Chartered Alternative Investment Analyst (CAIA®)

The CAIA charter gives you expertise and real-world skills in alternative investment analysis.

The Chartered Alternative Investment Analyst (CAIA) designation is offered by the CAIA Association, established by the Alternative Investment Management Association (AIMA) in 2002. It is a global, independent, and non-profit organization.

Their goal is to promote the education and development of professions surrounding alternative investments. The fact that it has low barriers to entry and is much less expensive than a Master's degree makes it very accessible to people worldwide.

However, despite the accessibility, this designation is difficult to obtain. Therefore, any candidate looking to achieve this prestigious certification must invest a significant amount of time and effort.

To become a charterholder, one must pass two exams, each of which takes an estimated 200 hours of studying to pass, and must fulfill other criteria. These exams are very difficult, with both exams having passing rates of about 60%.

CAIA charterholders often work in positions that involve portfolio management and asset allocation. The curriculum is focused on skills relevant to the valuation of alternative investments. Charterholders commonly work in firms that invest in alternative investments. These include hedge funds, private equity funds, and pension funds. A charterholder has the perfect skill set to thrive in these firms, as they have extensive knowledge surrounding alternative investments.

An alternative investment is anything outside of equity and fixed income investments known as traditional investments. This includes hedge funds, private equity (PE), real estate, commodities, derivatives, and real assets. These alternative investments are described in greater detail below:

Hedge funds are considered alternative investments because they typically take on greater risk to create better returns. It is a firm that takes money from investors, pools it to create a large portfolio, and then employs those funds in strategies that are not available to ordinary investors.

Typically this investment opportunity is only available to very wealthy individuals. Also important to note is that these funds charge large fees.

Funds of funds are also alternative investments which are portfolios of multiple hedge funds. They are a way for investors to expose themselves to multiple hedge funds if they are not wealthy enough to invest in all of them directly.

Private equity (PE), including venture capital (VC), is also an alternative investment. PE is the equity of companies that aren't publicly traded, as opposed to public equity, which comes in the form of stocks in the market.

These firms invest in many different ways. Sometimes they buy all the shares outstanding of a public company and take them private to manage the company before exiting for a profit. Other times they take control of a private company and then exit by selling them by taking it public using an IPO. Venture capital is the practice of investing in the private equity of young startups.

Real assets are an investment class that covers tangible assets. Real assets are physical goods that can be bought and sold for investment, unlike bonds and stocks, which are symbolic of a company's share or credit. They include art, land, real estate, wine, and even rare Pokemon cards (other trading cards are also included).

While technically a subset of real assets, Commodities deserve their own description due to the market's sheer size. They are alternative investments that include any fungible assets. This includes precious metals such as gold, copper, and platinum, which are known as hard commodities. Examples of soft commodities are coffee beans, tea, and wheat. Energy commodities include oil, coal, natural gas, and other assets used to produce energy.

Derivatives describe investments that derive their value from another underlying assets such as options and futures.

Options are contracts that give the holder the right but not the obligation to buy or sell an asset at a specified price and time.

A futures contract is an agreement to buy an asset at a particular price at a later date. Unlike an option, a futures contract is a commitment to buy that asset that must be executed as it is not a right but an obligation.

