Advanced Financial Modeling (AFM)

Top 5 financial modeling techniques and skills

Advanced Financial Modeling (AFM) is a term with a broad definition used to describe many different methods in financial modeling (FM) that are more complex and require more professional skills than basic modeling. These methods may require a lot of statistical knowledge and, in some cases, might involve learning how to program to create models in a financial modeling program or a programming language.

In many cases, advanced financial modeling contains many of the same types of financial models but looks at them in much more detail and uses complex methods to derive the model's assumptions.

Learning financial modeling is not an easy task. Trying to figure out the best way to build a financial model can be frustrating. Most people spend hours and hours researching and reading other people's opinions, trying to learn the best way to do it.

The problem with this approach is that there are many different ways to build a financial model. In addition, every project has different needs and budgets, leaving many feeling confused and unsure of which technique is best for their situation.

Don't feel like you're stuck figuring it all out on your own! Here are some tips for applying advanced financial modeling techniques to any project so you can get started today.

Scenarios and Scenario Analysis

Scenarios are great because they allow you to visualize all future possibilities. You can create different scenarios to account for different outcomes or potential changes to your business environment.

Scenario Analysis is the process of looking at how certain events could affect your financial model (either positively or negatively). Once you've created your scenario, you'll need to analyze the results and make the necessary adjustments. This way, you will be prepared for any changes that come your way.

For example, let's say you want to know how increased interest rates will affect your net income. To do this, you would create a scenario where interest rates increased by 0.5%. Then, your analysis would need to show the difference in net income between a 0 - 0.5% interest rate and a 1 - 1.5% interest rate over three years.

One type of scenario analysis is called stress testing. When analyzing an investment, a company will look at some of the worst-case scenarios for the business or how potential future events may affect the company. More recently, regulation has made it a requirement to stress test investments especially at large banks which take on risky investments.

Analysts may do this by finding the standard deviation of revenue and seeing what might happen if the company were to perform one or two standard deviations away from its mean. In statistics, two standard deviations account for about 95% of probable events, making it a very reliable measurement of the worst-case scenario.

To learn more, check out our video on scenario analysis, part of our Financial Statement Modeling Course.

Sensitivity Analysis

One of the most important aspects to consider when building a financial model is sensitivity analysis. Sensitivity analysis is a process that determines how changes in the various inputs affect the results of the model. A good sensitivity analysis should be able to answer three major questions:

- What are all the possible variable changes?

- How would these changes affect the results?

- What is the rate of change for every unit change in input value?

It's important to note that it's not just about exploring positive consequences but also about exploring negative consequences as well. This gives the users a clear picture of what could happen, no matter how dire or unlikely it may seem. For example, in many cases, a firm may ask its analysts how certain variables would affect investment and expect them to be able to create models that reflect these changes and the overall impact they would have.

Additionally, it is important to determine what percentage change is required to be considered significant. For example, if revenue projection increases by one percent but operating expenses decrease by five percent, the net income would decrease by four percent. If this difference is less than two percent, then it isn't significant and should not factor into the decision-making process for this project.

You may test these variables through a direct or indirect sensitivity analysis method. In the direct method, variables are changed in absolute terms, meaning that specific numbers are changed.

For example, if revenues were changed from $3 million to $5 million, the direct method would be used. In contrast, the indirect method changes numbers by a certain percentage. For example, imagine that the same $3 million in revenues was marked up by 20%. It is important to understand that sensitivity analysis and scenario analysis are two different processes that look at different things.

The biggest distinction between these two approaches is that sensitivity analysis typically looks at many individual variables and focuses on how much they are likely to change and how big of an impact they would have on the company's operations. In contrast, scenario analysis looks at the impact of larger events that may affect multiple variables in the business and typically analyzes extreme scenarios such as best-case and worst-case scenarios. Below is a video from our financial statement modeling course that explains sensitivity analysis.

Dynamic headings and features

The first step to building a financial model is to decide on your headings and features. This includes the model's limitations, the assumptions made, and any key performance indicators (KPIs) or metrics included.

Headings play a critical role in the presentation of the financial model. However, the most important thing about this step is to ensure flexibility. This means you can add or take away features at any time as you change your mind or learn more about the industry.

Flexibility can also be extremely valuable to perform scenario or sensitivity analysis. Changing and getting rid of certain variables to look at different scenarios is a must-have feature as part of any comprehensive financial model.

It is also important to outline all assumptions before building the financial model as it can help build in contingencies for risks and changes in the market. The assumptions should be clear and concise to keep them organized and share them with others who might need to know them to understand how those assumptions were arrived at.

It may be helpful to use charts and graphs when designing headings and features so that they're easy for people to understand.

Ability to consolidate multiple businesses or units

Consolidation is a key business process. It's an important part of the financial modeling process to always be aware of.

Here are three reasons why consolidation is so important:

- A company might want to consolidate its units to get a better idea of how they're all doing together

- It helps in identifying trends in one unit based on trends in another

- It helps to observe how the individual units of the company are performing against each other

Consolidation is crucial in the sum of the parts or consolidation models and is also an important aspect of merger models. All these models typically involve the valuation of separate units or projects and their consolidation to reflect the value of the entire business. This is generally used when analyzing businesses with many different segments in different industries rather than calculating a conglomerate's business growth as a whole.

