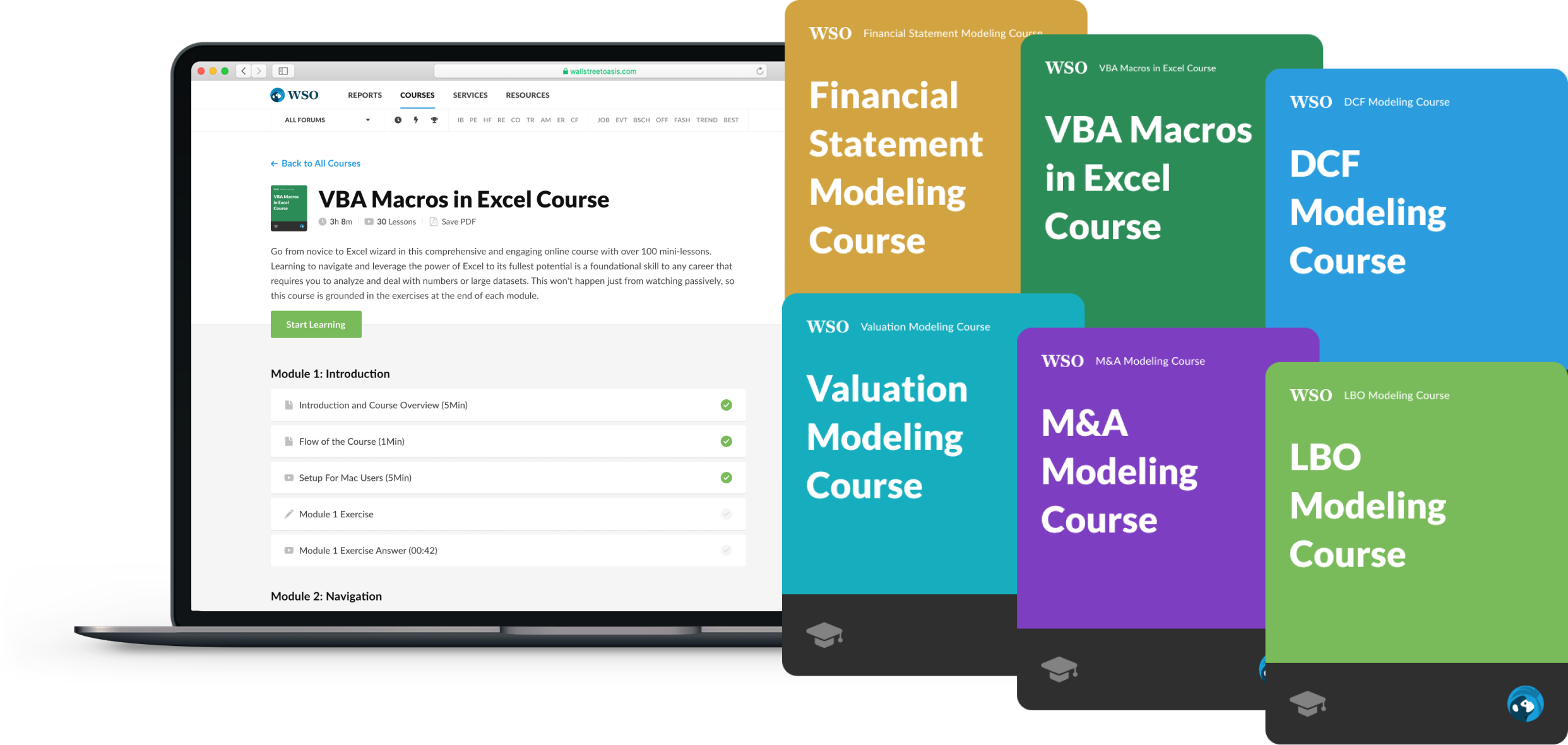

Everything You Need To Master Financial Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

or Want to Sign up with your social account?