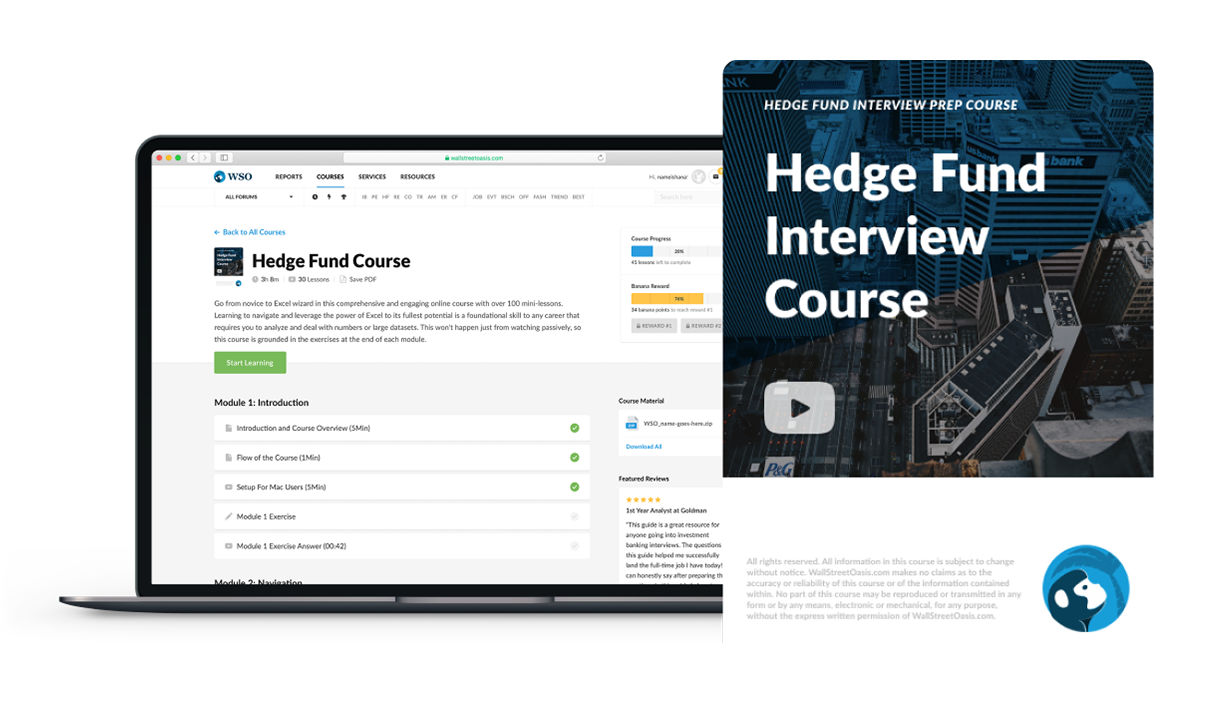

Everything You Need To Break into Hedge Funds

Sign Up to The Insider's Guide on How to Land the Most Prestigious Buyside Roles on Wall Street.

How to Become a CAIA Charter?

Becoming a CAIA charterholder is very difficult and takes a lot of hard work and dedication. It requires a serious time commitment and can be an arduous process. In addition, becoming a charterholder requires passing two difficult exams and fulfilling other criteria.

Any candidate is eligible to take the CAIA exams, as long as they do them in order.

However, it is essential to note that there are more requirements than passing the exam to qualify for the charter:

- A candidate must complete a bachelor's program and one year of professional experience OR

- Complete four years of professional work experience OR

- The CFA charterholder is in good standing.

The CAIA Association has chapters worldwide, making the test accessible to a diverse set of international candidates.

If a candidate has earned the Chartered Financial Analyst (CFA) designation, they are eligible to skip the first CAIA exam. This is because about 80% of the information on the first exam is already covered in the CFA curriculum.

Enrolling in the program costs $400, and registering for each exam costs $1250. If one registers through early registration, it costs $1150. Retaking exams cost $450.

The first exam contains 200 multiple choice questions to be completed in 4 hours.

It is split into two sections of 100 questions, each 2 hours long, with a small break in between. It is offered in both September and March every year.

The exam is challenging, with the CAIA Association recommending that a candidate study for 200 hours. Pass rates have decreased over time, with the September 2021 exam having the lowest pass rate yet at 51%. The topics of the first exam are provided below:

- Professional Standards and Ethics

- Introduction to Alternative Investments

- Real Assets

- Private Equity

- Hedge Funds

- Structured Assets

The first exam focuses most on professional standards and ethics, introduction to alternative investments, and private equity.

The second exam consists of 100 multiple choice questions and three sets of essay questions. It is split into two 2 hours sections with a small break in between. The multiple-choice section is worth 70% of the exam, while the essay section is worth only 30%.