Mergers and acquisitions can be complicated consolidations because there can be major changes in the business that will affect the company's value. In many cases, businesses merge to raise their valuation, and there may be favorable common expenses that can be reduced through a merger. These types of variables are important to take into consideration when consolidating businesses.

Everything You Need To Master M&A Modeling

To Help you Thrive in the Most Prestigious Jobs on Wall Street.

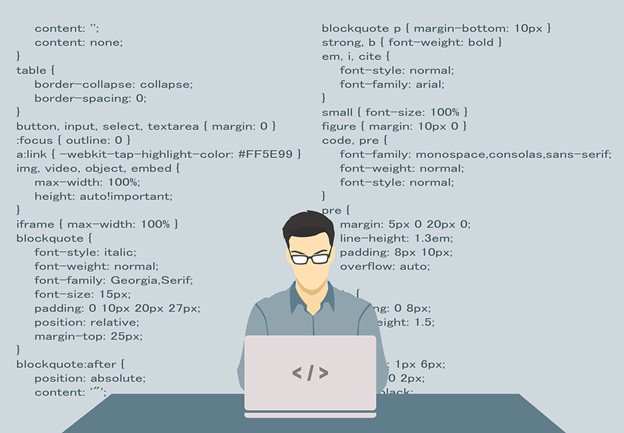

Programming in finance

As finance is becoming a complex field with traders looking for ways to get an edge over competitors, programming has made its way into accounting and finance. It is especially helpful when dealing with large amounts of data or where speed is of utmost importance.

Common programming languages used in finance include Python, C++, SQL, and Java. Python is often used in finance because it is fairly easy to read and understand and has a wide range of uses.

Programming is gaining a foothold in finance because it allows traders to make complex models that can use large amounts of data and more number of variables which is expected to increase the accuracy of the models used.

Quantitative finance is considered a complex, mathematics, and statistics-based discipline and uses heavy programming. Some of the most common predictive models created with programming are explained below.

The random forest model is a program that creates decision trees, which essentially asks a yes or no question that is meant to divide securities into two groups, usually based on certain financial metrics. A random forest model uses multiple decision trees to negate any individual mistakes the decision tree might make to find a collection of securities that meet certain criteria and perform well.

The general linear model (GLM) is the basis for many statistical models such as regression analysis. This model takes into account how multiple variables may affect a continuous variable. For example, this model is used to forecast and predict growth rates for companies and can be used for sensitivity analysis by looking at different variables.

A gradient boosted model improves weak hypotheses to create a more accurate and predictive model. It is often used with decision trees and usually outperforms random forest models. It aims to tweak weak learners or models that make predictions slightly better than random guessing and make them stronger predictors.

Everything You Need To Master Algo Trading using Python

To Help you Thrive in One of the Most Future Proof Careers on Wall Street.

How to learn advanced financial modeling?

One of the first things you'll want to do is find a resource of financial modeling articles that align with your interests.

If you're completely new to financial modeling, a great way to start is by nailing the fundamentals. This will make learning financial modeling much easier and enable you to better understand the instructions of others, and help gauge what is good advice. These fundamentals include learning about accounting and the structure of different financial statements, and how to use Excel to organize data and create tables and graphs.

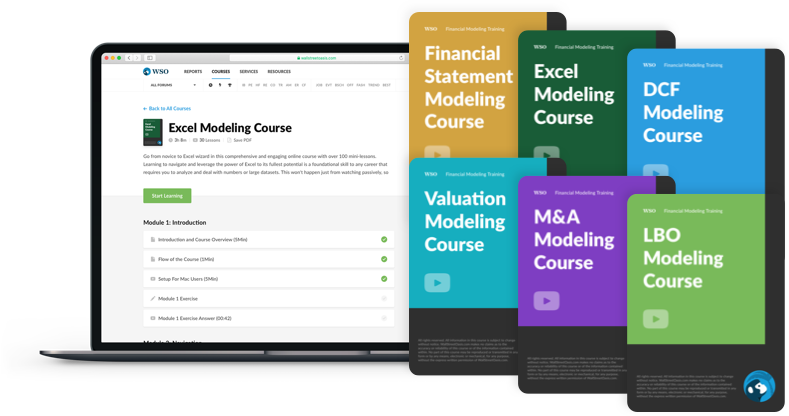

Another way to learn FM is by taking courses on the subject. Many universities offer FM courses at different difficulty levels, and some even provide credit for them. You may not be able to take these courses until you have some work experience under your belt, but they can be a great option if you're looking for advanced knowledge in the field.

A third option is to purchase an FM book or attend an FM training session with a company specializing in this type of training. This will give you all sorts of tips and tricks without having to spend hours searching online for answers or investing in expensive college courses.

More important is that you choose to learn in general and stay determined. The best way to learn is to get started. Don't expect to be a pro right from the beginning, but starting to learn basic models and trying to create them will become easier and take less time to do as you learn through trial and error.

As you learn more, it will give you the edge to learn the more complex analysis that we talk about in this article. The most important thing to understand is that "time in the market is more important than timing the market." The sooner you get started, the faster you will learn. It can be frustrating at times, but you will get better results if you are persistent.

No matter how you choose to approach learning FM, plenty of methods are available, all of which are viable options. So have fun and good luck!

Everything You Need To Master Financial Modeling

To Help you Thrive in the Most Prestigious Jobs on Wall Street.

Learn More

More about financial modeling

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?