The same as the first exam, the CAIA Association recommends studying for 200 hours for this exam. Historically, the passing rate for this exam has fluctuated between about 60-70%. Most recently, the September 2021 exam passing rate was 58%. The topics of the second exam are provided below:

- Emerging Topics

- Ethics, Regulation, and ESG

- Models

- Institutional Asset Owners and Investment Policies

- Risk and Risk Management

- Methods for Alternative Investing

- Accessing Alternative Investments

- Due Diligence and Selecting Strategies

- Volatility and Complex Strategies

These topics are weighted equally except for emerging topics and ethics, regulation, and ESG. Therefore, these topics are not included in the multiple-choice section of the exam. They are, however, weighted similarly to other topics within the constructed-response section.

The CAIA curriculum is a self-study program. Therefore, candidates are expected to learn the material on their own.

The CAIA Association provides candidates with the curriculum and study guides for each exam to assist them in studying. They also host orientations for candidates to give information about the curriculum. In addition to official study guides, many companies offer study guides for the exams. To stay in good standing with the CAIA Association and maintain the designation, a candidate must pay annual fees.

What Does a CAIA Charter Do?

CAIA charterholders work in many roles, particularly those where alternative investment is very common. Often candidates with this certification find themselves working in hedge funds (HFs) as they are considered an alternative investment class.

They are considered risky, and only the very wealthy are allowed to invest in them due to this high risk. However, hedge funds attempt to earn higher returns than normal by following unconventional strategies, making them a perfect place to work for someone with the CAIA designation.

HFs frequently engage in alternative investments classes such as derivatives, real estate, land, and commodities. In addition, charterholders may work in any position within a hedge fund, as roles are not dependent on the designation but on the return they generate.

Private equity is another common place to work for candidates with this accreditation. For example, venture capital firms invest in very young startup companies that are still private in exchange for a significant portion of equity. PE firms also invest in mature companies, real estate or create funds of funds, which are investment funds that invest in multiple hedge funds.

These are all alternative investments, making CAIA charterholders the perfect candidates for positions within PE.

Another area where CAIA charterholders often find themselves working is pension funds. These funds usually allocate their portfolio among stocks, bonds, and real estate.

Pension funds that allocate a small part of their portfolio to alternative investments such as derivatives and private equity are becoming more common. Therefore, a charterholder is a good fit for a consulting, board, or even a full-time role at pension funds because of their knowledge of alternative investments.

CAIA charterholders are often involved in portfolio management and asset allocation. The curriculum focuses on alternative investments and how to value them. This makes it extremely useful in the construction of portfolios. The certification is especially relevant in alternative investment management, and those with the charter often fill related positions.

CAIA vs. CFA

While the CAIA and the CFA have numerous similarities, they are also very different certifications. Those differences are outlined below.

The CFA designation is offered by the CFA Institute, an international, non-profit organization that aims to promote education surrounding the investment. The CFA certification is considered one of the most prestigious designations in finance.

It has an incredibly comprehensive curriculum that covers a wide range of concepts. Although, the CFA charter is very difficult to earn. A candidate must complete three grueling tests, log 4,000+ hours of professional experience, and must have a bachelor's degree.

It has more breadth than the CAIA curriculum, which only focuses on alternative investments. The CFA curriculum includes alternative investment and focuses mainly on portfolio management in general. This includes questions about economics, accounting, equity, and fixed income.

It is also considered more prestigious than the CAIA designation. The former is older than the latter by a large margin, with the CFA charter being created in 1963 instead of the CAIA charter's founding in 2002.The CFA charter is also much more challenging to obtain, with the curriculum containing three exams rather than two. The exams also have a lower pass rate when compared to the CAIA exams.

The CFA Institute recommends studying 300 hours for each of the exams.

On average, it takes candidates 4 years to pass all three CFA exams, while it takes candidates only 18 months on average to pass both CAIA exams. CFA charterholders also earn higher salaries on average than those with CAIA charters.

While these certifications do come with many differences, they are also similar in some ways. They are both considered Master's degree equivalents and are very difficult to pass. While the CFA curriculum is broader, it contains a lot of information on the CAIA curriculum, particularly the first exam. This is why CFA charterholders may skip the first exam and take the second CAIA exam only to earn the charter.

| CFA | CPA | CAIA | CFP | FRM | |

|---|---|---|---|---|---|

| Number of Levels | 3 | 1 | 2 | 2 | 2 |

| Costs | $2,550 to $3,450 | $1,000 to $3,000 | $3,000 | $2,000 | $1,500 |

| Exam Pass Rate | 30-50% | 40-50% | 70% | 67% | 40-50% |

| Content Focus | Portfolio Management, Investments | Financial Reporting, Audit | Real Assets, Alternative Investments | Financial Planning | Financial Risk Management |

| Career Application | All Encompassing | Accounting and Finance | Asset Management | Retail and Wealth Management | Risk Management |

| Study Time (hrs) | 300-350 per exam | Varies | 200 per exam | Varies | 200-300 per exam |

| Completion Time | 3-5 years | 2.5 - 5 years | 1-2 years | 4 years | <1 year |

| Work Experience | 4 years | 1 year | 1 year | 3 years | 2 years |

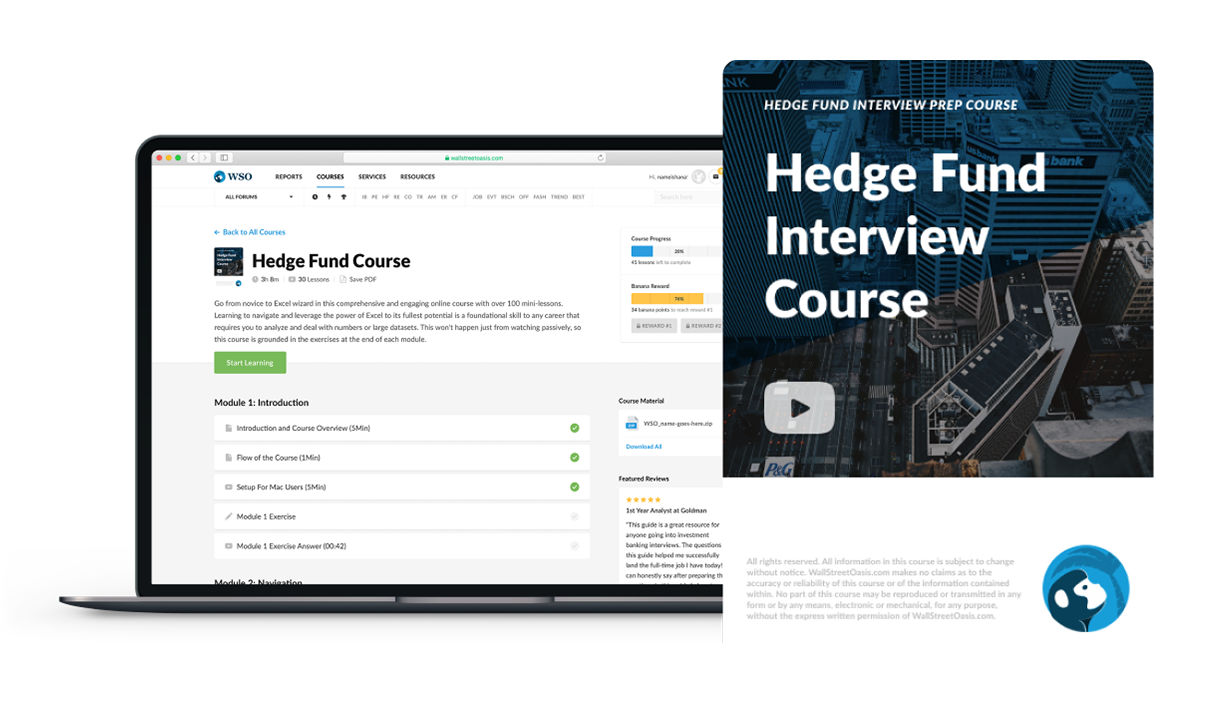

Everything You Need To Break into Hedge Funds

Sign Up to The Insider's Guide on How to Land the Most Prestigious Buyside Roles on Wall Street.

More Resources

To keep advancing your career, the additional resources below will be useful:

or Want to Sign up with your social account?